From our Fund Manager’s Desk

OUTsurance

As reflected in their tagline, “You always get something OUT,” OUTsurance continues to deliver value not only to its customers but also to its shareholders. This success stems from solid operational growth and consistently achieving risk-adjusted returns above hurdle rate and better than peers over time.

Founded in 1998 in South Africa, OUTsurance disrupted the short-term insurance market, which was traditionally dominated by the broker distribution channel for underwriting. By utilising a direct-to-market approach, OUTsurance reduced distribution costs, built a strong reputation for claims management, and refined pricing accuracy through their proprietary price rating model.

Despite challenges such as intense competition in a fragmented market and rising catastrophic events, OUTsurance’s management has demonstrated adaptability, innovation, and resilience. The company’s organizational culture aligns closely with the qualities we seek in investments, and their strategic initiatives have created a formidable competitive advantage—a true “moat.” This article explores the factors behind their success.

Overview

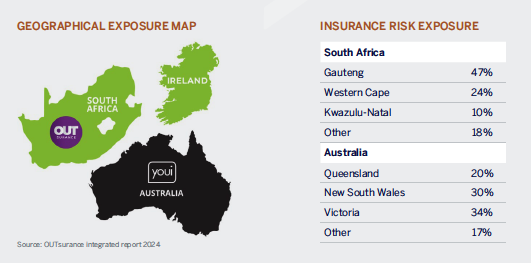

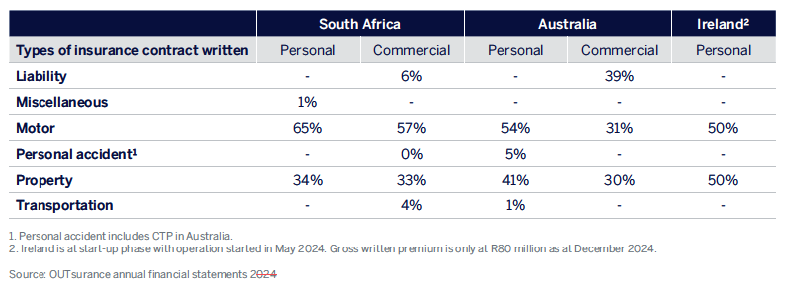

OUTsurance operates primarily as a short-term insurance provider under the “OUTsurance” brand in South Africa, “Youi” in Australia, and the recently launched “OUTsurance Ireland” in May 2024. Their short-term insurance offerings include personal (car, home, and compulsory third-party insurance) and business insurance. They also provide funeral, life, and pet insurance, although these represent smaller portions of their revenue and profits.

Why short-term insurance?

Short-term insurance is inherently cash-generating. Profits are earned through underwriting margins—the difference between premiums collected and claims paid—while premiums are invested to generate returns during the waiting period for claims or profit recognition, often referred to as “float returns.” Companies also earn returns on equity capital buffers, which are typically invested in interest-bearing or higher-risk assets, depending on their risk tolerance. Short-term insurance stands out for its frequent cash flow, as premiums are paid monthly or annually, and claims for most lines (e.g., motor, home, and business insurance) are settled within 12 months. Even for claims with longer durations (e.g., accidental bodily harm or business liability), investment returns can be achieved over extended periods. Insurers that excel in underwriting, investment management, and shareholder fund returns can generate profits exceeding internal rate of return (IRR), with cash flows as the backbone of this profitability. OUTsurance embodies these strengths.

01 / Strong Premium Growth:

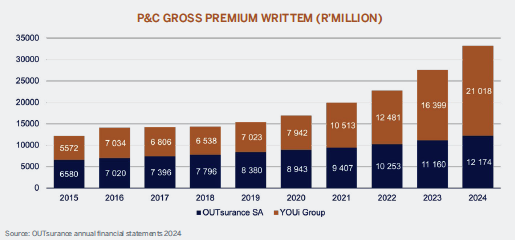

OUTsurance’s Property and Casualty insurance business has consistently achieved robust premium growth, driven by inflationary pricing adjustments and increased volumes from new product lines and expanded market penetration. In South Africa, premium growth has averaged an annualized rate of 6.3% over the past 10 years, primarily fueled by inflation-driven price adjustments in their mature personal line business. Management is actively expanding into the business insurance market, supported by the OUTsurance Business Brokers initiative. This strategy has proven effective, with volumes growing and profits entering a positive trajectory on the J-Curve. In Australia, premium growth has been exceptional, reaching an annualized rate of 12.93% over the past 10 years. This growth is attributed to market penetration and favorable exchange rates from a weaker ZAR relative to the AUD. Despite higher catastrophic events (e.g., floods, storms, and wildfires), OUTsurance’s ability to reprice policies promptly has mitigated claims impact, while YOUi continues to expand market share.

