Global Investment Backdrop

Up, up and away!

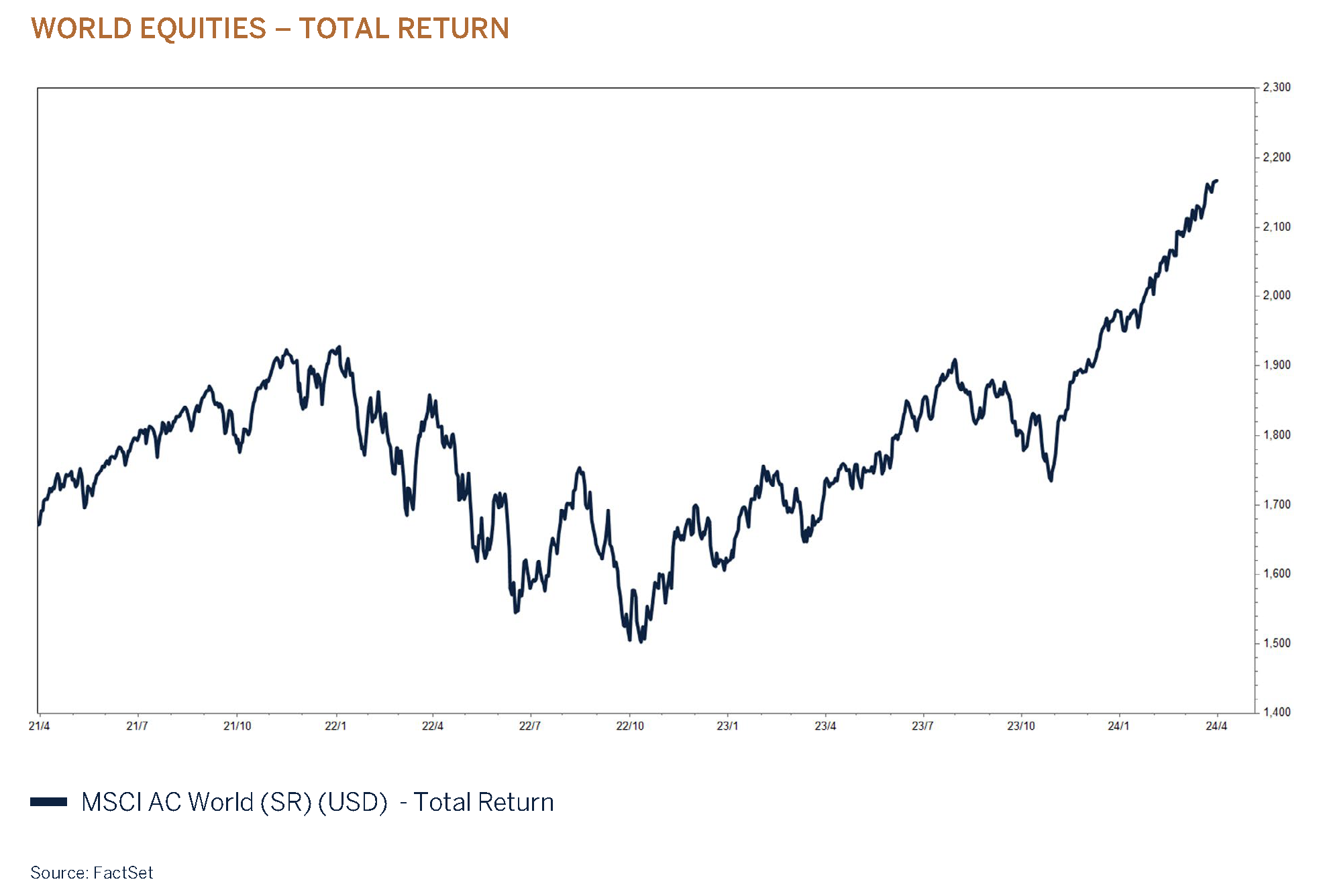

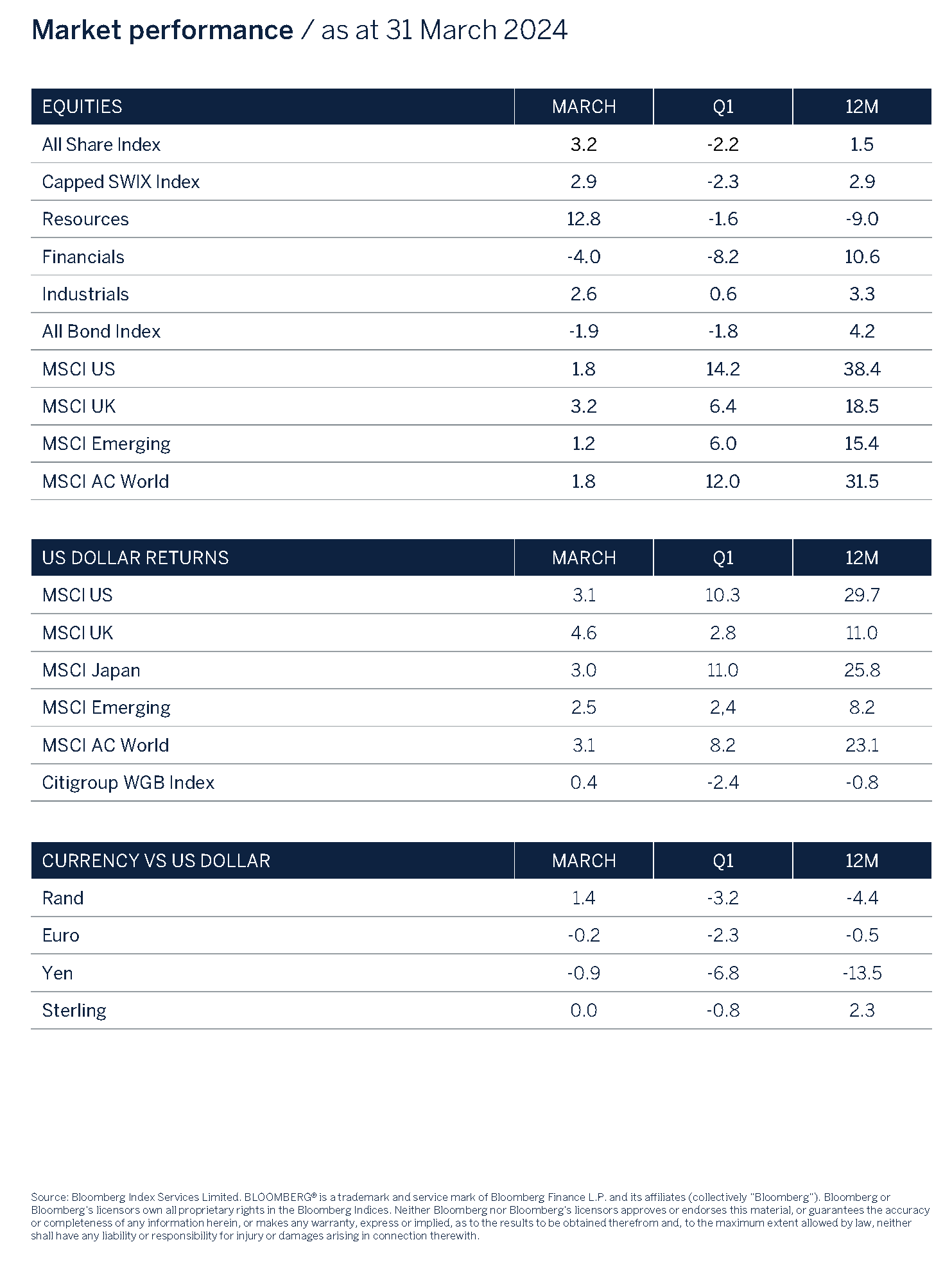

Global equity markets reached new highs as the world’s economic expansion and corporate earnings cycle have proven to be more resilient than was predicted only a few months ago. Investors have also been front-running expectations of lower interest rates to be sanctioned in the second half of the year as inflation continues to trend lower. In US dollar terms global equities are up +8% year-to-date, +23% over the past 12 months and an eye-watering +44% since the October 2022 bear market low point whilst in sterling terms they are +9%, +20% and +20% respectively.

