From our Fund Manager’s Desk

Healthcare

We regularly explore investment themes in the Melville Douglas Global Equity Fund. This time round we explain why we find healthcare compelling. We will then, by way of example, focus on a core holding – Boston Scientific – and three key themes – biologics, AI and value-based care.

The fund’s overweight position in healthcare relative to the All-Country World Index is premised on the long-term, sustainable returns and diversification it provides. We elaborate further.

Healthcare is a necessity

Irrespective of the economic environment, people will always require medical care, medication and health services. As such, demand is consistent, which makes the sector relatively recession-proof and stable. Healthcare companies can therefore continue to grow and provide steady revenue and earnings streams, even during economic downturns.

Strong secular growth trends

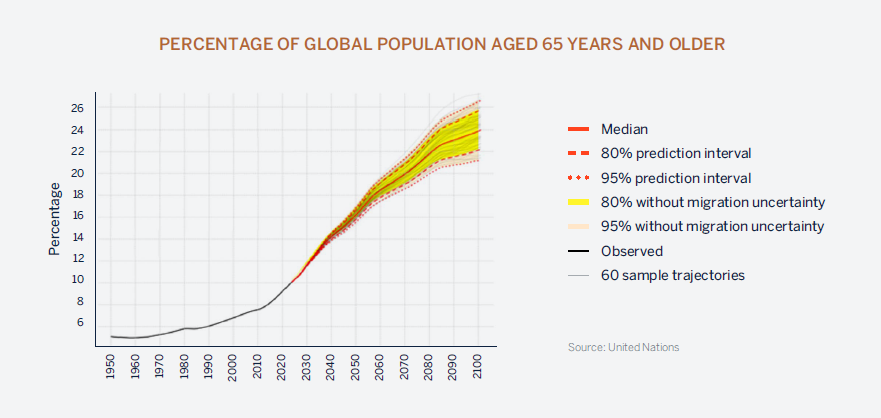

The global population is ageing. The chart displayed shows that people aged 65 years and older accounted for almost 10% of the world’s population in 2023. With declining birth rates and falling mortality, the senior population has been growing at an accelerating rate. According to the United Nations, this cohort is expected to represent 16% by 2050. As people’s lifestyles become more sedentary and their diets worsen, the incidence of chronic diseases, like diabetes, cardiovascular diseases and cancer is expected to rise too. This creates a consistent demand for existing treatments ranging from drugs to medical devices and drives the need to develop new treatments, supporting growth for healthcare companies as they help alleviate the disease burden for the end consumer.

A hub of innovation that underwrites its future relevance

Companies that are continuously investing in research and developing new products and services can potentially meet unmet medical needs, address emerging health issues and improve existing treatments, all of which further supports long term revenue growth. Healthcare companies are well placed to leverage technological advances such as artificial intelligence, continually adding to new opportunities for long-term returns.

An attractive fishing ground for quality compounders.

Healthcare often grows at a faster rate than GDP, a trend that makes the sector an attractive area for investment. It provides opportunities for consistent, above average growth through its inelastic demand, demographic changes and continuous innovation. Companies that capture these long-term enduring trends and reinvest into their businesses often compound their growth over time, termed by Warren Buffet as the snowball effect.

A portfolio risk counterbalance

Healthcare’s defensive nature offsets the cyclical and volatile nature of other sectors such as technology, financials and industrials. This allows us to balance risk while still capitalizing on growth and create a resilient investment strategy.

A wealth of varying opportunities

The sector is composed of a wide range of sub sectors which allows us to adjust exposure and spread risk strategically, depending on the industry trends and the attractiveness of the various subsectors.

Within the fund, we have indirect exposure to pharmaceuticals and biotechnology (which uses living organisms to create drugs), through our exposure to ICON. This company performs clinical drug trials on behalf of biopharma companies and helps bring drugs to market faster and in a more cost-effective way. What’s attractive about this company is that it earns revenue from drug trials irrespective of whether the treatments eventually make it to market. Drug trials can last many years, and thus the revenue that ICON earns recurs over this lengthy period.

