From our Fund Manager’s Desk

Fiserv

“May you live in interesting times,” an English saying that is often misattributed as a Chinese curse. Origins aside, it is hard to dispute that the past years could qualify with wars, pandemics, technological disruption, and market crashes. Amidst the chaos, quality growth investment opportunities are to be prized.

Enter Fiserv stage-left, a company that certainly fits the bill. The company provides two key mission-critical services: back-office systems for banks and electronic transaction systems for businesses. As such, the company combines the exciting but often volatile growth of fintech with the mature but steady growth of its legacy core banking business.

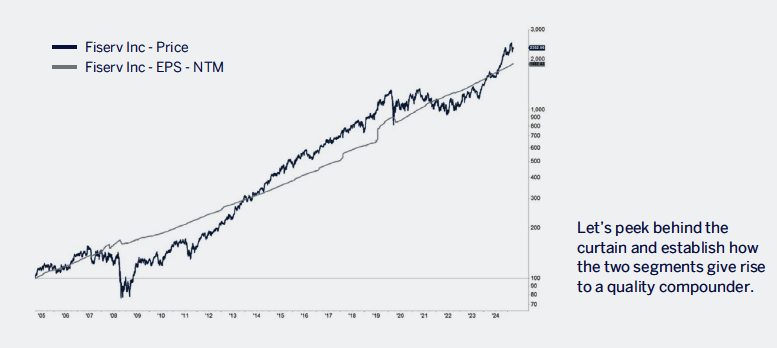

We expect this mix to drive an impressive long-term record of shareholder return.

A Steady-Eddie Compounder

01 / Merchant Solutions

Fiserv is a merchant acquirer. This is simply the process of enabling businesses to accept credit cards, debit cards, and other digital payments from their customers. Fiserv provides many of the products and services that enable this process.

KEY ACTIVITIES INCLUDE:

-

Providing Point-of-Sale (POS) Systems: This includes hardware like terminals, software for managing sales and inventory, and integration with payment processing networks.

-

Payment Processing: Facilitating secure transactions by processing credit card payments, debit card payments, and other electronic payment methods.

-

E-commerce Solutions: Enabling businesses to accept online payments through their websites and mobile applications.

-

Integrated Solutions: Offering integrated solutions that combine payment processing with other business functions like inventory management, customer relationship management (CRM), and loyalty programs.

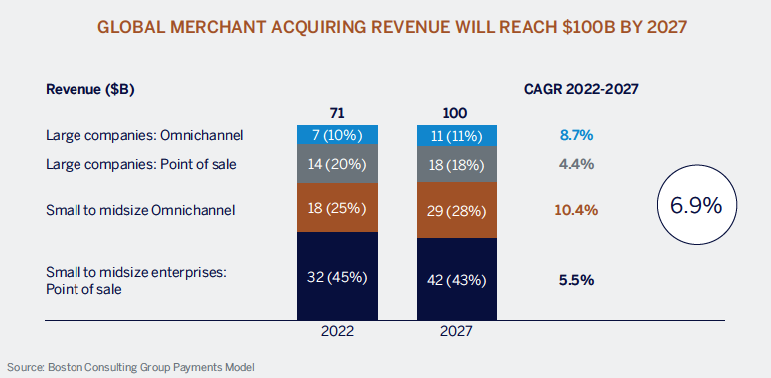

Why is merchant acquiring an area you want exposure to? That’s easy, growth

Merchant acquiring has experienced significant growth over the last decade and that’s expected to continue. As shown in the chart, related revenue is expected to reach $100bn by 2027, with the small to medium business (SMB) segment being the most significant. The opportunity is large, but the market is fragmented with several participants. There are the scaled incumbents (Fiserv, Global Payments, Wordplay, etc.) and the modern acquirers (Square, Toast, Adyen, etc.). In this crowded field, two dominant business models will “win” over the coming decade within SMB payments acceptance:

/ Be the software platform. This involves owning the distribution and monetizing via SaaS, payments, embedded finance and commerce-enablement services.

/ Be a preferred partner in embedding and powering services. These ecosystem-building and monetization-enhancing services include payments, issuing, capital, payroll, insurance, tax and lead generation.

Why is Fiserv an excellent way to play this theme? Because it ticks the above boxes very well. Its Clover system offers a comprehensive, all-in-one platform that combines POS hardware, software, and payment processing. This eliminates the need for businesses to juggle multiple systems, simplifying their operations. It also caters to businesses of all sizes, from small mom-and-pop shops to large enterprises, allowing for significant market penetration.

