From our Fund Manager’s Desk

Experian

We regularly explore the investment rationale of one of the companies held in the Melville Douglas Global Equity fund to articulate what we find compelling. This time round we have chosen Experian.

If information is power and power is money, Experian has a lucrative edge. The firm has quietly amassed a data empire that underpins a wide range of critical functions in the modern economy. From lending decisions to fraud prevention, Experian’s data-driven insights are increasingly vital as the digital age accelerates. This note will examine Experian’s business model and why it deserves a place in the fund as a “Melville Douglas Compounder”.

What is Experian?

The credit information industry traces back to 1803 when a group of London tailors began swapping information on customers who failed to pay their debts. Experian originated out of the operations of Great Universal Stores (GUS), a retail conglomerate in the UK. GUS had millions of small customers who purchased goods on credit through its mail order business and home furnishing stores. In the 1960s, approximately a quarter of British families were customers of GUS. Therefore, GUS was probably the largest lender in the UK at the time. The company built its own credit databases, which were originally only for in-house use until IBM persuaded them to sell the information externally. The commercial conduit for GUS’ credit information services was formalized in 1980 as CCN Group. The business grew in part through acquisitions, including the 1996 purchase of US-based Experian, formerly known as TRW Information Systems and Services. Experian, as it was renamed, was spun off from GUS in 2006. The IPO was in October 2006 at £5.60 per share. In 2007 it added another geographical leg beyond its key US and UK franchises by acquiring Serasa, Brazil’s leading credit bureau.

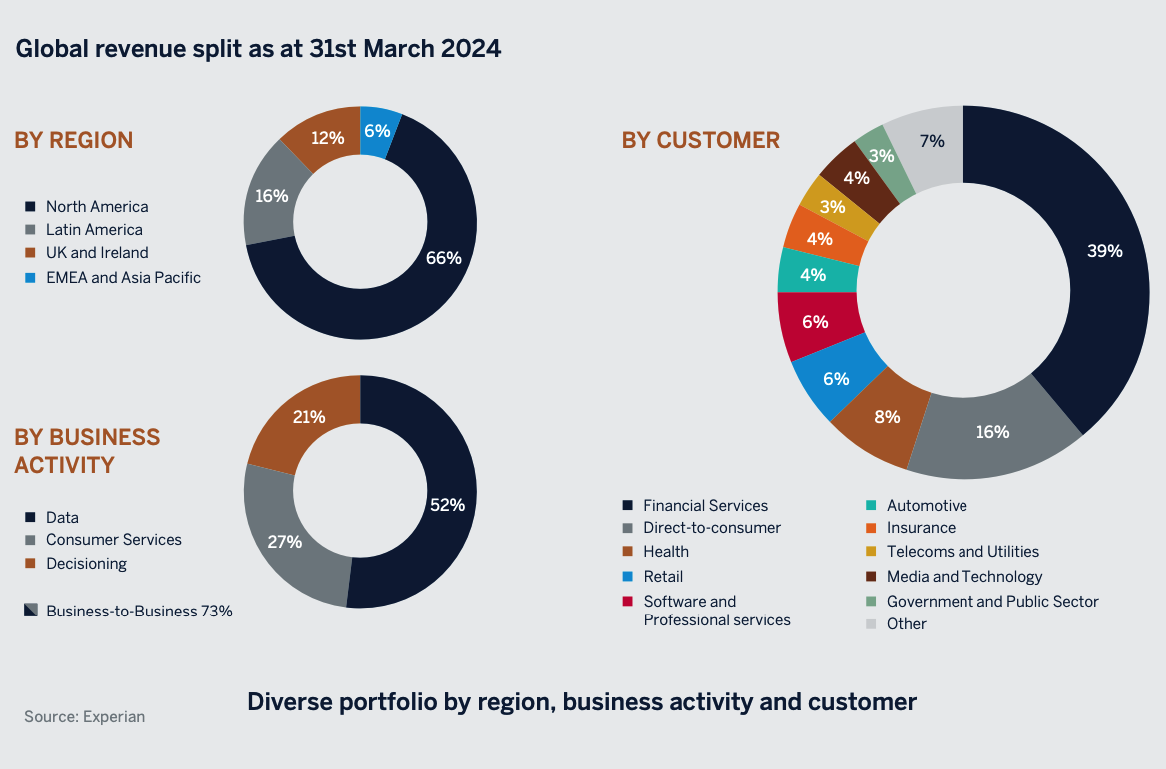

The company reports its financial results according to three segments: Data, Decisioning and Consumer Services. Data and Decisioning includes its credit bureaux and provides businesses with a suite of data driven tools and services, enabling better decisions about credit risk, fraud prevention, and marketing. Consumer Services provides credit reports and scores to consumers, empowering then to make informed financial decisions. While the competitive advantages for Experian’s other businesses are not quite as deep as the core credit bureau business, they are natural add-ons that have significantly expanded its growth opportunities.