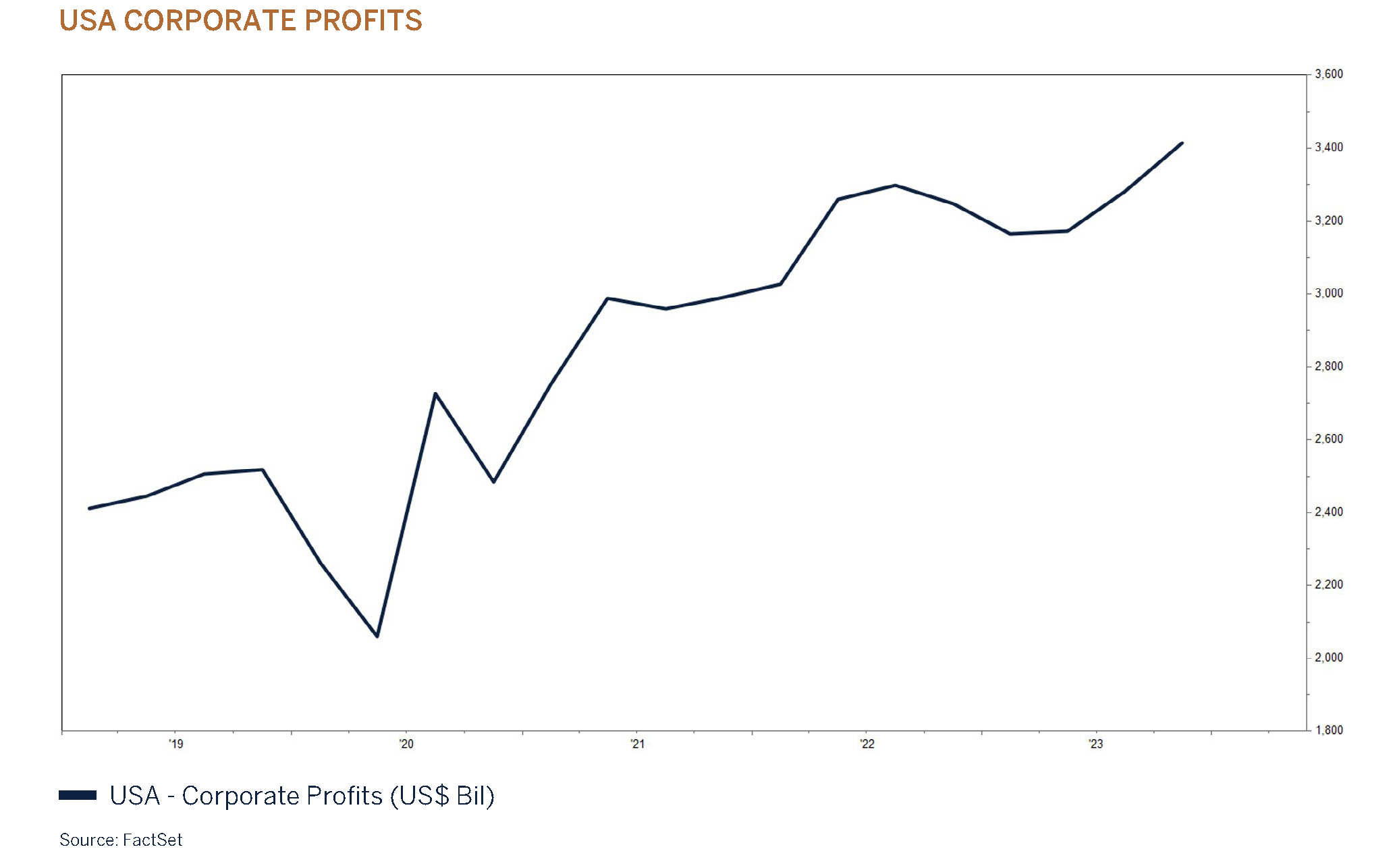

While high interest rates have played their part in dampening credit extension and in turn slowing excess demand, fiscal support together with drawdowns on savings and buoyant labour markets have in most part offset the negatives from restrictive monetary policies. Whereas a mild economic recession (soft landing) was our base case for 2024 it would now appear that a “no landing” outcome for the global economy is more likely. Corporate profits and the investment cycle have turned positive, thereby providing an important underpin to the labour market which has benefitted from an improvement in the participation rate (supply of workers) as enticing wages lure employees back to work.

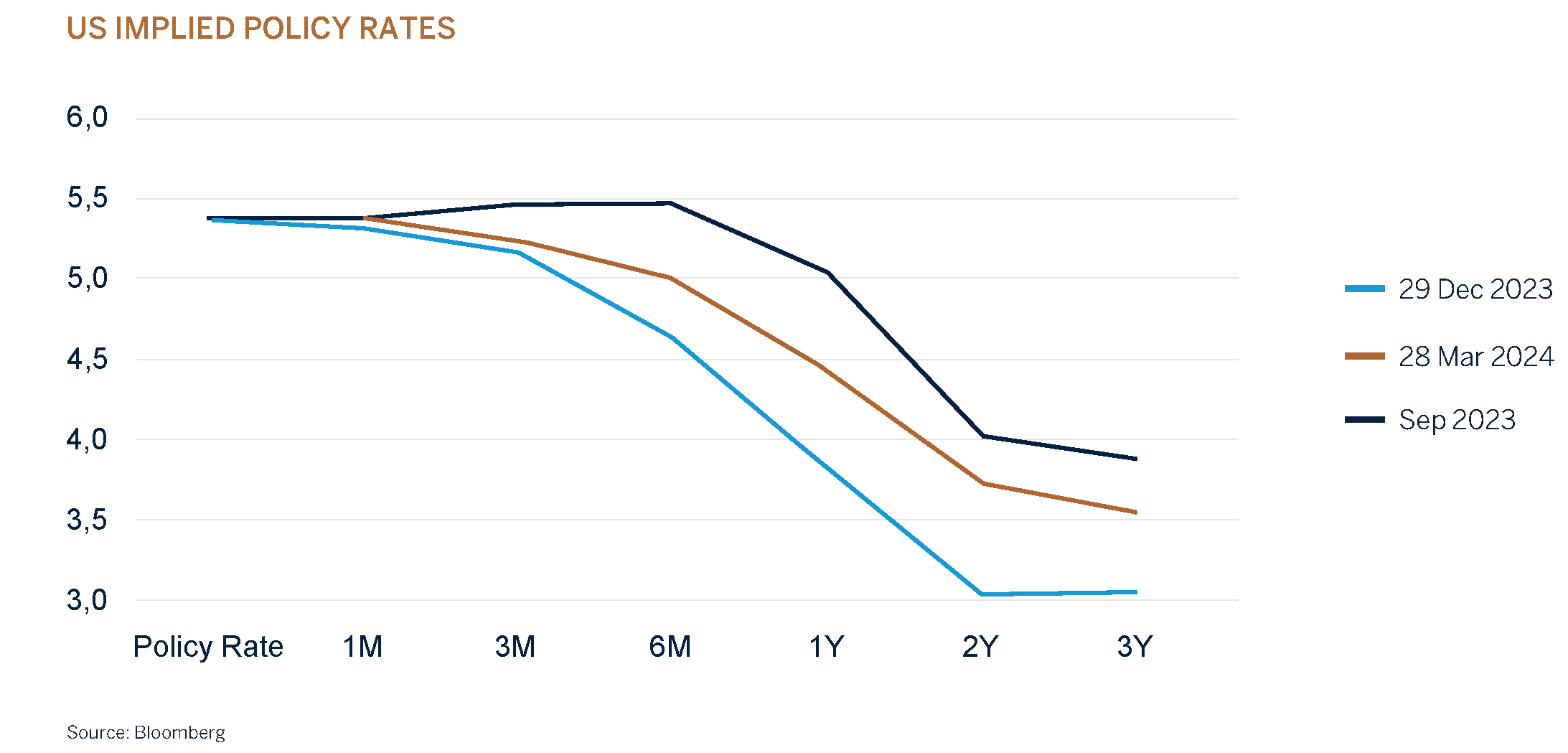

Further to this, financial conditions have eased considerably since many key central banks signalled in Q4 last year that interest rates had peaked. We did express our concerns in our end of 2023 report that bond yields appeared to have overreacted to the improvement in the outlook for interest rates, a time when six interest rate cuts of 25bps each were priced for the rest of 2024. Since then, sovereign bond yields have adjusted modestly higher to reflect the reality that the path for core inflation, albeit lower, looks set to be both bumpy and sticky as the global economy recovers and favourable base effects begin to fade. However, we would expect that the speed of positive developments in Artificial Intelligence (AI) and other forms of disruptive technology to noticeably improve the day-to-day productivity and growth rates for many corporates and their employees, which supports the view for sustained lower inflation over the medium term.

It would not be unreasonable for fixed income investors to demand a higher rate of return than what we have become accustomed to since the 2008 Global Financial Crisis as debt metrics have worsened across many countries since the outbreak of the Covid-19 pandemic. Credit spreads on the other hand have tightened, perhaps too much, as expected default rates continued to ease as a result of improving macro fundamentals.

The strong performance from AI and technology stocks on the back of robust earnings growth have propelled global equity markets higher during the first three months of the year. The US equity market gained +10.3% due to its high exposure to growth (technology communications) stocks and again benefitted from this secular growth trend.

Japan was however the best performing equity market within developed markets during the quarter, marginally outperforming the US with a gain of +11.%. A weak Yen coupled with an improvement in industrial activity, corporate reforms and government support initiatives have all played a role in lifting Japanese equities to a new high, surpassing their 1989 peak! Continental Europe and UK markets lagged the strong performance from the US and Japan due to their tepid economies and lower exposure to technology companies.

