From our Fund Manager’s Desk

We regularly explore the investment rationale of one of the companies we own in the Melville Douglas Global Equity Fund to articulate what we find compelling. This time round we have chosen Linde. Plucking money out of thin air is not just a trick played by sleight-of-hand conjurers. Industrial gases companies have done it for decades. This note elaborates why we like these modern-day alchemists.

WHAT ARE INDUSTRIAL GASES?

From rocket fuel to filling up balloons for children’s parties, industrial gases are used everywhere. They are a key input in a multitude of heavy manufacturing processes. In steelmaking oxygen is blown through molten pig iron to lower the carbon content. In refining hydrogen is used to desulfurize gasoline to ensure emission standards are met. Going one step further, hydrogen is increasingly displacing petroleum-based fuels by acting as an energy carrier in fuel cells. Industrial gases can also be found in the kitchen, where inert and safe nitrogen gas is used in food packaging to help preserve freshness and provide padding to reduce damage.

WHAT DO INDUSTRIAL GASES COMPANIES DO?

An industrial gases company produces nitrogen, oxygen and argon by capturing the air we breathe. Air is liquefied via cooling and pressure and then each component is separately distilled at their various boiling temperatures. Other gases (e.g. carbon dioxide, helium, hydrogen and acetylene) are usually sourced from other industrial processes as by-products.

An industrial gas company, such as Linde, sells and distributes gases to its customers depending on the volumes involved. For heavy consumers Linde would build their own gas production facility on the same site as their customers’ operations where it can be physically integrated. Linde also ships gases in bulk by specialised trucks on the road or sells smaller amounts in the cylinders you would see used by welders or in hospitals.

HIGH SWITCHING COSTS IS THE SECRET SAUCE

Industrial gas companies are highly cash generative businesses that avoid much of the feast or famine suffered by other commodity producers. How do they manage this feat when they are selling a processed version of a free and abundant commodity (i.e. air)?

The answer is very sticky customer relationships. Linde receives premium prices and can lock into long term contracts because the switching costs for its largest[1]volume customers are high. The Big Three industrial gas companies tend to dominate market share for the big on-site commissions as a result of their technical expertise, scale and reputation (clearly, an accident with oxygen and hydrogen can do a lot of damage). The number one priority for high volume customers is a regular, safe and reliable supply of a vital input to their production process. For example, hydrogen represents only about 1% of a refiner’s cost of production. Why quibble about the cost of some[1]thing that is effectively a rounding error compared to its overall expenses?