Building on its credit database – a balanced business mix

Why is a credit bureau an attractive business model?

A credit bureau (or “consumer reporting agency” in the US) searches and collects individual credit information. The information includes credit applied for, whether or not their applications were successful, bill-paying habits and how they repaid loans. Experian acquires data from thousands of sources, including from creditors, debtors, debt collection agencies or offices with public records (e.g. court records) as well as incorporating demographic information on consumer purchasing activity. The data it collects are the foundation for credit scores used by lenders to assess the creditworthiness of a consumer.

This data is sold for a fee that is typically tiered (i.e. $0.80 per credit report for the first 10,000, then $0.75 and ultimately $0.60 for a very large number of reports). Customers include large multinationals, financial institutions (i.e. banks, mortgage lenders, credit card companies and other financing companies) and governments as well as small mom-and-pop businesses. About 39% of Experian’s revenue still comes from the financial-services industry. That proportion might sound high but is down from about 70% in 2000.

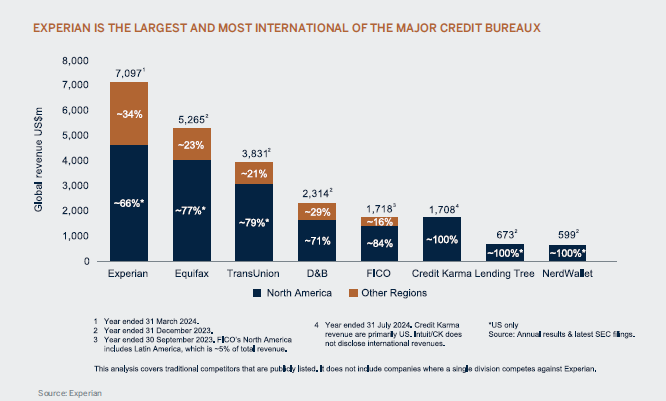

The US credit reporting agency (CRA) industry is concentrated given it is dominated by a top tier of three players. There are other much smaller CRAs, but they do not pose much of a competitive threat. The other two major players are Equifax and TransUnion, which are less global and more US-centred compared to Experian. Another significant competitor is Dun & Bradstreet, which is just focused on business lending, where it is the market leader in the US (Experian is #2). Experian is split 80% consumer credit information and 20% business credit information. Outside the US, the industry structure and competitive landscape varies. For example, credit bureaux tend to be state owned in Germany. In Brazil there is only one significant credit bureau, which is Serasa (owned by Experian). Experian is also the dominant player in the UK.

Given the concentrated industry structure, credit bureaux/CRA competition tends to be oligopolistic. Although a credit report is often a tiny fraction of a lender’s total costs, it is a crucial piece of information to assess the risk of default. Hence, the credit report industry does not need to compete on price. The market leaders tend to provide a joint service as banks and lenders usually pull credit data from more than one firm when determining the creditworthiness of consumers. The result is a highly profitable and cash generative credit reporting industry.

Given its lucrative dynamics, why doesn’t this industry attract more competition?

There are three main reasons:

/ First, there is the difficulty and expense of replicating a database of similar depth and quality. Experian has a powerful network effect, whereby businesses want to use its information, and are happy to supply it with their own, as it has the best data. This has fuelled multi-decade growth of an unrivalled database of millions of records that have been tirelessly matched and enhanced.

/ Second, there is no incentive for most banks to go to the expense of setting up data distribution to new entrants, unless there is a major pricing issue, which there isn’t. As credit bureaux data is based on the voluntary reporting of thousands of financial institutions, it is unlikely a startup, particularly amid heightened data security concerns, would be able to convince banks to share consumer information.

/ Third and finally, regulators have imposed high barriers to new entrants to ensure consumer protection. For example, the US regulator requires credit bureaux to have the infrastructure and processes in place to deal with any consumer disputes over the accuracy of their credit score within 30 days.