Thermo Fisher Scientific is another company which strategically allows us to gain exposure to the biopharma industry without the risk of being directly affected by the success or failure of a single biopharma company. This company is a picks-and-shovel play as it provides scientists with mission critical tools used in the research and development of drugs, early detection of diseases, as well the understanding of it. It’s a one stop shop for everything needed in a lab and can be likened to an Amazon.com for the Life Sciences and tools sector.

We also have medical device exposure through Boston Scientific, which sells innovative products like spinal cord stimulators, drug eluting stents and other groundbreaking devices that provide an alternate to invasive surgeries and medical procedures. Innovation in Medical Technology, like robotic surgery systems and continuous glucose monitors, which helps people manage diabetes more effectively, can significantly improve patient outcomes.

Finally, we hold UnitedHealth and Elevance, which are the largest companies in the US that provide and administer health insurance and healthcare services to individuals. US healthcare is unique amongst the G7 countries in that it does not have a government health service that is available to the entire population, regardless of age and income. To access its leading-edge healthcare, most of the US population is required to sign up to private insurance or government health insurance programs.

What we find attractive about this managed care subsector, is that it plays a pivotal role in lowering US healthcare spending. A big part of the growth for UnitedHealth and Elevance comes from managing more healthcare spending for the government, which ultimately helps control healthcare costs. Unitedhealth and Elevance are also focused on reducing healthcare costs by providing quality healthcare services at a lower cost, which is also known as Value based Care. This is important as US health expenditure is 17% of GDP, which remains substantially higher compared to peer countries and the concern lies in costs rising further to an unsustainable proportion of GDP.

Unlike pharma companies, these companies are not subject to patent cliffs and the ongoing pressure to innovate, which results in a more consistent profit generating business model.

STOCK FOCUS / Boston Scientific

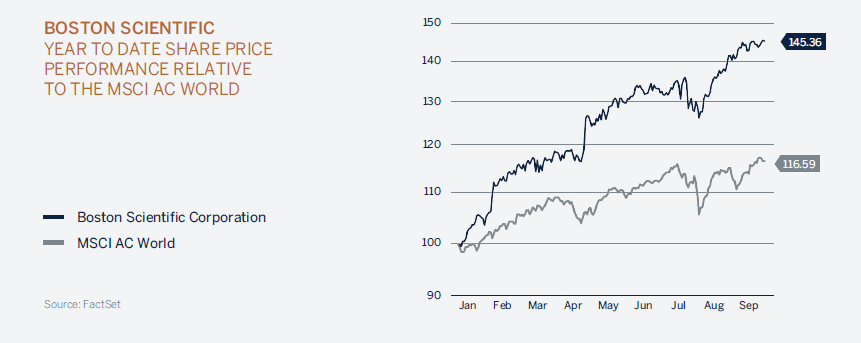

Boston Scientific is a key holding in the Global Equity Fund and one of the best performing healthcare stocks in the fund year to date.

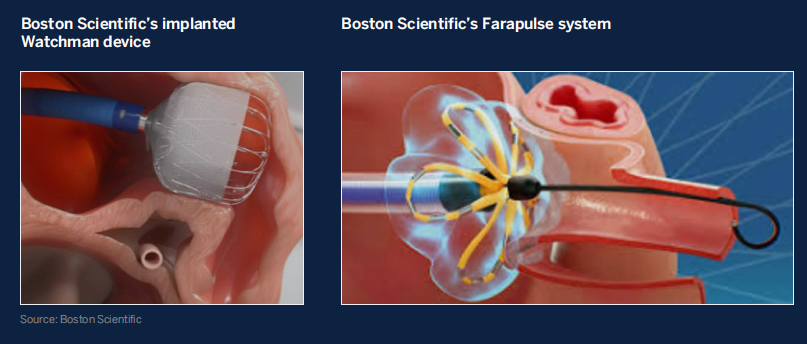

As a global medical device manufacturer, it’s also a leader in most of the categories it operates it. This ranges across multiple specialities like cardiology, urology, chronic pain and neurological conditions. We remain positive about Boston Scientific over the long term as it continues to benefit from global procedure growth as well as a shift towards procedures done in outpatient settings. Growth will continue to be driven by continuous new product launches (like Watchmen and Farapulse), a structural shift towards higher-growth markets, accretive mergers and acquisitions, and as it enters new markets.