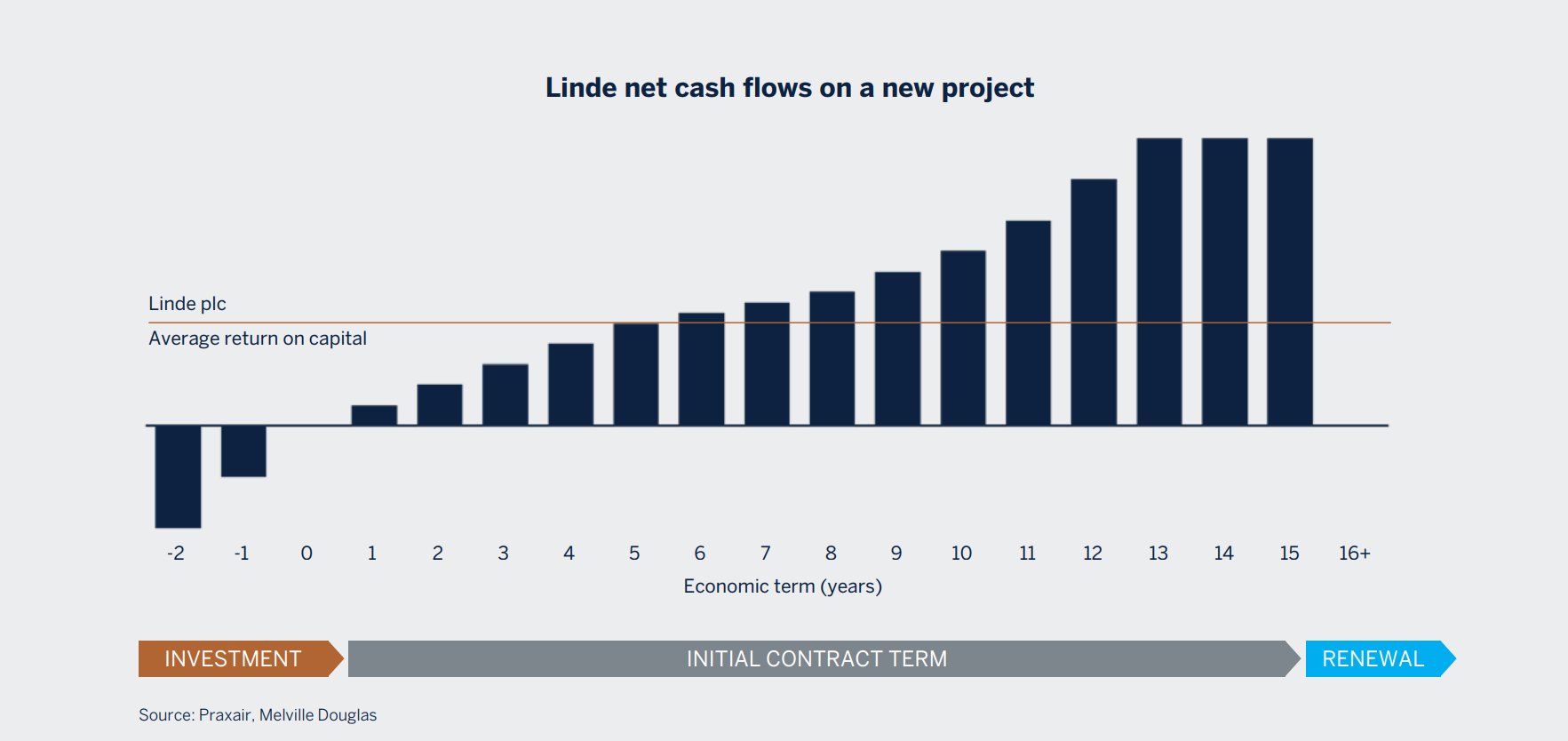

Air separation units are often built by the industrial gas company onsite and embedded with their customers’ operations to minimize transportation costs and ensure reliability of supply. To reassure the industrial gas company will get a return on this initial hefty investment customers will agree to 10- to 15-years “take or pay” contracts with cost pass-through clauses. “Take-or-pay” contracts help to insulate industrial gas company earnings from downturns as they require customers to purchase a minimum amount of product from their plants. The advantage of the cost[1]pass through clauses is that it links the largest input costs (electricity and energy) to inflation, which secures and stabilises the industrial gas company’s profit margins.

This all adds up to a fantastic deal for industrial gas companies. The cash flow on such projects is negative for the first few years through the investment phase but be[1]comes very cash flow generative thereafter. Renewal rates for these onsite contracts hover around 95%, i.e. winning a contract can create a customer for life.

SCALE BEGETS SCALE

Big onsite operations bolster the rest of the business as they create regional monopolies based on scale. The first company in a locality secures a big advantage because often there is only one such customer within a 250-mile radius and transportation costs are onerous beyond this range. The large customer typically consumes about 70% of the annual output, enabling the industrial gas company to piggyback this scale advantage and sell the remaining product locally to smaller customers, such as oxygen for welding or healthcare, via cylinders or via trucks that fill large storage tanks.

The Big Three major multinational producers (i.e. Linde, Air Products and Air Liquide) dominate the market with approximately 75% market share. The remaining market share is made up of numerous smaller regional players who benefit from the very local nature of business. With high technological, capital expenditure and incumbent onsite barriers to entry, the status quo is unlikely to change soon. Linde management have told us that market dynamics are relatively rational. When competing for contracts, typically 25% of the time there is no bid from another player due to incumbency position, 25% of the time there is one other competitor, 25% of the time there are two others and only 25% of the time there are more than two.

MULTIPLE AVENUES FOR GROWTH

Demand for industrial gases increases roughly in line with industrial production growth in developed economies and up to one-and-a-half times industrial production growth in emerging economies. Growth areas include energy, environment and emerging economies. For example, oxygen demand is driven by its greater usage in industrial processes to improve efficiency and healthcare demand as populations age. An exciting opportunity is the rapid growth in hydrogen as a fuel for transportation and heating. As well as offering their engineering experience, the Big Three industrial gas companies have a competitive edge because they operate most of the hydrogen transmission pipelines and are setting up distribution networks as new hydrogen refuelling stations proliferate.