During the quarter we have been increasing exposure to equities, acknowledging a more accommodative stance from central banks, easing financial conditions, and evidence that the corporate earnings cycle has bottomed. Valuations are however on the higher side and short-term investor sentiment appears optimistic; we have therefore settled on a neutral exposure to the asset class for the time being. To us the market is priced for a strong acceleration in earnings growth and significantly lower interest rates. While this is possible, tail risks from elevated interest and inflation rates and a very uncertain geopolitical backdrop remain prevalent, and we would prefer a more cautious approach with a focus on quality until the margin of safety from a valuation perspective becomes more favourable.

Where do we find ourselves in the economic cycle?

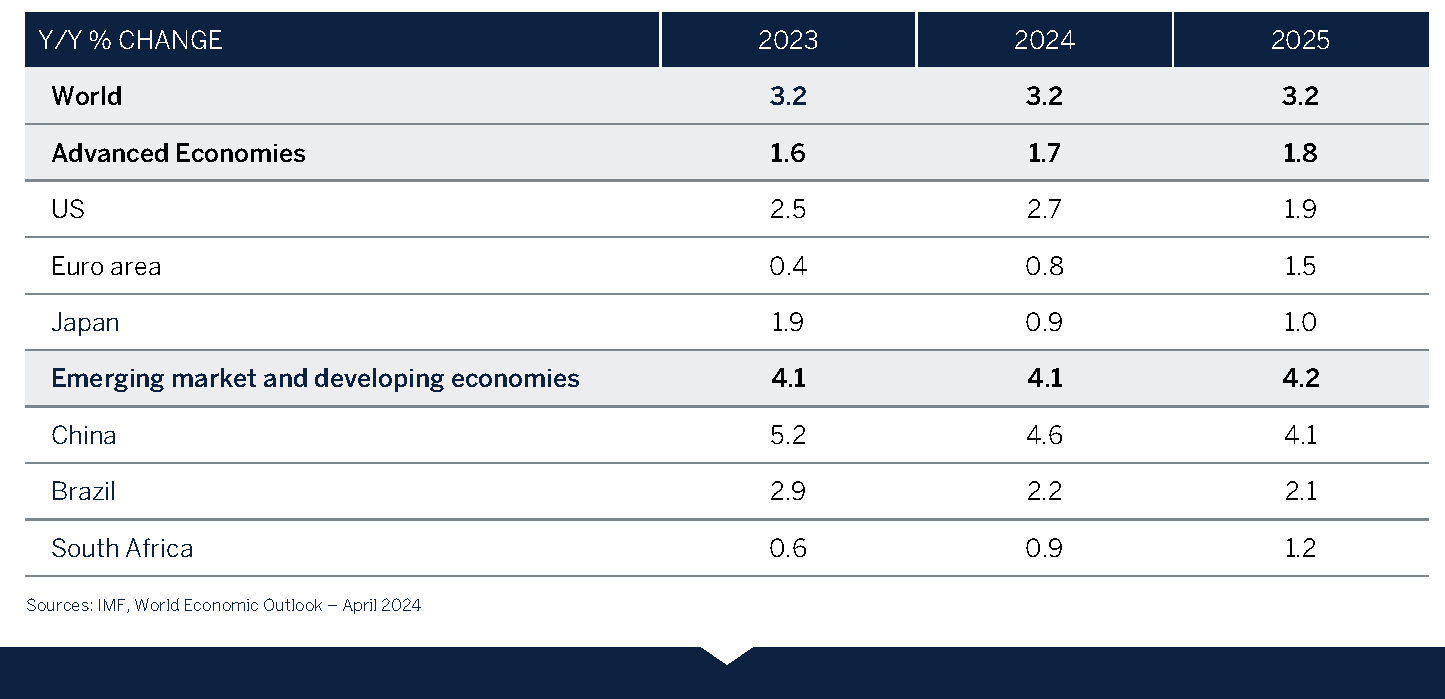

The outlook for the global economy has improved. On balance, economic data continues to surprise positively, resulting in economists upgrading their forecasts. The global economy is now expected to grow in line with its long-term average. This is supported by strength in underlying consumer demand, an improved outlook in capital expenditure (capex) by companies as a recovery in their profits continues which in turn should lead to the continuation of a buoyant employment market.

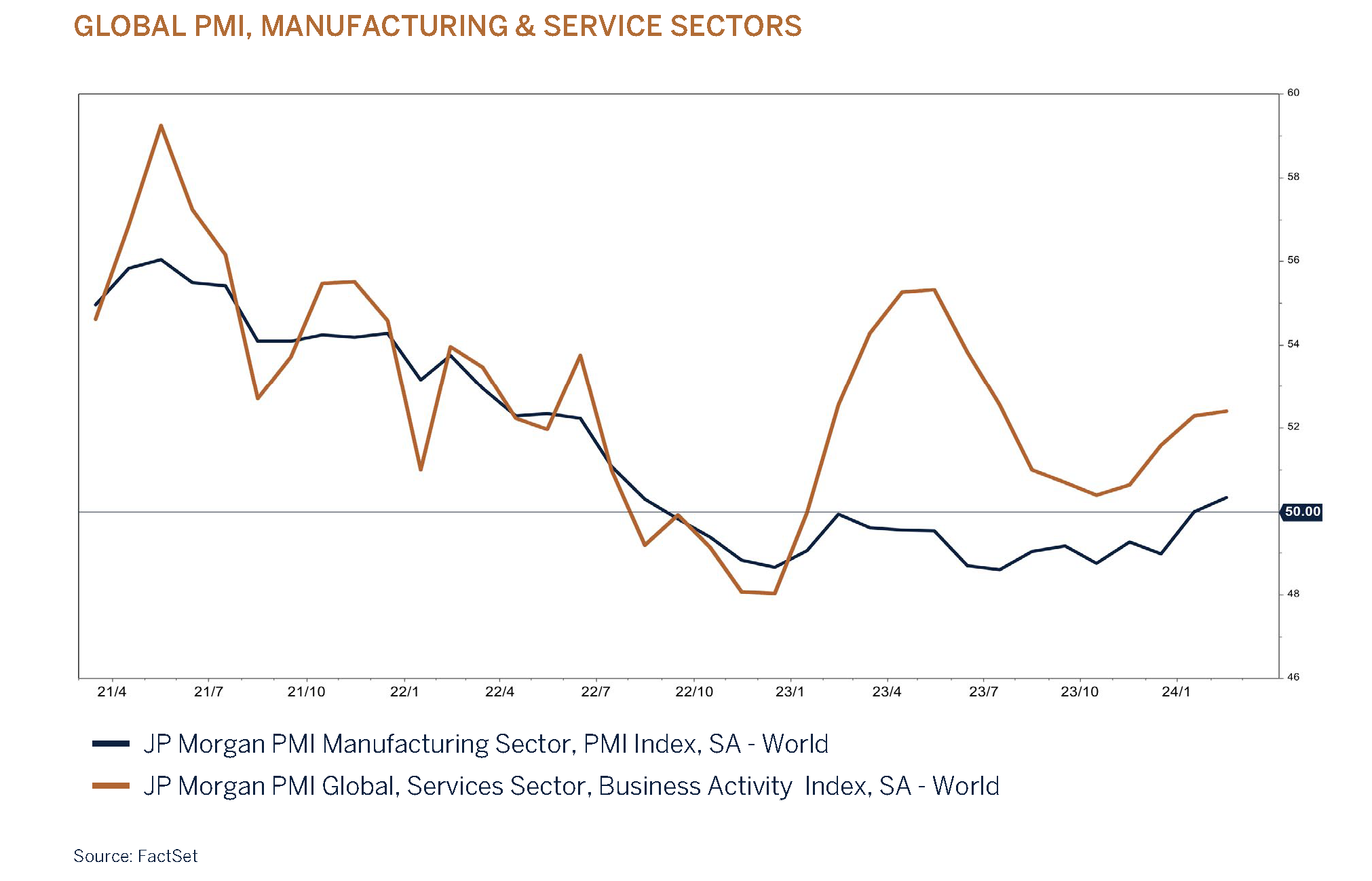

Furthermore, it is encouraging to note that leading economic indicators have not only bottomed but have turned positive supporting the view that the worst of the economic cycle is behind us. At the same time global economic sentiment (current situation and expectations) as measured by Sentix has turned positive.

While we have no reason to doubt the improved economic growth outlook, we do recognise that several indicators suggest that the global economy appears rather mature or “late cycle”. Late cycle is not a sufficient condition for a significant slowdown in economic momentum or indeed the next recession, but it is usually associated with a period of more lacklustre investment returns as the starting point for valuations is higher than long term norms and the base for corporate earnings to grow from is not depressed given elevated profit margins - the best entry point for the equity market is when recovery potential is plentiful.

This cycle has in fact been quite unusual by several measures. While central banks have done their best to lower inflation, growth and credit extension by way of aggressive interest rate hikes, at the same time governments have injected large amounts of fiscal support to ease the escalating “costs of living” due to the energy crisis whilst in the US President Biden used fiscal measures to support various economic growth and infrastructure initiatives. In other words, the world so far has avoided recession, an outcome many had understandably feared. It would therefore be reasonable to assume that the expected cyclical rebound (from an elevated base) will be more modest than what is usually the case after a sharp economic downturn.

