From our Fund Manager’s Desk - Amazon

We regularly explore the investment rationale of one of the companies we own in the Melville Douglas Global Equity fund to articulate what we find compelling. This time round we have chosen Amazon. It’s always “Day One” at Amazon. This mantra was espoused by Amazon founder and long serving CEO, Jeff Bezos. First mentioned in his now famous 1997 shareholder’s letter, Bezos outlined the fundamental measures of Amazon’s potential success — relentlessly focusing on customers, creating long term value over short-term corporate profit, and making many bold bets. Considered one of the more insightful and visionary corporate leaders of the last three decades, his retirement in 2021 left investors questioning if his departure would mean it was now Day Two. Amazon represents the best of innovation and corporate strategy within the Global Equity Fund. At the same time, it is also one of the best executors at scale in any industry globally. We see tremendous opportunity ahead for Amazon and value in its stock. This is the fascinating story of its success.

In the business of scale

From its modest beginnings as an online bookstore in 1994 to becoming the world’s largest ecommerce platform outside of China, Amazon has continued to defy sceptics over the last 25 years. Today, more than $600bn of goods are sold through its online platforms and brick-and-mortar stores. By comparison Walmart, America’s number one retailer, is the same size but growing at less than half the pace of Amazon.

A large part of Amazon’s success has been its industry leading distribution and fulfilment capabilities. In the early 2000’s, the company strategically chose to open its online e-commerce platform to outside sellers (third party merchants) – today they make up about 60% of sales. Fulfilment by Amazon (FBA) is a service that allows businesses to outsource order fulfilment. Amazon will handle the logistics of receiving, warehousing and delivering stock – leaving the nearly two million Amazon sellers to focus on finding products that customers will love.

Today, Amazon Prime members get free same day delivery through a sprawling and complex logistics network. Countless employees, thousands of vehicles, and nearly 100 aircraft work in concert to deliver a package to a customer’s door only hours after clicking the buy button. Building out this level of service has come at huge expense and to replicate it would be a task beyond almost any new entrant.

Amazon’s scale advantage over any would be competitors benefits them in two ways. The first is a cost advantage – by moving greater volumes through their warehouses, the cost per delivery is lower. This allows Amazon to take a higher margin off third party sellers and offer their own products at a lower price.

The second benefit is the intangible value derived from the massive network of buyers and sellers. Customers will keep returning for the selection and value that Amazon is known for. On the other hand, merchants know that to reach the largest audience they must sell on Amazon.com. This network is very profitable for Amazon. With 200m customer subscriptions, Amazon Prime is estimated to be a $25bn per annum business, while the ecommerce platform takes in almost $40bn annually through merchant advertising.

Software is eating the world

In 2011, Marc Andreessen, one of Silicon Valley’s foremost thinkers, famously wrote that “software is eating the world.” His prediction was that software companies would disrupt traditional industries and gradually take-over a large part of the economy. His image of the future was prescient. More than ever before we live in a data driven world where software is an increasingly important part of every business.

Cloud hyperscalers provide the IT infrastructure needed to allow entire businesses like Netflix to exist in the cloud. Traditional industries like financial services are moving into the cloud at an accelerating pace. The cloud allows organisations to store, retrieve and usefully deploy data and software applications. Offering cost efficiency, flexibility and huge, huge scalability – everything an IT department is looking for.

Starting in 2007, Amazon Web Services (AWS), found a loyal customer in Amazon.com – its first and best customer. Soon thereafter, realising that like e-commerce fulfilment, it could scale faster by opening its infrastructure to third parties. By offering its expertise to them it would lower the cost of doing business for Amazon’s own operations.