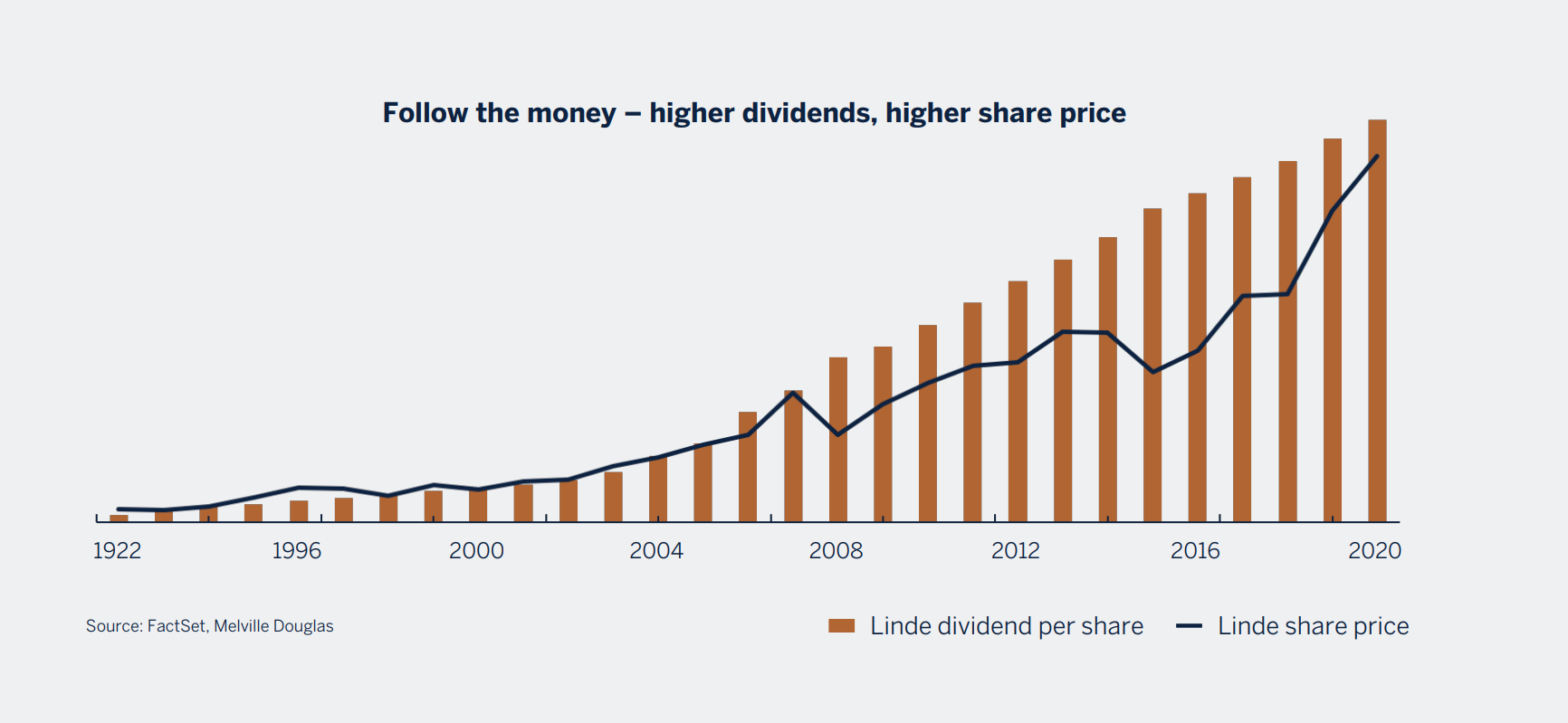

PROOF IS IN THE PUDDING

The fund has been a long-term shareholder of Linde, the world’s largest industrial gas company. In addition to benefiting from compelling industry dynamics, Linde is well diversified across customers, geographies and end markets. Its management team is regarded as the best of the Big Three producers.

All these advantages have resulted in a business that has managed to grow its dividend by 15% per annum since the company was publicly listed in 1992. Given rock-solid competitive advantages and growth potential, we expect the business to deliver steady profits and dividend growth. This is something to be prized amidst a disrupted world. The share price may zig-and-zag, as share prices do, but over the long term it will reflect the underlying dividend stream paid to shareholders. The stock is a shareholder wealth compounder and remains a core holding in the fund.