From our Fund Manager’s Desk

We regularly explore the investment rationale of one of the companies we own in the Fund to articulate what we find compelling. This time round we have chosen Boston Scientific.

Rather like investing, maintaining a sustainable edge in medical innovation requires staying within your realm of expertise whilst maintaining a diversified portfolio of attractive opportunities. Boston Scientific has transformed itself into one of the best proponents of this strategy within the MedTech industry. We elaborate why we hold the shares.

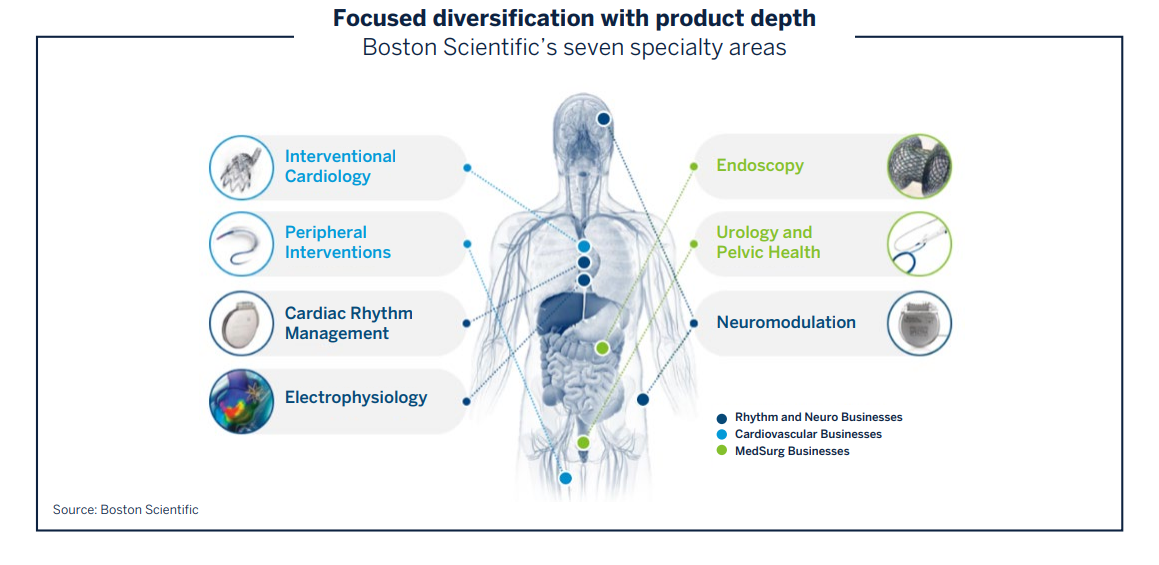

Boston Scientific develops and sells global medical devices. It is well regarded in the industry for its long-held cardiovascular franchise, which includes pacemakers, defibrillators and stents. These legacy products are still growing steadily in demand but the pace is limited given competition from the likes of Medtronic and Abbott. Ongoing innovation has helped. For example, Boston Scientific’s Resonate™ family of implantable defibrillators and Eluvia™ drug-eluting stents to keep arteries unblocked has helped to bolster growth in its cardiovascular franchise. However, the nub of the investment case is the company’s diversification into adjacent fields of expertise. Through a mixture of in-house innovations and bolt-on acquisitions, Boston Scientific has branched out into faster growing areas, such as neuromodulation and endoscopy.

