From our Fund Manager’s Desk - JPMorgan

Canary in a coal mine?

Well into the 20th century coal miners would use canaries as an early warning system. Canaries are more sensitive to toxic gases than humans. If the canary keeled over, the miners knew they were in danger. This system is only useful if the miner heeds the warning and escapes the mine.

With the recent collapse of Silicon Valley Bank and Credit Suisse, is the canary teetering into another 2008-type global financial crisis? At present, the birdie will be just fine as this time there are few toxic loans, and the big banks are much better oxygenated with healthy capital buffers.

Nonetheless, recent events are a timely reminder of the inherent leveraged risk within banking, the sector’s reliance on the whims of central bank policy and its core importance to the economy

(as evidenced by recent government interventions).

The purpose of this note highlights some of the business risks associated with banking and that quality matters. Our adherence to investing in high-quality sustainable growth businesses (via

JPMorgan) allowed us to avoid much of the trouble. The very same also provides us with the confidence to face whatever storms may be on the horizon.

Understanding the risks...

Banking at its core is a balancing act of multiple risks and it’s the effective management of these risks that determines success. The risks are many, but we will highlight the major three here:

- Credit/Counterparty risk – This is when borrowers or counterparties fail to meet contractual obligations. This risk cannot be eliminated but banks can lower their exposure. Since business conditions for borrowers are unpredictable, banks lower their exposure through diversification into a broad range of sectors. This is what Signature Bank did not do enough of, with its significant exposure to the crypto sector helping to erode depositor confidence.

- Interest rate risk – This is the potential for investment losses that can be triggered by a move upward in the prevailing rates for new debt instruments. Interest rates & bond values have an inverse relationship, meaning an increase in interest rates will result in the value of a bond or other fixed-income investment in the market declining. This risk is reduced by buying bonds with different durations, or by hedging fixed-income investments with interest rate swaps, options, or other interest rate derivatives. These are the actions Silicon Valley Bank (SVB) failed to take sufficiently during 2022 (when the Federal Reserve started significantly ratcheting up rates) and resulted in the bank having to realise significant losses when they were forced to sell their now lower value long dated bonds for the sake of liquidity.

- Regulatory risk – The risk that a change in laws and regulations will materially impact a security, business, sector, or market. Regulatory changes can possibly increase operational costs, reduce the attractiveness of an investment, or even alter the competitive landscape of sectors. Banks are heavily regulated due to their systemic importance to the overall economy and the knock-on effect to millions of lives. The quid pro quo of the regulation is that when banks run into trouble, governments and central banks are forced into action. Tax funded bailouts being viewed as the lesser of two evils. As American oil tycoon J Paul Getty once quipped, “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.”

Given these risks, aspects such as i) market share/position, ii) a deep diversified deposit base, iii) effective/timely risk management and iv) good quality management become critical. It is in these specific areas (and others) that JPMorgan shines and is a different beast from some of the smaller regional players. But don’t just take our word for it, let us have a look under the hood.

JPMorgan Chase is a leading, global, universal bank and following the acquisitions of Bear Stearns and Washington Mutual during the 2008 global financial crisis became the biggest US bank with total assets of $3.6trn and 250,000 employees. The bank has been led by Jamie Dimon for over a decade and his successful tenure has made him a rockstar in finance circles. The bank is a leading US consumer and commercial lender with a market share of over 11% of US deposits and strong market shares in auto-lending and credit cards. That combined with a global asset manager with $4.0trn of client assets and as a top tier global investment bank, has the makings of a best of breed bank.

Its consumer & community banking division (41% of 2022 revenue) banks over 60 million households with number one or two market share in deposits nationally. It is also the number one US credit card issuer. Loan growth has been flat over the last 10 years, but the quality of its book has improved, and increased loan growth is expected to be a driver over the medium term.

JPMorgan’s corporate & investment banking division (36% of 2022 revenue) is also a market leader. It continually ranks number one or two in terms of investment banking revenue (versus Goldman Sachs), and it is the number one player globally in terms of fixed income trading. The division is also the number two custodian globally, with $30trn+ in assets under custody. As we have seen with Credit Suisse, being an also-ran investment bank is not a comfortable place to be.

Overall, JPMorgan’s diversified nature provides steady through the cycle revenue growth, with its

continued investment in technology resulting in greater operational leverage. This should result in further margin expansion and outsized growth at an earnings level. It provides exposure to the rising rate cycle (albeit most of it behind us), while still providing some downside support through its scale and market position advantages.