We have listed some of the indicators below which would suggest that a strong cyclical recovery in economic momentum is unlikely this time around:

- The unemployment rate is at or near record low levels.

- The US personal savings ratio is materially below its historical average levels.

- Real interest rates are at elevated levels.

- Corporate profit margins have peaked and are trending lower.

- US High Yield credit spreads are trading at the bottom of their 15-year range.

- Equity valuations (MSCI ACWI P/E) are well above their 20-year average.

Conclusion

With the headwind from rising interest rates looking set to ease further in the second half of the year coupled with better-than-expected private sector financial health, a tight labour market and easier financial conditions the global economy has proven to be much more resilient than most predicted and the economic expansion now looks set to modestly gather pace as the year progresses.

While interest rates almost certainly have peaked, Central Banks can afford to be patient and wait for “more certainty” that inflation is indeed still declining and on a sustainable path to target levels before sanctioning interest rate cuts. Our base case is that interest rates will trend lower from June onwards, but we do acknowledge that there is a very real risk that interest rates stay higher for longer given how strong underlying global demand is. In addition, commodity prices have bottomed, and there are signs of a recovery in goods demand that should set the stage for a rebound in inventory accumulation.

Global equity market valuations have benefitted significantly from the improved outlook in growth. Earnings for corporates outside of AI and IT have been rather lacklustre, but this too is expected to improve due to favourable base effects and as the economic recovery broadens. While we acknowledge that a combination of positive earnings momentum, lower interest rates and falling inflation bode well for equity returns, we believe that a lot of the good news is already reflected in many share prices offshore, with little margin of safety for investors in the event of disappointment. The same dynamics have been playing out in the corporate credit market where risk spreads are trading at or close to historical lows which again points to an element of investor complacency.

As a result, we have positioned portfolios with a neutral allocation to global equity across multi asset portfolios, and a focus on quality global businesses with proven pricing power and healthy balance sheets. Bonds are fairly priced and together with cash currently provide investors with favourable income yields and diversification while equity markets are trading at elevated levels.

South Africa

Down but not out

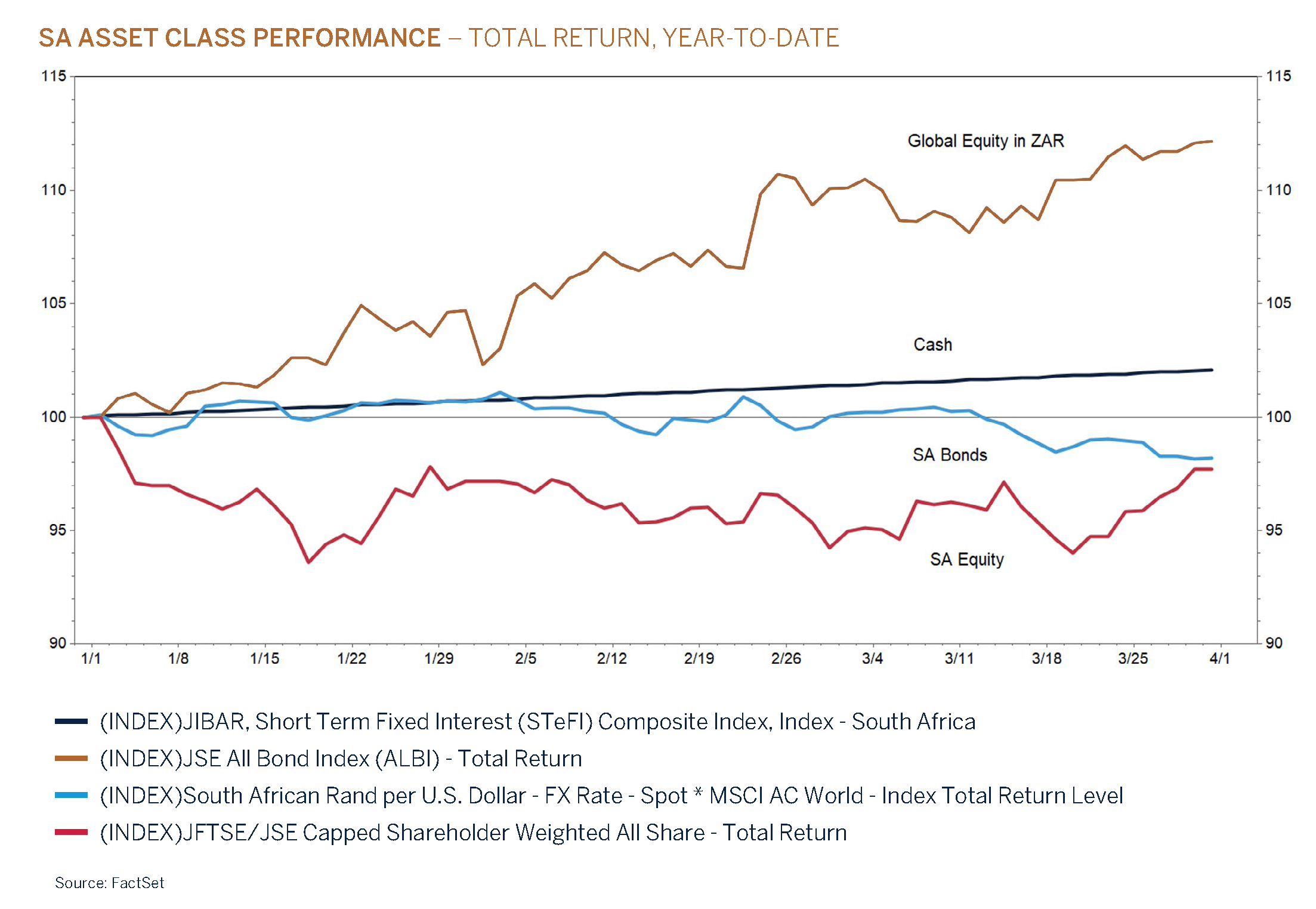

In South Africa, economic growth remains lacklustre with few vectors in the near term expected to drive growth. Corporate earnings have been under pressure, but favourable base effects are expected to drive earnings growth higher over the next 12 months. The disappointing growth and heightened uncertainty over this year’s general elections resulted in JSE listed equities not only underperforming global equities by a significant margin, but also the emerging market peer group.

The Industrial sector generated a positive return during the quarter, aided by a weaker rand. This was followed by Resources that staged a strong comeback during the month of March (+12.8%) to end the quarter slightly down. The gold sector in particular had a strong quarter given the positive momentum in the underlying gold price which has reached a new all-time high as Central Banks and Chinese consumers stepped up their buying in an effort to diversify reserves and wealth, amidst a Chinese real estate recession. The Financial sector was the worst performing sector during the quarter.