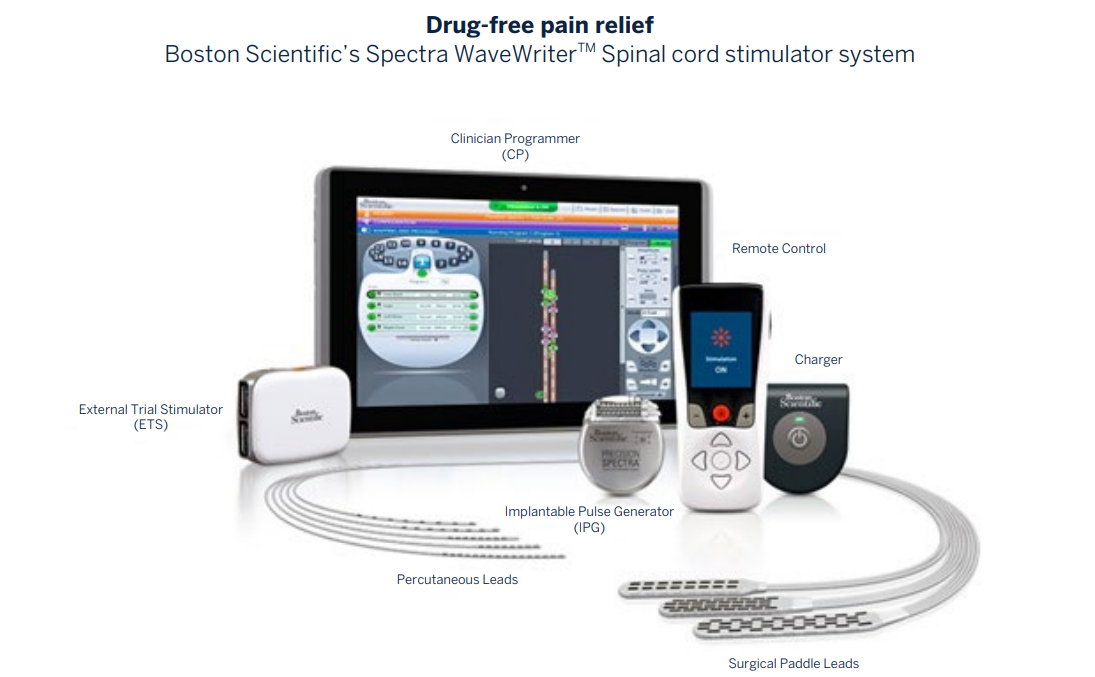

Within neuromodulation Boston Scientific provides spinal cord and deep brain stimulator systems used for the management of chronic pain and the treatment of Parkinson’s disease respectively. The company’s Spectra WaveWriter™ Spinal cord stimulator system is a drug-free treatment that can mask pain messages travelling to the brain by sending electrical impulses to the spinal cord that can vary with frequency, pulse width and amplitude.

Patients are also able to provide real-time feedback, using a remote control which is designed to enable adjustments because everyone experiences pain differently and pain changes over time. One in five adults in Europe are affected by chronic pain and therefore this innovative treatment can help to reduce the growing dependence on opioid drugs by high-risk users.

Another exciting growth opportunity is endoscopy. This is a procedure where the inside of your body is examined using an endoscope, which is a long thin flexible tube with a light source and camera at one end. The worldwide endoscopy devices market is expected to grow over +6% annually and exceed $35bn by 2022. A driver has been the consistent increase in the incidence of cancer, gastrointestinal diseases and other chronic diseases, which can be attributed to the ageing population, growing incidence of obesity and lifestyle related factors. Additionally, the improvement in visualisation and diagnostic technology, accompanied by higher awareness of advantages among medical professionals, is driving the demand. The market is dominated by flexible endoscopes, of which Boston Scientific has several products in this category.

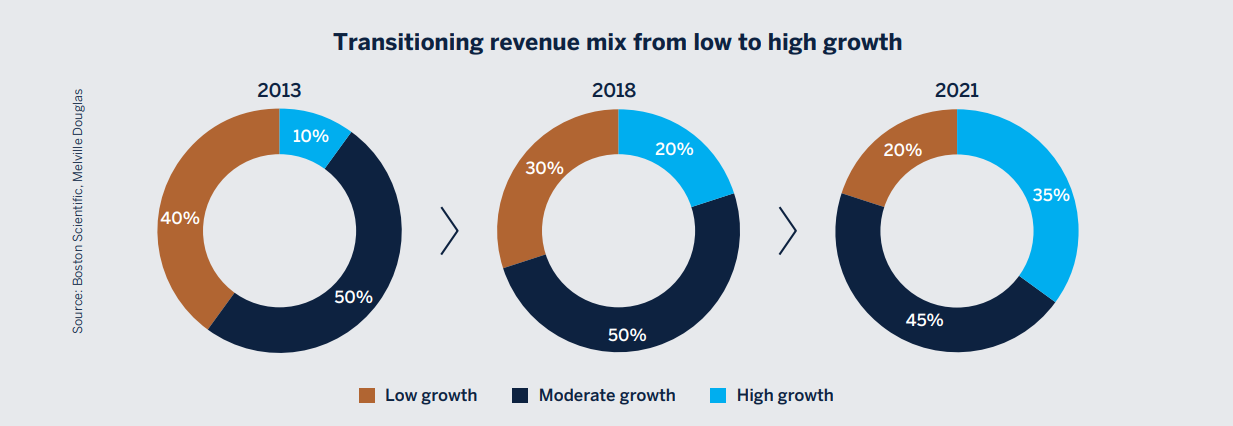

Boston Scientific’s diversification strategy is starting to pay dividends. Revenue is projected to grow +8% to +10% per annum, an acceleration from several years ago due to management’s decision, led by chief executive Mike Mahoney, to undertake this transformative shift in the business mix to higher growth devices categories. As a result, the revenue mix to the flattish growing (0% to +3% per annum) pacemakers, defibrillators and stents businesses declined from 40% of group revenue in 2013 to 30% in 2018, and management are targeting 20% by 2021. The flipside is an increase in the revenue mix in high (greater than +10% per annum) and moderate (+4% to +9% per annum) growth markets to 80% by 2021.

In addition, Boston Scientific has a track record of driving operating profit margin expansion since 2012 through productivity improvements and cost savings. The company expects operating margins to exceed 30% over the long term from about 26% today. The combination of accelerating revenue growth and expanding profit margins is expected to drive +12% to +15% per annum earnings growth over the medium term. A strong platform to deliver compound investment returns to shareholders. The shares are valued approximately in line with the medical devices sector, although a premium is warranted given the potential to deliver earnings per share growth above their peer group.

In summary, an investment in Boston Scientific directly benefits from the increasing demand for healthcare as populations age and from rising patients’ expectations for high quality care. Unlike prescription drugs, where pricing will likely remain a political football during and beyond the Presidential election campaigns, MedTech is viewed favourably as “part of the solution” to improve healthcare outcomes and lower medical costs. Boston Scientific’s ongoing strategy of targeting a spread of high growth speciality niches ensures it retains leadership at the cutting edge of innovative therapies. Focused diversification makes sense in MedTech as well as in global equity fund management.