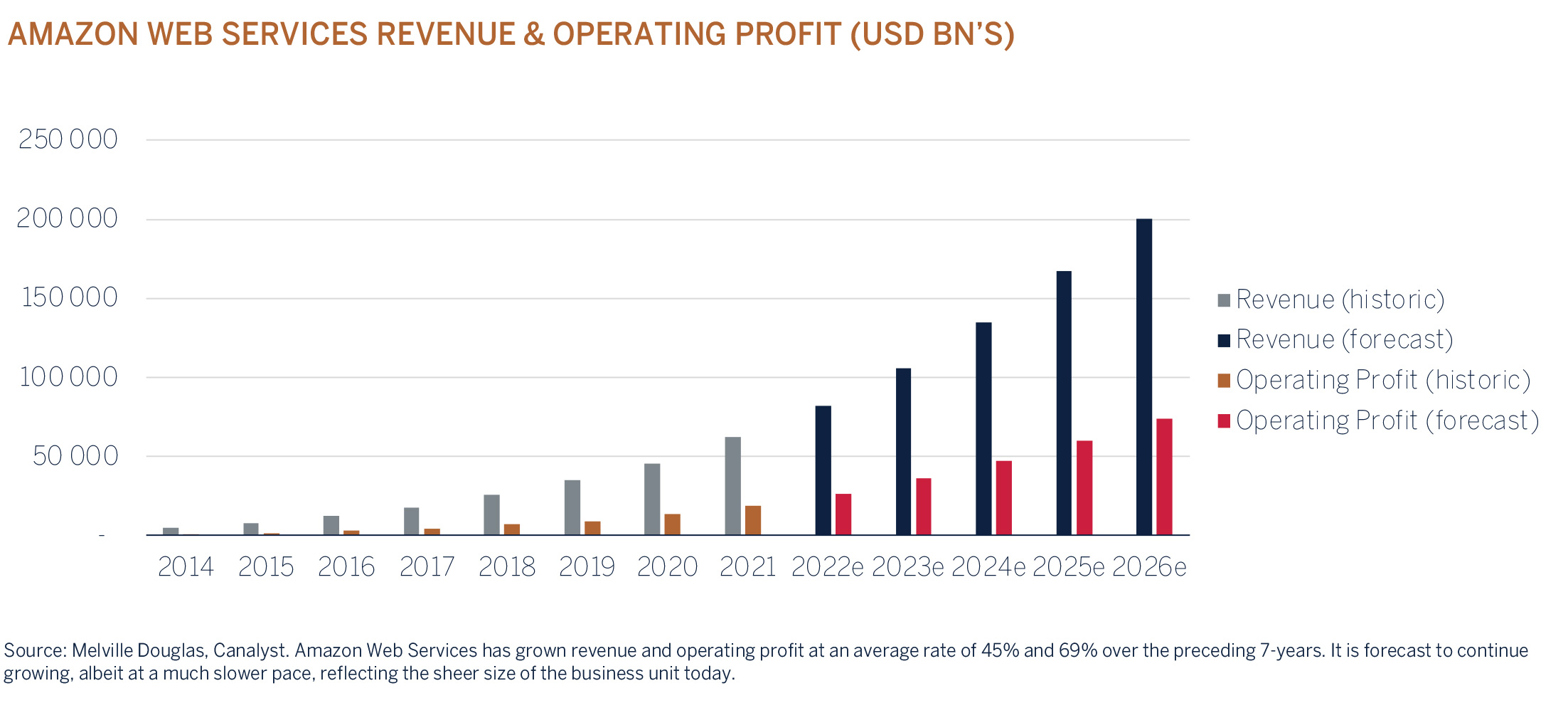

AWS is the largest cloud computing business globally with $80bn in sales, and data centres across more than 200 global locations. Within Amazon, AWS is now the core of its profitability and largest single source of cash flow. With large barriers to entry, sticky customers, high margins and a long growth runway – AWS exhibits many of the quality attributes that we look for in a company. If AWS were a standalone business, we would likely own it in the Global Equity Fund.