Growth reforms bring hope

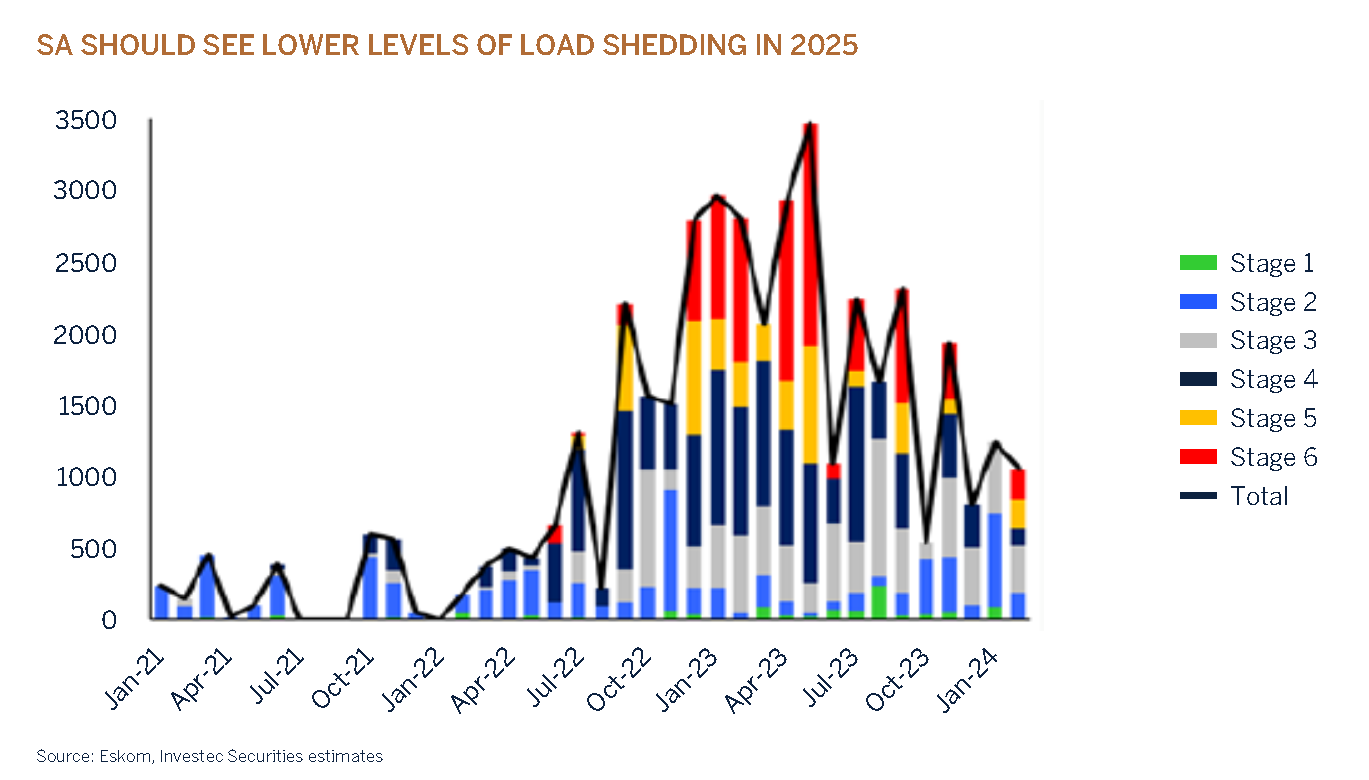

Investors have become sceptical over the eventual implementation of the growth reforms that have been promised by president Ramaphosa. Rightly so, as this process has evidently proven to be painstakingly slow. The country has been shifting from one crisis to another over the past decade. While not ideal, the good news is that the country and policy makers have not allowed “a good crisis to go to waste”. The positive developments surrounding Eskom’s unbundling process and the electricity generation with the assistance from the private sector, as well as the changes in management at Transnet are good examples of what can be achieved when the private sector and government work together to find solutions to SA’s crumbling infrastructure and lacklustre growth. An example would be when in March, NERSA granted approval for Eskom’s transfer of transmission responsibilities to the National Transmission Company of South Africa (NTCSA), which is a significant step to creating a competitive energy market in South Africa. The NTCSA is now fully operational from 1 April 2024. While loadshedding remains a concern and a restraint to economic

growth, it is encouraging that the worst is now behind us and that the country should see lower levels of loadshedding, below Stage 3 in 2025. Renewable energy projects have played an important role in increasing electricity generation while Eskom was trying to keep the coal power stations running, and there is currently another 6GW of renewable energy projects registered with NERSA. Certainly, a step in the right direction as these projects are hugely positive for employment creation and uplifting communities.

Many companies and households’ hands have been forced into being proactive and adaptive by investing large amounts into renewable energy to combat the energy crisis facing the country. The point being is that this cost has been incurred and, is now in the base, meaning that companies are better equipped and have become less reliant on Eskom to do business. A sea change from a year earlier when the economy was literally brought to a standstill, brings reason to be more optimistic for the year ahead.

We are encouraged by these developments, as the successful implementation will allow for more competition, an improvement in service delivery and ultimately a higher trajectory of economic growth as the blockages to doing business and trade internationally subside. Please refer to this link for a comprehensive update report on the progress made by Operation Vulindlela in terms of achieving the stated priority structural reforms https://www.stateofthenation.gov.za/assets/downloads/Operation_Vulindlela_Progress_Report_Q4_2023.pdf

There are however still a few hurdles to overcome, one being a change in legislation which will allow the private sector to participate, and then of course the agreement of terms and conditions which must still be negotiated and concluded. The private sector will participate, but only if it is financially feasible and only if the opportunities meet their required returns on investment. Herein lies the challenge as the SOE’s will be negotiating conditions that will allow them to at least cover their interest cost and operating expenses. At the current elevated interest rates on debt that could prove to be challenging. One of the potential solutions is to approach international development banks with the aim of switching expensive debt for cheap debt, i.e., lower interest rates. This is achievable but will require more certainty from the regulator with watertight contracts in place. We will be following these developments closely as successful implementation will create significant opportunities for the private sector and listed companies, albeit that the lead times could be 2-3 years in some cases. But first we need to get through this year’s election, as the outcome and continuity (or not) of the current administration will determine the path for growth reforms.

Volatility abounds in the wake of the general election

On 29 May 2024, South Africa will head to the polls to either renew the mandate of the ruling party or elect an entirely new administration that will govern the country for the next five years. Unlike in the previous elections where the ruling party was able to garner enough votes to govern on its own, in these elections it is expected that the governing party may for the first time, in thirty years, not be able to achieve a majority victory to form a government alone.

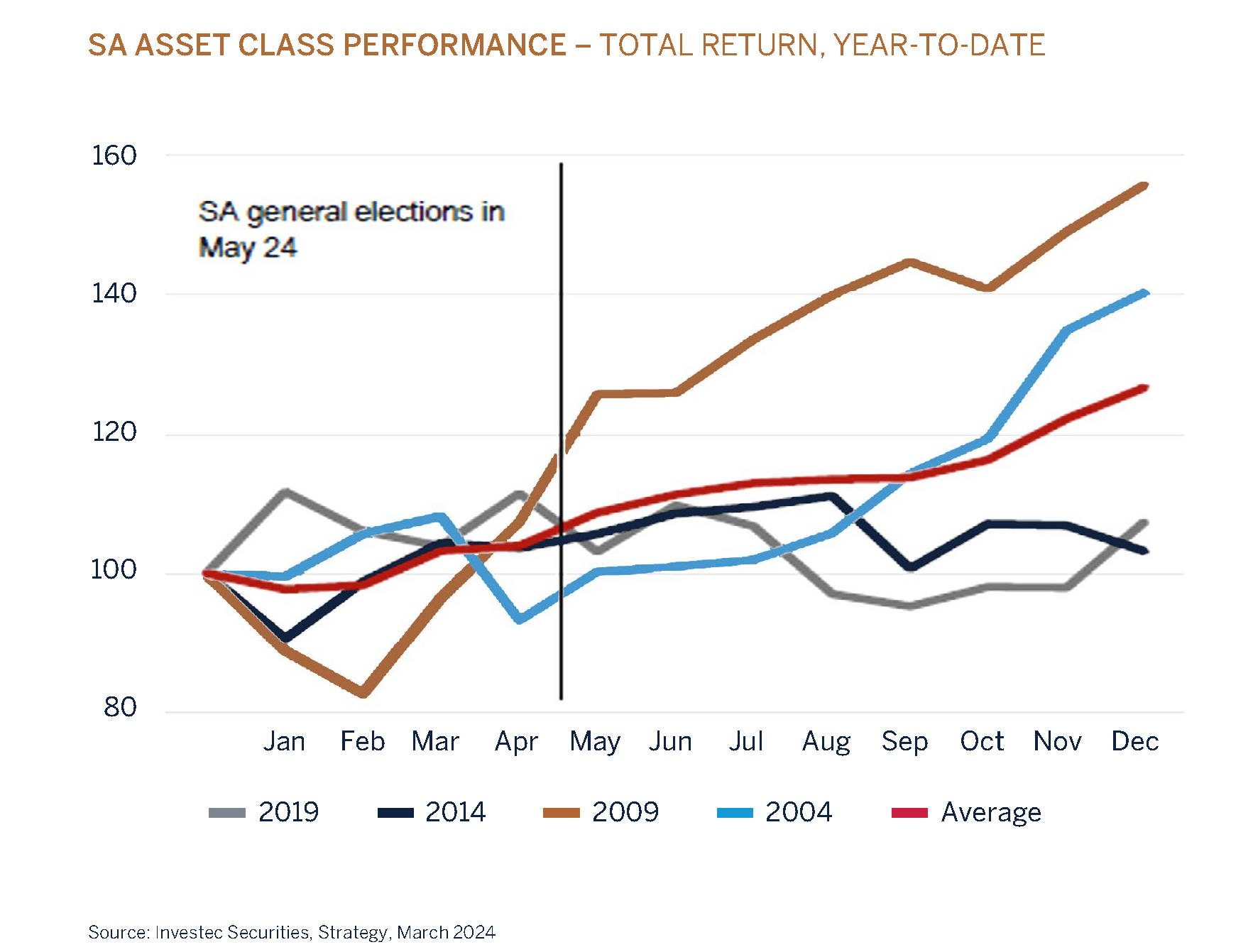

The possibility of this electoral outcome introduces some form of political risk in the short term, where some of the structural reform projects that the current administration had embarked on may be at risk. It introduces an element of policy uncertainty, and we expect both currency and bond yields to be volatile ahead of this event. South African bond yields and the Rand are already expressing this jitteriness, with the SA 10-year bond (R2035) selling off from 11,4% in the beginning of the year to 12,2% at the end of March. The South African Rand joined the party with the currency weakening from R18,36 at the beginning of this year to R18,99 at the end of March against the US dollar. It is important however not to lose sight of how financial markets have previously behaved in the period leading up to the elections vs the subsequent period. The uncertainty from investors that we are currently experiencing in SA has been the norm, and without making any predictions it is quite possible that financial markets could rerate again once there is more political certainty. We are not betting on this, but with valuations of SA assets already reflecting the expected volatility, an outcome that is better than feared could have a positive impact on asset prices. SA equity has historically bounced back in the period following the elections, as can be seen below.