Steady Eddie growth

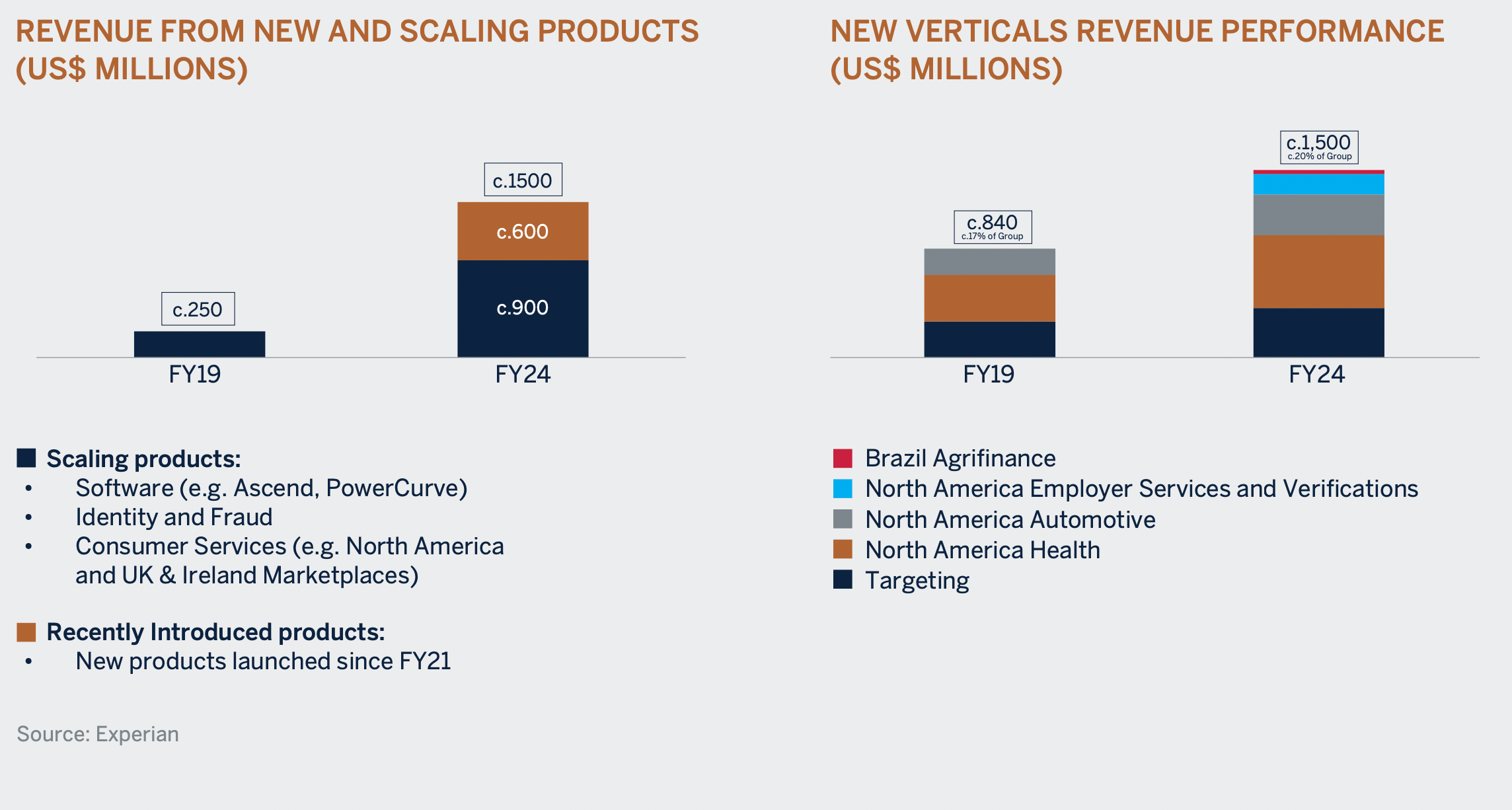

Experian’s three largest markets for its data are the US, the UK and Brazil. The first two geographic regions are expected to grow steadily. A key driver is the sale of data analytics software platforms to enable its clients to enhance lending decisions. For example, Experian’s software automates and drives the process when a person applies online for a bank loan. This includes checking the borrower’s credit status and their ability to repay the loan, applying the bank’s lending criteria, checking that applicants are who they say they are and replying with an answer within seconds for a process that previously took days. Another example is the PowerCurve suite, which helps clients deal with delinquencies (e.g. determines whether it is worthwhile renegotiating debt) and is anticyclical in nature.