02 / Claims

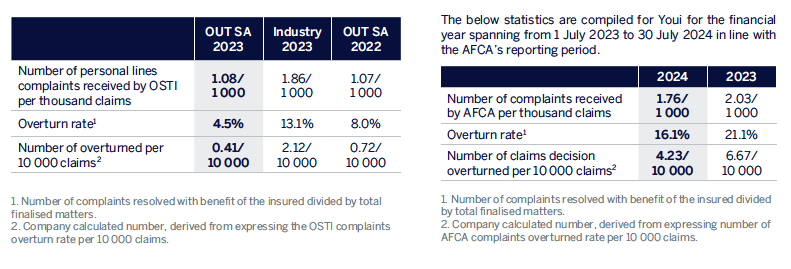

A best insurer knows how to price correctly for the appropriate risk being underwritten. OUTsurance is a great example of that—they always underwrite well using their internally built system for pricing, claims processing, and telematics. Therefore, when it comes to the claims process, it limits reputational risks.

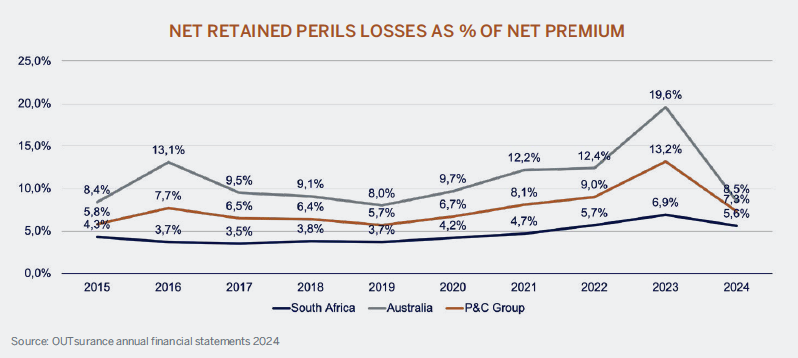

03 / Natural Perils: Addressing Increased Frequency

The global increase in natural disasters, exacerbated by climate change, poses challenges for all property and casualty insurers, including OUTsurance. Such events lead to insurable losses exceeding normal claims expectations, potentially impacting earnings and capital reserves.

The above graph shows the net claim costs that were retained by OUTsurance over the past 10 years as a percentage of net earned premium. OUTsurance employs several strategies to limit the impact of natural disasters: diversifying underwriting across product lines, geographies, and client profiles; repricing policies frequently to reflect evolving risks while maintaining minimal client churn; and utilizing reinsurance to transfer a portion of catastrophic losses, including purchasing coverage for claims exceeding acceptable thresholds. Despite the ongoing challenges of climate change, OUTsurance’s robust capital buffers, strategic reinsurance, and proactive repricing provide a strong foundation for generating attractive risk-adjusted returns. Initiatives like the OUTbonus in South Africa further help retain clients during repricing periods.

04 / Growth Initiatives:

At just 27 years since inception, OUTsurance has reached maturity in the South African personal insurance market, where it leads in motor insurance within the direct channel. However, there is significant growth potential in business insurance (via direct and broker channels), in Australia outside Queensland, New South Wales, and Victoria, and in Ireland, where their operations launched in May 2024.

At just 27 years since inception, OUTsurance has reached maturity in the South African personal insurance market, where it leads in motor insurance within the direct channel. However, there is significant growth potential in business insurance (via direct and broker channels), in Australia outside Queensland, New South Wales, and Victoria, and in Ireland, where their operations launched in May 2024.

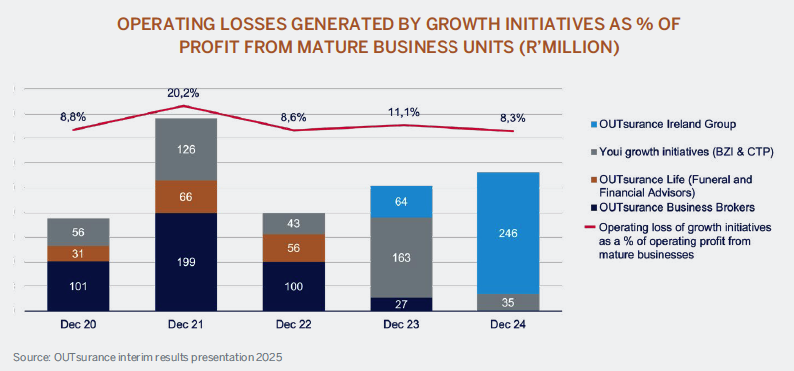

OUTsurance adopts a prudent approach to new ventures, limiting losses to 10% of operational profits. This strategy:

/ Protects capital buffers, reducing the need for equity raises.

/ Allows exits from ventures with unfavorable risk-reward profiles.

/ Ensures efficient resource allocation, focusing on organic growth rather than high-cost mergers and acquisitions with limited synergies.

This disciplined approach has proven effective, enabling OUTsurance to prioritize sustainable growth while maximizing operational efficiency.

Conclusion

Through strategic innovation, operational resilience, and prudent capital management, OUTsurance demonstrates the hallmarks of a long-term earnings compounder, consistently delivering superior risk-adjusted returns. Their ability to adapt to market dynamics, proactively address challenges, and capitalize on growth opportunities positions them as a compelling investment case.