Conclusion

Looking into the future, we expect that the growth projections for the near term will be better due to a reduction in loadshedding and signs of reforms at SOE’s such as Transnet. However, in the medium term, growth will be dependent on implementation of structural reforms, lower interest rates and an improvement in external demand. Chinese authorities have announced several stimulus measures over the past few months and any improvement in growth momentum, international trade or commodity prices are sure to benefit South Africa’s economy.

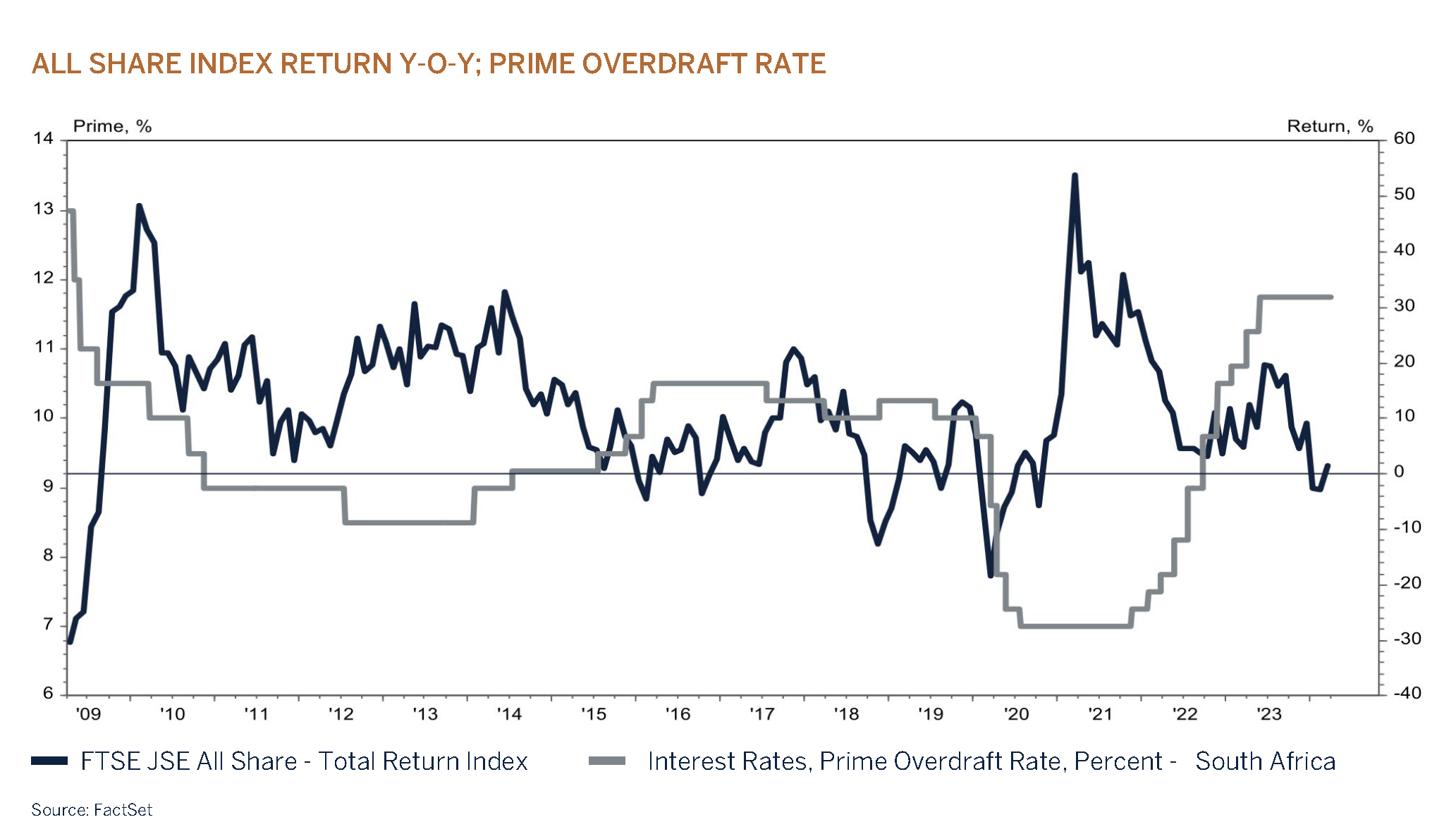

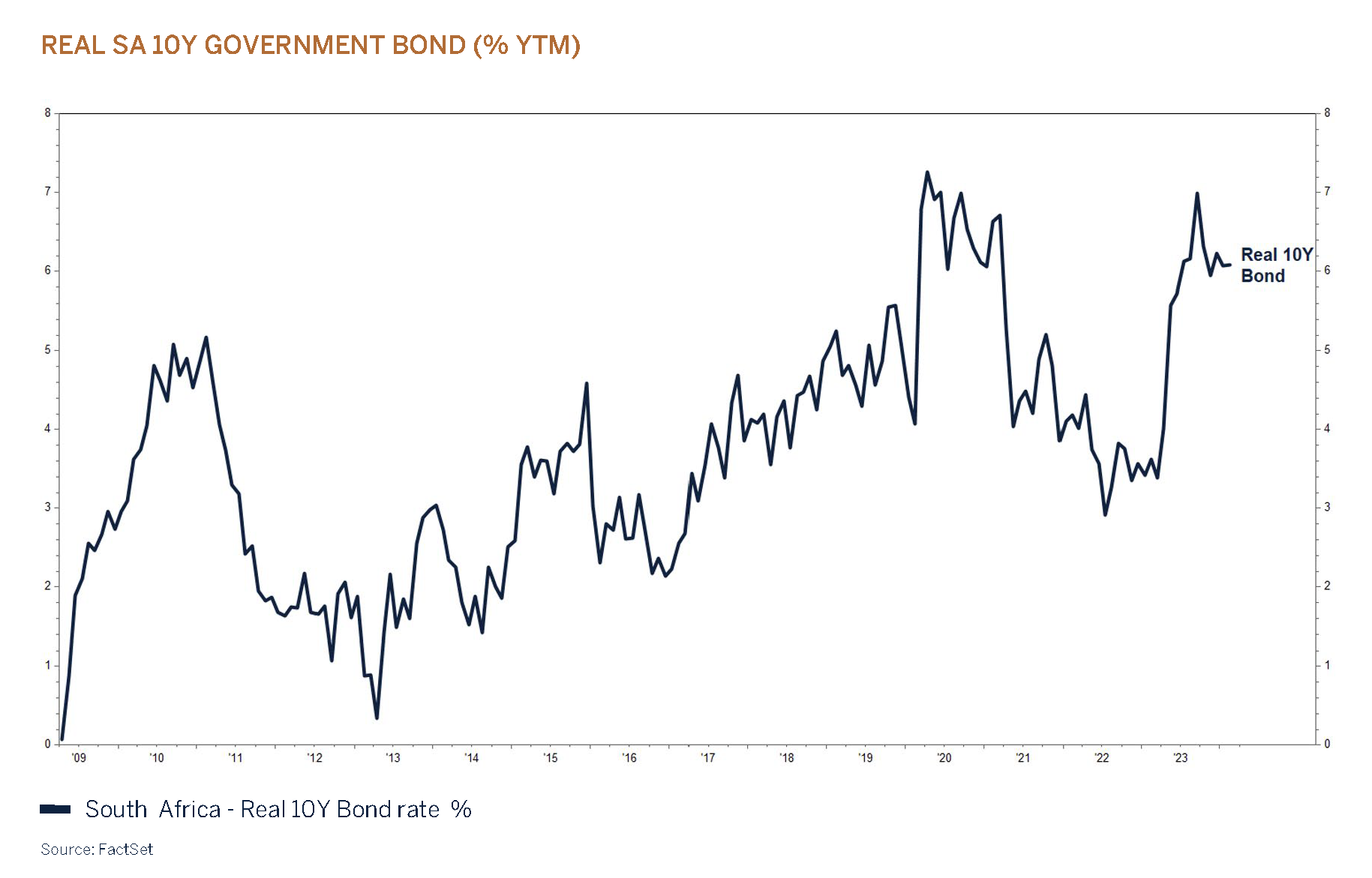

We believe that interest rates have peaked, and rate cuts are expected to materialise both locally and globally in the latter part of this year, which will support valuations in 2024. Sovereign bond yields have adjusted modestly higher to reflect the reality that the path for core inflation, albeit lower, is set to be both bumpy and sticky on its way down as the global economy recovers and favourable base effects begin to fade.

SA valuations remain undemanding but what remains crucial is the implementation of government’s structural reform initiatives which are required to unlock value for investors. We continue to actively monitor the key drivers of asset class returns, which include valuations, the outlook for inflation, interest rates, the change in the direction of leading economic indicators and developments in employment. Our strategy remains unchanged, and we will continue to invest in high-quality businesses with strong balance sheets, robust cash flow streams and attractive valuations as we seek to achieve superior risk adjusted long-term returns.