Watchman and Farapulse are two significant products from Boston Scientific that focus on treating conditions related to the heart. Watchman is a small device that’s implanted in the heart and helps prevent blood clots and strokes in people with a heart condition called atrial fibrillation. An alternative to this is blood thinners but some people are not able to use this because of its side effects, so Watchman is a much safer option. Farapulse treats another effect of atrial fibrillation. It sends small electric pulses to the heart to stop abnormal heartbeats.

Both Watchman and Farapulse are key growth opportunities for Boston Scientific because of the increasing prevalence of atrial fibrillation. The expanding market, along with endorsements from leading cardiologists and potential for global adoption, positions Boston Scientific for continued growth and leadership in the cardiovascular device market.

THEME FOCUS / Biologics

From drug discovery, biologic drugs, robotic surgeries to improving healthcare access, continuous innovation positions the sector for growth by creating new revenue streams and potentially reducing costs through implementing more efficient ways of operating.

A key theme which we remain excited about is Biologics. These are drugs made from living organisms. Their structures are quite complex compared to small chemical drugs, but the benefit of these drugs is that they can be designed to specifically target diseases making them more precise as treatments.

Biologics are effective in treating chronic and complex diseases like cancer, autoimmune disorders, and rare genetic conditions. They also play a key role in developing personalised medicine, where treatments are tailored to the individual characteristics of each patient.

The biologics market is growing strongly and is outpacing the growth of traditional chemical drugs. The proportion of biologics is gaining more importance and is expected to grow by 10% annually from 2024 to 2030 according to Grand View Research.

As a result of this, it’s expected to be valued slightly below half of the pharmaceutical market by the end of the decade. This growth is partly driven by the increase in patent approvals for biologics, growth in biosimilars, which are generic versions of biologics and cell and gene therapies.

Cell therapy involves using whole cells to repair or replace damaged tissue. For example, a patient with damaged bone marrow from leukaemia can receive a transplant of healthy stem cells from a donor and these stem cells will generate new, healthy blood cells.

Gene therapy on the other hand, aims to correct or modify specific genes to treat diseases at their genetic root. A person with a genetic lung disorder like cystic fibrosis can receive a treatment that delivers a healthy version of the defective gene into their lung cells, allowing those cells to function normally.

Cell and gene therapy is still a nascent market which was valued at around USD8.7bn in 2023 is expected to grow just under 20% annually to 2030.

So how are we capturing this theme in our fund?

In the Global equity fund, Thermo Fisher Scientific provides this exposure by providing the essential products and services needed for creating and testing all drug types, including biologics. They offer materials for growing cells, equipment that makes production easier and systems to purify the drugs. They also provide high-tech instruments to check the quality of these drugs. To close the loop, Thermo Fisher Scientific also provides solutions to produce, store and transport biologic drugs safely and effectively.

In addition to the growth outlook for biologics, what makes Thermo Fisher Scientific appealing is that the biologic drug manufacturing process and products used in it need to be verified by health authorities. Once this is done, it’s quite difficult to change, and so the same process and products need to be used over the patent life of the biologic drug. This ultimately benefits Thermo Fisher Scientific by creating a sticky revenue stream until the drug comes off patent.

THEME FOCUS / AI

The role of artificial Intelligence in healthcare is fundamentally changing the way we approach the industry. The benefits are significant, particularly with a US healthcare system that’s burdened by rising costs and labor shortages. AI is making healthcare more efficient, effective and patient-centred, by being able to digest large amounts of data to improve the speed and accuracy of healthcare processes.

Drug discovery

With the discovery of drugs even with technological advancements, developing new drugs still takes years to develop and in reality, only very few drugs make it to market. With AI, there’s an opportunity to use data and AI models to cut time and costs as well and improve the likelihood of success in bringing drugs to market. AI can basically analyse large sets of data to identify potential drugs and predict their behaviour and effects, which would lead to a wider variety of drugs available to treat diseases.