There is also growth from new market segments such as healthcare, automotive and fraud detection. For example, Experian services more than 60% of all US hospitals with revenue cycle and identity management. Furthermore, Experian’s direct-to-consumer offering is an attractive business in its own right.

Brazil, where Experian is the largest credit bureau, is the fastest growing region. In Brazil, limited financial data means lenders charge borrowers significantly higher rates of interest as they are unable to determine good or bad credits. Inefficient capital allocation is detrimental for economic growth, and therefore the government has been keen to address this issue through regulatory change to make credit bureau data collection easier. Experian has been ideally positioned to benefit, as well as expanding its product and services offering in this more nascent market.

Experian continues to find new growth opportunities.

These new growth avenues and the mission-critical nature of the credit data business (i.e. lenders cannotoperate without Experian’s data) all add up to a robust business model.

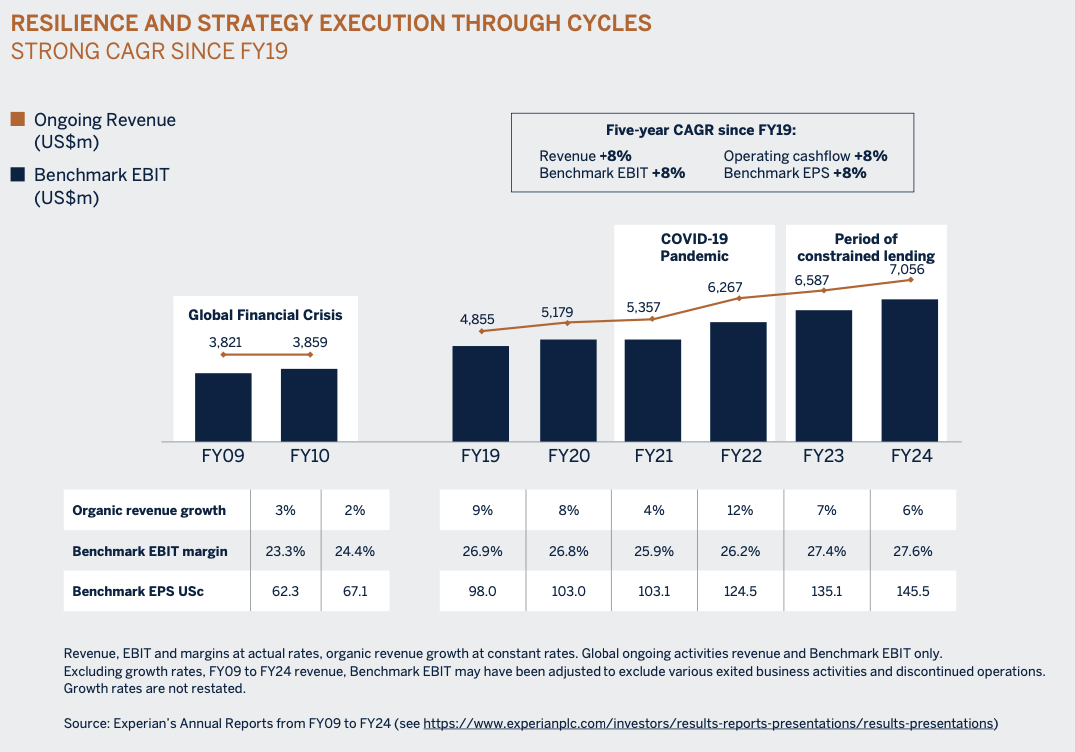

The business has proven to be resilient through the ups and downs of business cycles. Although credit application volumes slow in a recession, the core bureaux in the US, the UK and Brazil only account for around a third of group revenue. Experian has counter-cyclical protection through its risk management and asset protection offerings as well as products in healthcare and other segments.