Asset Allocation

SA Equity – Neutral

The performance from SA equity has been rather disappointing over the past few years. The impact of Covid-19 was significantly more damaging in emerging market countries including SA, who simply couldn’t afford to stimulate their economies and support consumers through aggressive fiscal measures in the same way as developed economies. The result was that it took the domestic economy and corporates much longer to get back to pre-Covid levels. There were other factors that also contributed to a slow recovery, including poor service delivery, a significant increase in loadshedding, the visa debacle, Transnet woes and significantly higher interest rates. Some of these detractors have been addressed. Loadshedding has become less intense than a year ago and Transnet’s volumes have picked up considerably over the past few months. The effect is that the operating cost of doing business has declined sharply for many companies, with less fuel to burn and improved volumes. Tourism, an important contributor to SA’s economy has also picked up considerably over the past 18 months. In addition, we have seen a surge in the gold price and the bottoming in the prices of other metals such as the PGM’s. And finally, in line with the trend globally, interest rates have peaked and are expected to decline during the second half of the year. All contributing to an improved growth outlook in South Africa and for domestic companies from arguably a very depressed base.

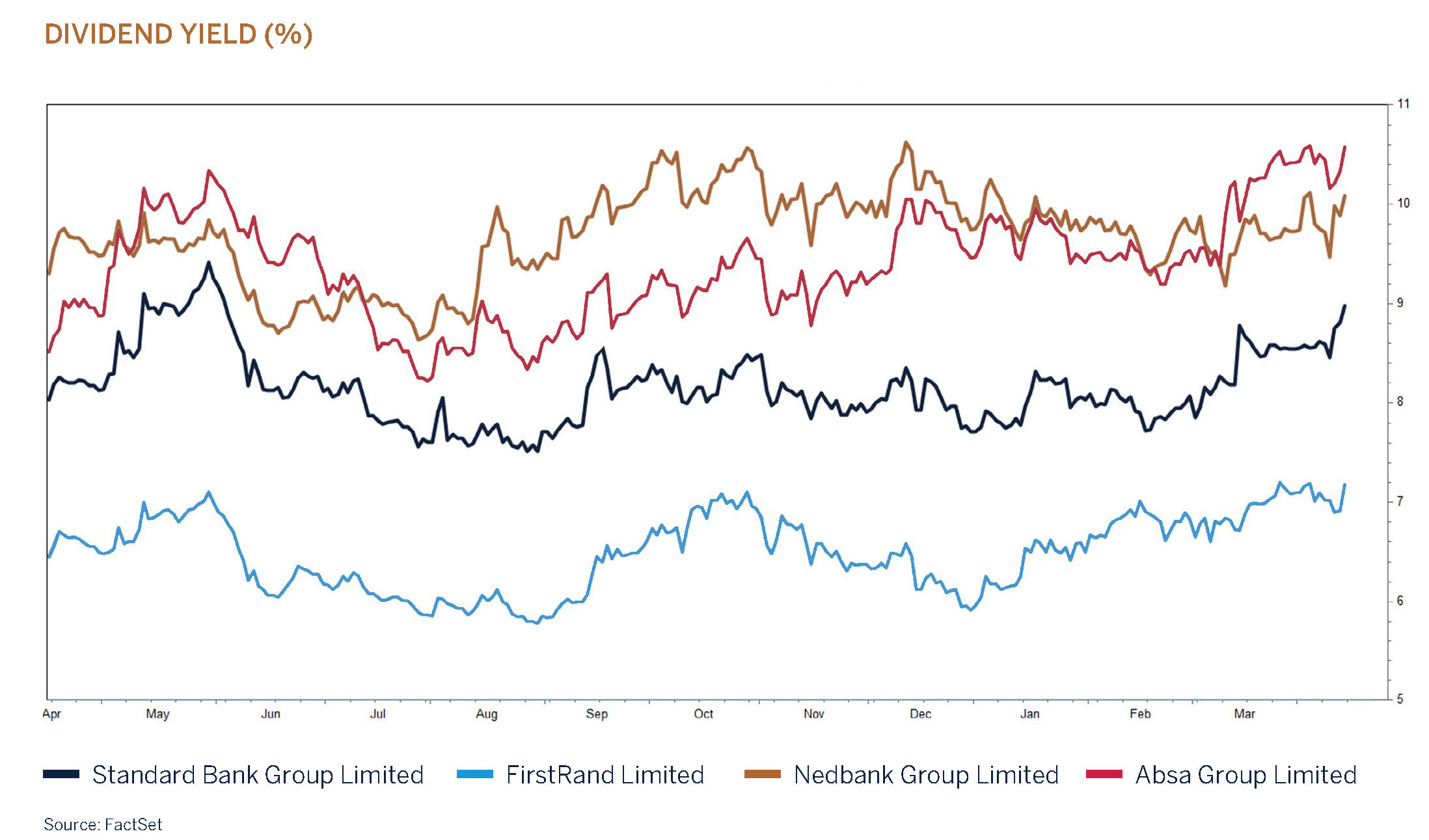

The uncertainty related to this year’s general election has resulted in the derating of SA listed equity prices this year, with many shares offering attractive valuations for patient long term investors. By way of example, the banking sector is trading at Covid-19 levels with dividend yields ranging between 6% and 10%, which in certain cases are also above their price-to-earnings ratios. The attraction is that these (income) yields are significantly higher than inflation to begin with and provide protection against inflation as these corporates grow their profit streams over time. In other words, investors are adequately compensated at current valuations even if SA’s economic growth trajectory doesn’t improve as expected.

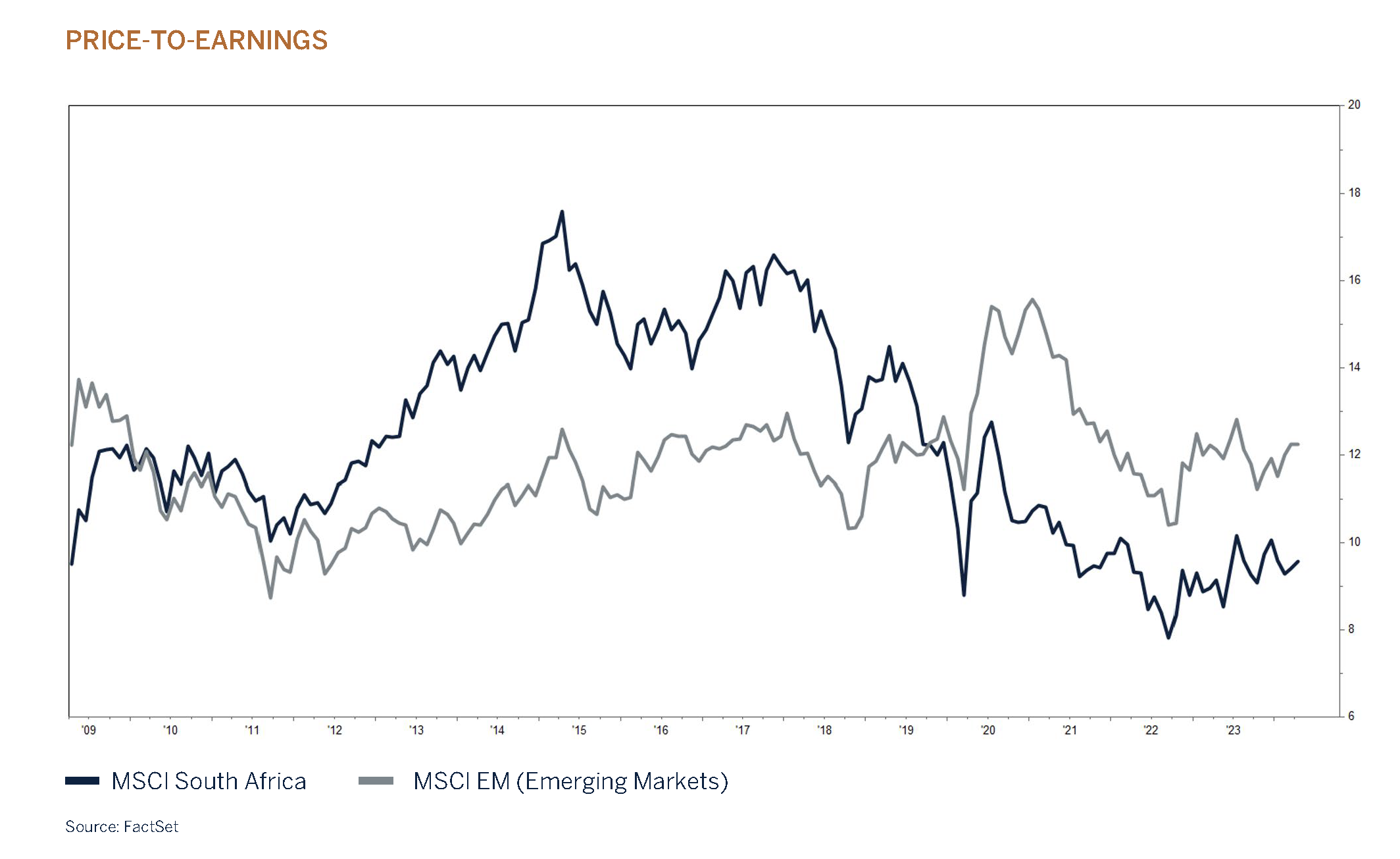

Another example which illustrates the relative attractiveness of the domestic equity market is when we compare the local market valuation to that of the emerging market peer group. Whereas the local bourse used to trade at a

premium, that is no longer the case and a reflection of SA’s growth woes coupled with an increase in its cost of capital. While valuation alone is not the only reason to commit capital to the domestic market, it is an important indicator of how much bad news is already reflected in prices. Lower interest-and-inflation rates and an improvement in earnings growth have always resulted in attractive returns for shareholders, and this time should be no different.