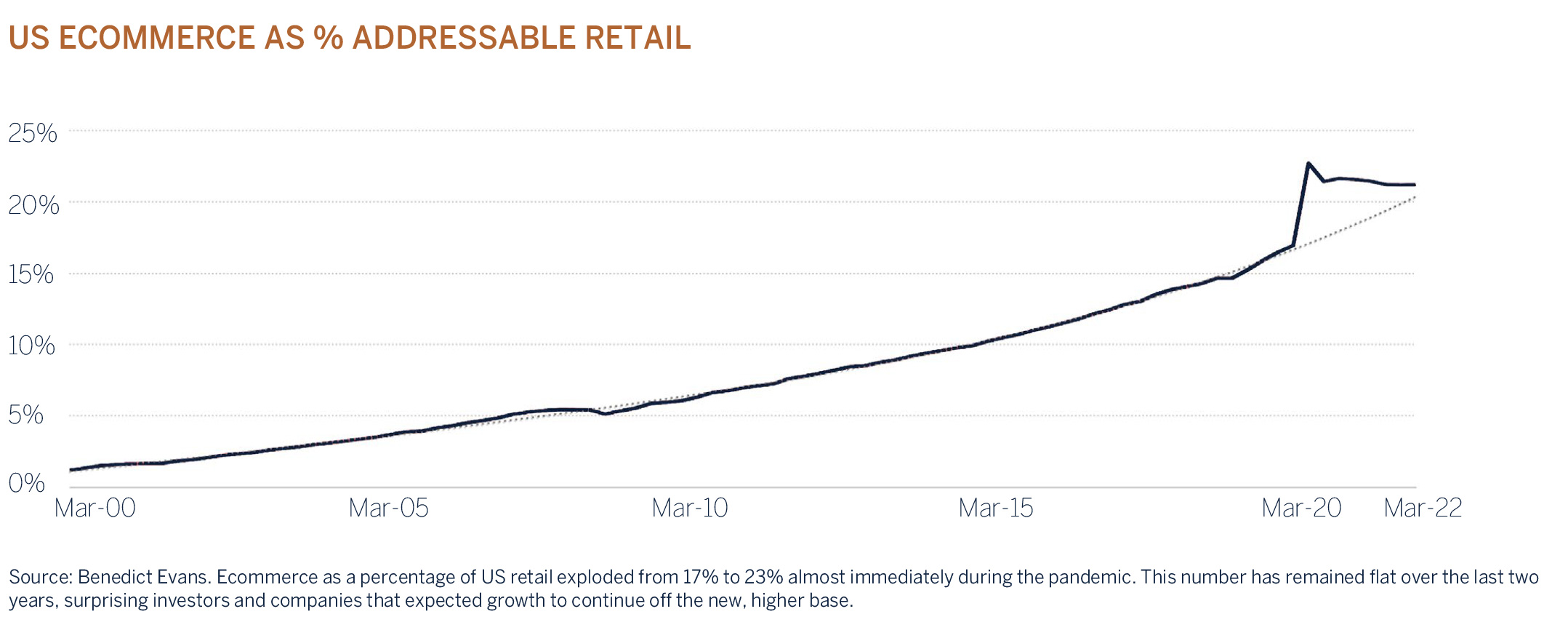

The great pull forward

The COVID-19 pandemic forced change to the way we live and to how companies manage their operations. Practically overnight, lock-ins begun and work-from-home became the normal operating procedure. This advanced already in place trends as the demand for online services, ecommerce shopping, and remote working tools exploded. Being the world’s pre-eminent ecommerce platform and having a large base of customers in the internet economy, Amazon’s business surged during this time.