Fiserv’s existing infrastructure and scale provide Clover with a significant advantage in terms of payment processing, security, and reliability. Newer entrants often lack this established foundation. The company has decades of experience in the financial technology industry, giving Clover a deep understanding of the needs of businesses and financial institutions. There are also cross-sell opportunities with the rest of the business. Clover benefits from integration with Fiserv’s broader ecosystem of financial solutions, including core banking, payment processing, and risk management – providing a seamless experience for businesses and financial institutions.

Fiserv’s comprehensive offering, its cross-sell opportunities and impressive scale should continue to facilitate market share gains. As one of the larger players, Fiserv is expected to further consolidate its market leading positions over the medium term. Growth will also come from more value-added services (VAS). As of mid-2024, Clover VAS penetration reached 20% of their merchant solutions customers and Fiserv targets 27% by 2026. VAS should drive higher revenue per client, with VAS clients generating 32% higher average revenue per user (ARPU).

The final growth avenue is international expansion. In 2023, revenue outside of North America accounted for around 10% of Clover revenue, but payment volume grew twice as fast. Clover remains in the early stages of expansion in markets such as UK, Germany, and Argentina, and in 2025, Clover plans to enter five new markets: Brazil, Mexico, Australia, Singapore and Hong Kong. Naturally, there are already some local players in these markets but Fiserv should be able to leverage its existing relationships with some of the local financial institutions in order to gain any possible additional traction.

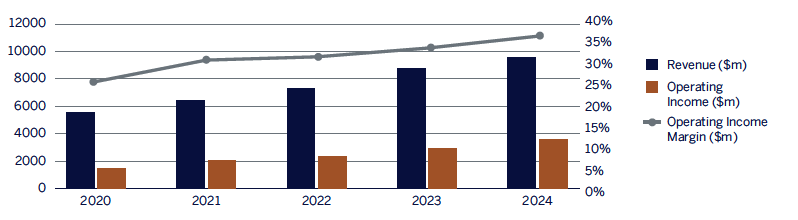

The above growth avenues should lead to low double digit revenue growth and its scale advantage should help facilitate margin expansion. The current operating margin of approximately 30% is below that of the Financial Solutions segment; expansion will bring them closer together. This means the business could easily achieve mid-teens earning growth over the short to medium term. That’s very attractive to say the least.

That concludes Act I, onto Act II.

02 / Financial Solutions

Fiserv’s roots lie in core processing systems, the most basic and mission-critical system for banks. The company is a leading provider of financial technology solutions to banks, credit unions, and other financial institutions globally. They have a strong market position with a large customer base and a comprehensive suite of products and services.

KEY ACTIVITIES INCLUDE:

/ Core Banking Solutions: Offers core banking systems that power the day-to-day operations of banks, including account opening, deposits, loans, and other core banking functions.

/ Digital Banking Solutions: Provides solutions for online and mobile banking, enabling customers to access their accounts, make transactions, and manage their finances through digital channels.

/ Payments Processing: Facilitates electronic payments processing, including account to account transfers, wire transfers, and other payment methods.

/ Risk Management Solutions: Helps financial institutions manage risks such as fraud, credit risk, and compliance with regulatory requirements.

Core processing is the nuts-and-bolts system that banks need to maintain their deposit and loan accounts and to post daily transactions. Given the integral nature of core processing to their operations, banks very rarely switch systems. That’s because besides the potential for interruptions, converting to a new system would require the banks to retrain employees. Customers typically sign multiyear contracts, and customer retention approaches 99% annually, excluding customers lost because of acquisitions by another bank. That means that the business is very sticky, with a high retention rate. But the segment is a mature one, with Fiserv already having significant penetration amongst financial institutions in the US.

Given this segment’s mature nature, only mid-single digit revenue growth is expected and no significant operating margin expansion. But its operating margin of approximately 45% is already impressive and very much sustainable.

Conclusion

Before the curtain falls, let’s bring it all together. Fiserv’s fast-growing merchant solutions business, spearheaded by Clover, should continue to grow, gain share and further cement its market-leading position. This provides Fiserv with exposure to the fast-growing and exciting fintech space. But this space can be volatile given its relative early stage and very competitive landscape. Fiserv balances this unpredictability with a high-margin, sticky and far more stable financial solutions business. The combination of the two provides a stable earnings profile, while leaving room for significant growth. The result is a quality compounder, one that exemplifies our investment philosophy – a bulletproof business model that delivers attractive growth amidst these “interesting times”.