Global Equity – Neutral

Contrarian investors will be nervous about global stock markets at new all-time highs. However, it is worth noting that share prices do not have memories. A record high only equates to a market peak if it is the last high in an upturn. And bull markets can last for years. They are typically killed off by an economic recession or aggressive central bank rate hikes rather than

price action per se.

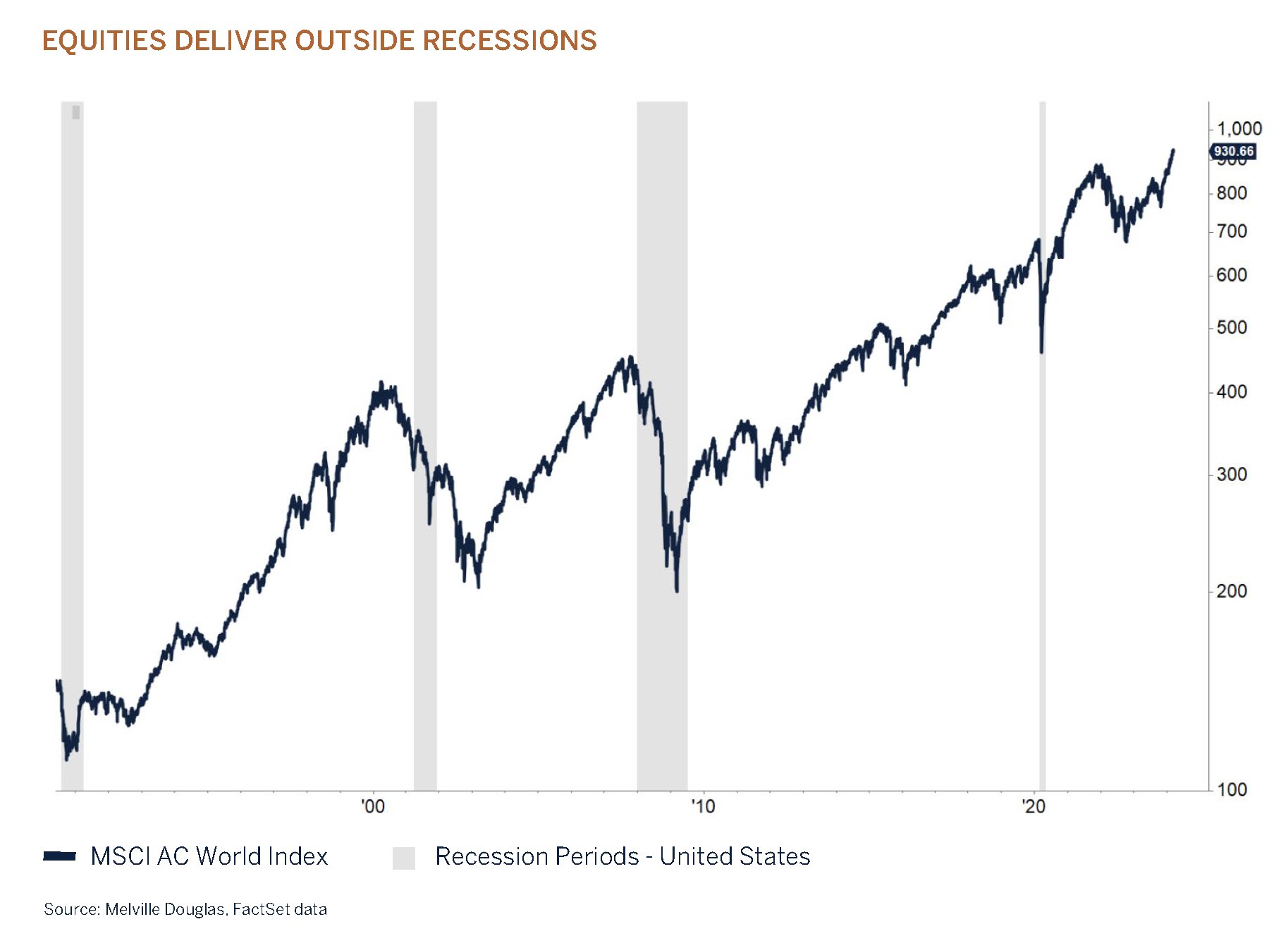

As shown by the grey shaded areas on the chart, economic recessions are not conducive to rising stock markets. To a greateror-lesser extent, company profits are inextricably linked to the wider economy. Even essential items, such as consumer staples, are adversely impacted as a more frugal consumer seeks to trade down to a cheaper brand or private label product.

The problem with predicting economic downturns is that we will only know with hindsight how long and deep they end up being. For example, during the depth of the 2008/2009 financial crisis, there was talk of a potential lurch into another 1930s-type depression. The MSCI All Country World Index plummet of -55% was a partial reflection of the heightened risk of this Armageddon scenario playing out.

That is not to say, market selloffs/corrections do not occur outside recessions, they happen often. However, non-recession selloffs tend to be shallower and shorter-lived experiences. The most recent example being the -23% peak-to-trough fall in the MSCI All Country World Index in 2022. The fear was that sharply higher interest rates and soaring inflation would send the world back to 1970s-type stagflation. Fortunately, these worst fears were not realised. As eminent economist Paul Samuelson quipped in 1982, “the stock market has predicted nine out of the last five recessions”.

What does this mean for the outlook for this year?

As well as the rate of inflation coming down, the main driver for the stock market rally in 2023 was that the world skirted a widely expected recession. If these conditions can continue to hold then markets can progress further.

Of course, nothing is certain. The apple cart could be upset by a corporate earnings downturn, further deterioration in the Chinese economy as deflation and the weak property sector takes its toll or inflation not playing ball which would likely result in more monetary tightening.

Nonetheless, the current improving macro data has lowered risks compared to this time last year. This bodes well for another positive year in 2024 for equities as an asset class. The neutral tactical position against strategic benchmarks in client investment portfolios reflects the supportive backdrop counterbalanced by elevated share price valuations, largely in the US, resulting in a nuanced risk/reward compared to bonds and cash. Longer term, equities remain one of the most effective ways to preserve and grow wealth.

SA Fixed Income – Overweight

The year 2024 began with financial markets optimistic and expecting global central banks to cut policy rates in the first quarter of the year. However, inflation proved to be persistent, and this optimism faded away quickly. Policymakers expressed their unease with the deceleration path of inflation. As a result, we are now anticipating that the interest rate-cutting cycle will begin in the second half of the year.

In both its meetings this year, the South African Reserve Bank (SARB) kept interest rates on hold at 8,25%, with the tone in its last meeting more hawkish even though the decision was unanimous. This hawkish tone was further reinforced by the rhetoric emanating from the US Federal Reserve (US Fed). In its first meeting of the year in March 2024, US Fed Chair, Jerome Powell, indicated that the Federal Open Market Committee (FOMC) was in no rush to cut interest rates and would wait for clearer signs of lower inflation before easing monetary policy. He nevertheless reiterated that it would be appropriate to ease interest rates sometime this year, with recent higher-than-expected inflation data not “materially changing” the overall inflation view.

In February, the Minister of Finance, Mr Enoch Godongwana, delivered the national budget amidst a challenging economic growth outlook. The nation’s long-term growth prospects are hampered by factors such as power outages, inefficiencies at ports, failing rail and road infrastructure, high interest rates, growing borrowing costs and heightened geopolitical tensions.

It turned out that the announced budget was better than what was expected. The debt as a percentage of GDP has been revised lower and is now expected to reach its peak at 75,3% in 2025, instead of the previously predicted 77,7%. One of the major positive outcomes of the budget was the announcement made by the minister regarding the government’s plan to use foreign reserves unrealised profits held in the Gold and Foreign Exchange Contingency Account (GFECRA). The National Treasury will withdraw a total of R150 billion from this account over the next three years, with R100 billion in 2024 and R25 billion for each subsequent year. This withdrawal will be used to repay debt and reduce the country’s debt burden while following strict guidelines. Using reserves to reduce the debt burden instead of using them for consumption is considered a positive development by the market and will contribute to reducing fiscal risk.

We believe that local bond yields, currently at 12.2%, are attractive in both absolute and inflation adjusted terms (real yield). However, we advise caution in the near term as volatility is likely to rise in the period leading up to the general elections. To mitigate against the short-term volatility, we plan to maintain a shorter duration position within fixed income. We anticipate lower interest rates in the second half of 2024, but we believe that the cycle could be shallower than previously expected. We will carefully monitor the actions of the developed central banks as they will have a significant impact on the SARB’s ability to move on policy rates.

Domestic Cash – Underweight

We favour long duration fixed income assets over cash in SA at present in anticipation of lower interest rates this year.