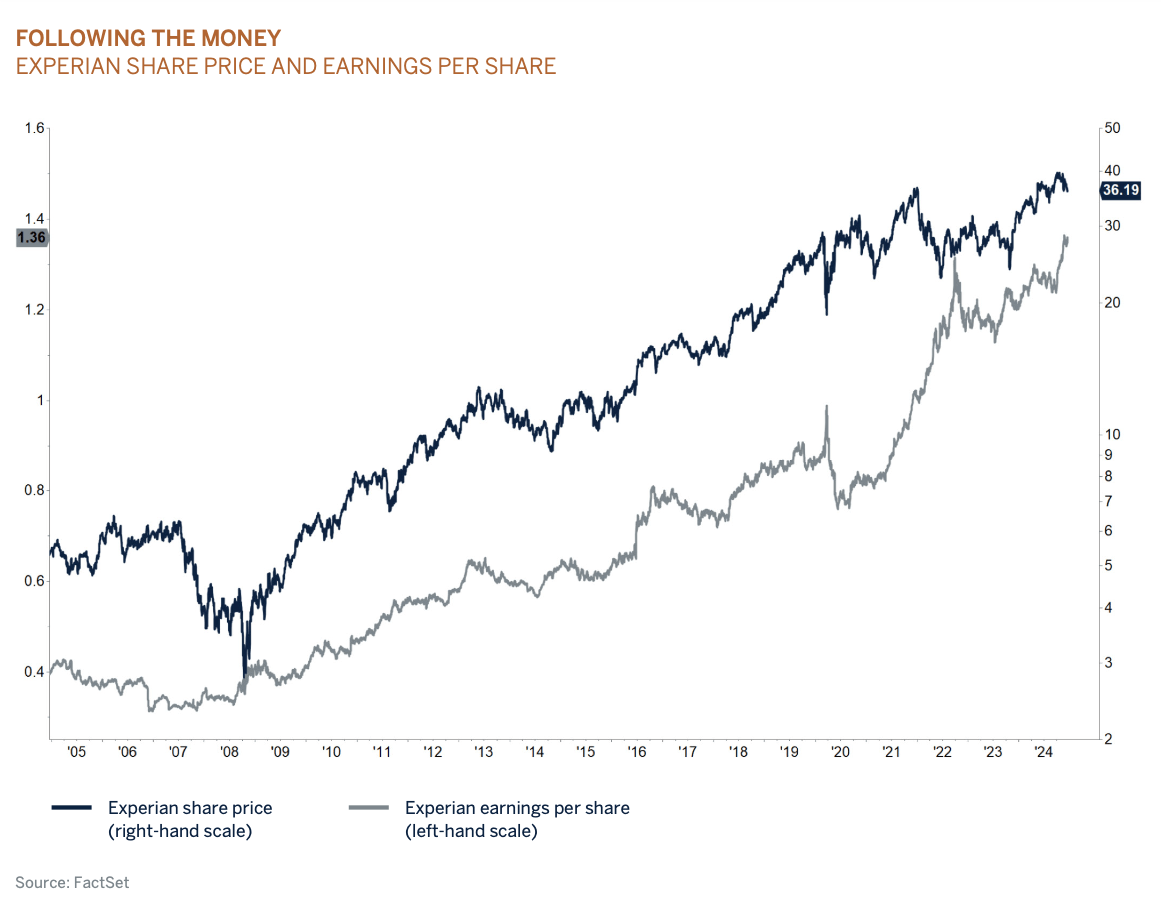

The proof is in the pudding. As shown in the chart, Experian saw positive organic revenue growth during the Global Financial Crisis, despite many of its financial sector clients running into difficulties, because there was a pick-up in demand for its credit monitoring, risk management and collections offerings.

A bullet-proof business model

When investor sentiment normalised, the shares quickly recovered and then went on to be a ten-bagger. There was a similar disconnect, albeit less extreme, through the pandemic and during a period of constrained lending when rates were hiked up in 2022 and 2023.

When investor sentiment normalised, the shares quickly recovered and then went on to become a ten-bagger. There was a similar disconnect, albeit less extreme, through the pandemic and during a period of constrained lending when rates were hiked up in 2022 and 2023.

Elementary, my dear

“It is a capital mistake to theorise before one has data.” So said Sherlock Holmes (A Study in Scarlet by Arthur Conan Doyle). It is equally critical in business.

Experian provides the information and the tools for its clients to make the right decisions. In an increasingly complex, disruptive and digitised world, the company is finding ever more opportunities to optimise its proprietary data. With a rock-solid competitive edge, multiple growth avenues, and resilience through business cycles, Experian has been (and will likely continue to be) a core compounder in the portfolio.