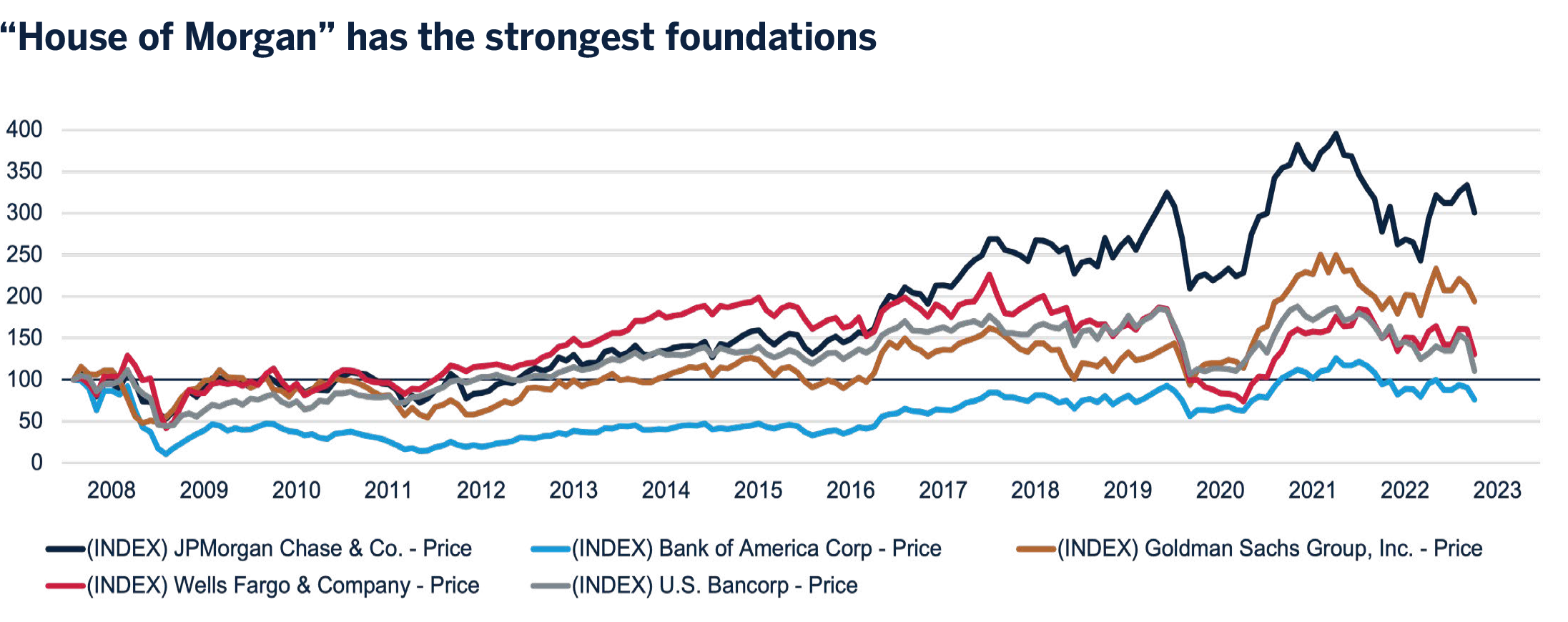

The above chart shows the share prices for JPMorgan, Bank of America, Goldman Sachs, Wells Fargo and US Bancorp. All indexed to their respective prices in 2008.

The first thing one will notice is that bank prices generally move together, with all of them usually reacting to the same macroeconomic events. Wells Fargo initially outperformed JPMorgan, until the fake accounts scandal in 2016 (amongst other troubles). Since then, the JPMorgan share price has performed best out of this cohort. It has vastly

outperformed the less diversified Goldman Sachs and the more regional US Bancorp. Bank of America’s performance is also a reminder that a large retail franchise does not an easy life make. JPMorgan’s well run diversified nature and market leading positions contributed to its success over the last 15 years. And its quality has made a significant difference versus other banks.

In closing

"Quality is not an act. It is a habit. "

Aristotle

JPMorgan, by design, has made a habit of bettering its banking peers over the long-haul. There is no “sure thing” in investing but sailing on the most secure ship in the fleet when storm clouds are in sight (with an enviable track record of navigating the trials and tribulations along the way), is a very close second. As humble custodians of your wealth, please rest reassured that we always have our eyes towards the horizon.