In the Global Equity Fund, ICON is using AI to develop better clinical trials and process large amounts of clinical data to gain better insights in the drug development process. They’re also focussed on using robotics and automation which to date has significantly reduced costs for their business.

Diagnosis

In diagnosis there’s a huge opportunity. AI can precisely analyse medical scans, like X-rays, CT scans and MRIs and spot patterns and anomalies that may not be visible to the human eye. With earlier detection of diseases and improved diagnosis of patients, doctors will be able to intervene and treat patients sooner and potentially prevent more severe complications from occurring. AI can also analyse trends in scans over time, flagging even slight changes that could indicate that a patient's condition is worsening. This can lead to faster recovery times and shorter hospital stays which could reduce healthcare costs.

Personalisation

AI can also enable personalized treatments which are tailored to patient's unique needs. This allows for more precise and effective intervention as it caters specifically to a person’s health profile by analysing a person’s lifestyle, medical history and genetic information. AI is transforming the study of genes by making the analysis of genetic information faster, more accurate and insightful. It helps by quickly reading and interpreting DNA sequences to identify patterns and important genetic variations that might be linked to diseases. It can also predict an individual’s risk of developing certain conditions based on their genetic makeup, which would enable earlier medical intervention.

Robotics

By incorporating AI into surgical robots, AI can assist surgeons in performing complex procedures with much more precision and control, which is very important with delicate surgeries. Robotic surgery essentially minimises the invasiveness of procedures and reduces recovery times, making it overall safer and more effective than manual surgeries. Within the fund, Boston Scientific is using AI in some of its medical devices and given the technical nature of its products, they have an AI based marketing platform that provides personalized education for their customers.

Efficiency

With IT, there’s significant scope to become efficient with endless paperwork involved in Drs offices and hospitals. Many healthcare workers manually enter data which reduces productivity and often leads to errors. AI could basically alleviate this burden through an AI scribe which can provide real time notes. Routine tasks, like updating medical records and scheduling appointments can all be automated. The workload on healthcare staff, errors and costs can all be minimised, and healthcare providers can focus on patient care, which is most important.

In the Global Equity Fund, UnitedHealth is investing heavily in AI to lower its costs. They’re using AI to handle repetitive tasks and to answer basic questions in call centres to improve their customers’ experience. Those are just a few of the many ways in which AI is revolutionising healthcare and we expect this theme to play out over the next few years.

THEME FOCUS / Value-based care

Value-based care is another key theme in the healthcare sector. It’s considered one of the biggest disruptions with significant runway for growth over multiple decades. In essence it’s a way of providing healthcare that focuses on making patients healthier while controlling costs at the same time.

In the traditional fee-for-service payment model, doctors are reimbursed based on the quantity of services delivered. This tends to drive up healthcare costs. Value based care on the other hand, reimburses doctors based on the quality and efficiency of the services they provide, so they’re accountable and incentivised to help patients get better and stay healthy.

Different healthcare providers then work together as a team to take care of a patient. This means the primary doctor, specialists and hospital all communicate and plan the patient’s care together. Instead of waiting until patients are very sick, regular check-ups, screenings, and healthy habits are emphasised to prevent illnesses. Value based care relies on technology platforms to help identify high-risk patients, manage care effectively, and steer patients toward the most cost-effective treatments. By focusing on keeping people healthy and reducing hospitalizations and specialist visits, while increasing primary care visits, value-based care can reduce healthcare costs, by between 15% to 20%.

Many major healthcare companies like UnitedHealth and Elevance are heavily investing in it and we expect them to benefit from the uncapped profits from these services over the medium to long term.

In conclusion, the healthcare sector is an important part of our investment strategy. The constant need for healthcare makes it a stable and reliable area to invest in, even during tough economic times. With an ageing population, more chronic diseases, and continuous innovation in AI, biologics and value-based care, the sector has strong potential for long-term growth. Our investments in companies like ICON, Thermo Fisher Scientific, Boston Scientific, UnitedHealth and Elevance position us well to benefit from these trends and support sustainable growth. By managing risk and taking advantage of healthcare’s constant demand, we aim to provide steady, above-average returns for our clients.