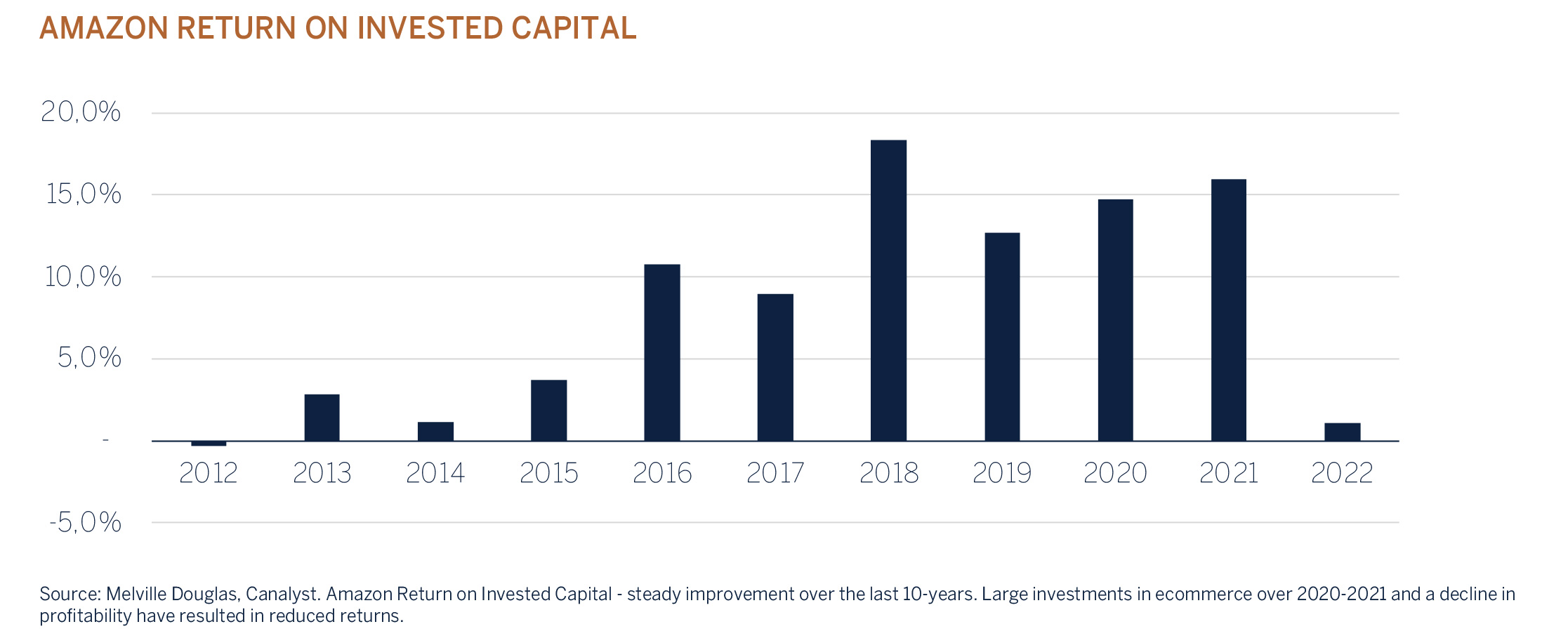

In response to this, Amazon moved into an accelerated build out phase – over two years Amazon doubled its warehouse capacity which it had taken 25-years to build. These new facilities would be staffed by hundreds of thousands of new workers bringing Amazon’s headcount to more than 1.6 million – making it the one of the largest private employers in the world. This exuberance wasn’t to last. The reopening has seen shoppers, still flush with funds from stimulus cheques, shift spending to travel and experiences. The accelerated growth experienced during COVID-19 has not been sustained and we have seen a significant slowdown. Excess capacity and increased overheads have swung the ecommerce business from its most profitable year ever to making a loss. This has resulted in what we believe are temporarily depressed profits and a break in the long term trend of an improving measure of Return on Invested Capital.

With the countermeasures taken by Amazon it should take approximately 18 months to grow into the capacity that has been built. At that point, increased utilisation should result in efficiencies driving higher margins and a return to prepandemic profitability growth trends. When companies invest money to expand their business you don’t typically get an early return. Amazon’s focus on long term value creation serves us as investors. We would be concerned if the business chose to optimise short term profitability over investing for future growth.

Amazon defines customer value at its core

Amazon made buying on the internet safe and reliable. Removing the frictions of online payments and returns while resolving customer worries about counterfeits and delivery issues. The relentless focus on customer value over the last 25 years has seen Amazon grow to become synonymous with ecommerce in the US. The core principles behind its success are saving customers money, saving them time, and offering a vast selection. Today AWS does the same for a very different set of customers, but it is the same principle of driving customer value that allows it to succeed.

And remains a long-term winner

Jeff Bezos was once asked by an employee what Day Two looked like at Amazon, he responded “Day Two is stasis. Followed by irrelevance. Followed by an excruciating, painful decline. Followed by death.” Our view is that Amazon remains a Day One organisation. The company has time and again demonstrated a long-term mindset, focus on its customers, and a proven ability to adapt and rapidly innovate. Importantly, it has maintained this while growing to become one of the largest businesses in the world. By every account we see Amazon continuing to create longterm value for shareholders.