From our Fund Manager’s Desk

S&P Global

It is rare to find industry bellwethers that have not only withstood the world’s trials and tribulations for over a century but have thrived. They must be doing something right.

S&P Global fits the bill, with a pedigree spanning from the late 1800s but evolving to become highly relevant to today’s financial trends. Its core Standard & Poor’s (S&P) credit rating business is an integral part of the debt capital markets plumbing, playing an essential role in quantifying and standardizing potential risk across the world. With the rise of passive investments, its indices business is fast following a similar trend due to its critical nature. Finally, it has leveraged its deep knowledge and financial database to grow a highly lucrative market intelligence business.

In this note we take a closer look at all three of S&P’s major businesses – ratings, indices and market intelligence. We will establish what makes them so special and elaborate on why they are perfect fit for the fund’s focus on quality compounders.

S&P Ratings

In simple terms, credit rating agencies provide the equivalent of a personal credit score to institutions and governments. The agencies achieve this by:

- Assessing the creditworthiness of a company or country by analyzing their financials

- Assigning a grade from A-D (A representing most likely to repay)

- Communicating these grades to investors to help them decide if the issuer is “safe” or fits their purposes.

But why are issuers so eager to have their bonds rated?

Credit ratings provide value to bond issuers as well as bond investors, creating a double-sided network effect. Bond issuers value credit ratings from Standard & Poor’s and Moody’s because of their wide acceptance among asset owners and asset managers, particularly important in cross-border bond issuance deals. By getting a bond rating from a market leader such as S&P, the bond issuer usually pays less in interest (often 30-50 basis points in savings per year). This generates even more value for the issuers and makes them less sensitive to S&P pricing changes. As well as providing a significant value add, the ratings agencies’ dominance secures their pricing power. S&P is the market leader with just under 50% share of total issuance value, Moody’s second with approximately 40% and Fitch a distant third. These century-old brands have become the language of the bond markets.

Their brands are so strong that even their heavily criticised role in the 2008 financial crisis proved to be only a temporary blip. Much of the criticism centered around the AAA ratings given to mortgage-backed securities that in many cases were comprised of sub-prime loans. The rating agencies failed to account for the possibility of a broad nationwide decline in house prices and how that would impact the performance of the bonds. In the aftermath regulators tightened supervisory powers over the credit rating agencies, but their value to the system was recognised and their business models were by-and-large unaffected.

S&P Ratings comprises 25% of total group revenue and 32% of group operating profit. The higher proportion of profit hints at the impressive margins. Its operating margin of approximately 60% is second only (within the business) to that of S&P Indices.

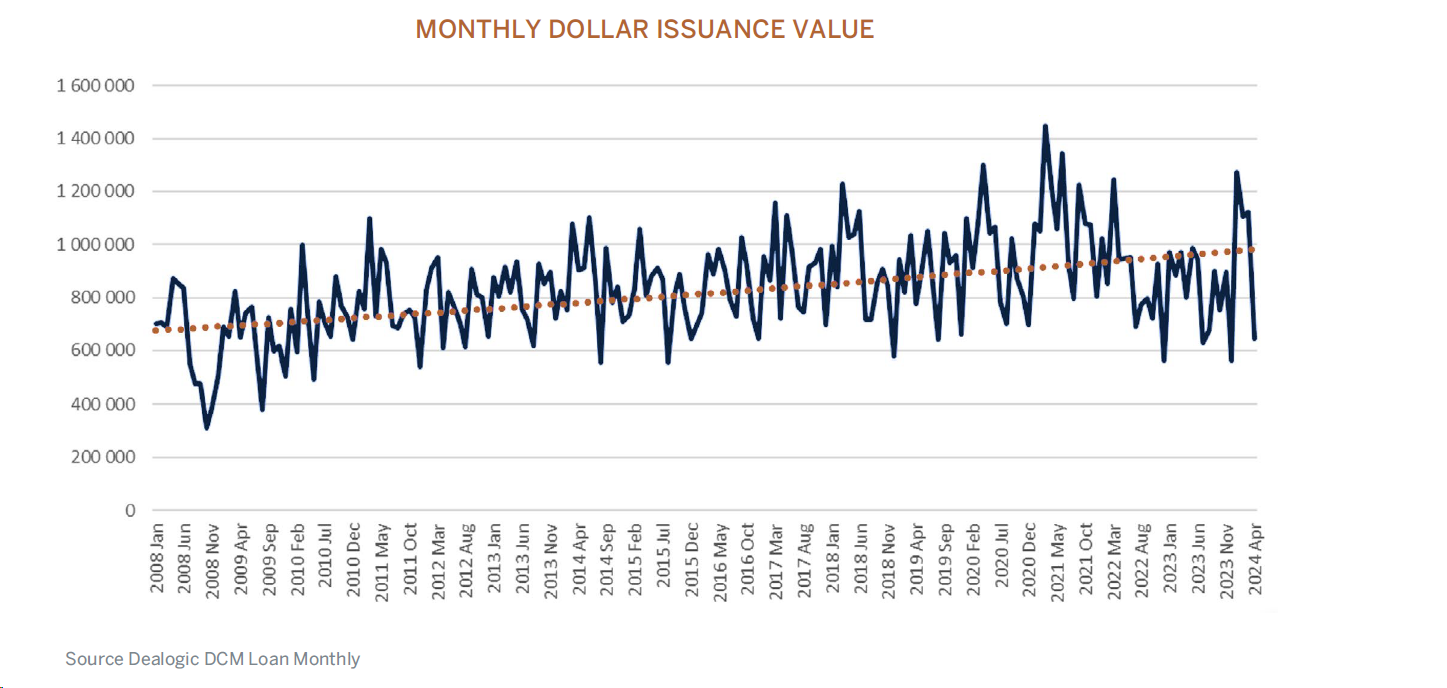

Bond issuance volume is the key revenue driver for S&P’s ratings business. The graph below shows monthly bond issuance in dollars. The first thing one might notice is how cyclical issuance is, unsurprising given its dependence on sometimes volatile macro factors. The second thing you might notice is that the trend is certainly growth, with more dollar credit issuance over time. Having established a growth trend, let us have a look at some of its underlying drivers.

Where is the growth, what drives issuance?

Increasing corporate leverage.

Increased leverage is commonly cited as a consequence of historically lower interest rates. The strong free cash flow generation of corporate balance sheets coupled with the large debt capacity and a return to lower rates, should continue to support corporate growth. In essence, the ratings business is a long-term play on the growth of the global economy. More business activity equals more issuance.

Growth in private debt markets.

A consequence of the global financial crisis was the pull-back by banks on many lending activities and the development of private debt markets to fill the void. Private debt markets have grown faster than public debt markets in recent years, with private debt growing tenfold in the past decade.

While most of this debt is unrated and therefore not profitable for ratings agencies, as this industry grows and attracts greater participation from individual investors via asset managers and carries greater systemic risk, there will be tighter regulation. This in turn is likely to lead to higher demand from private borrowers for issuer requested ratings and credit analysis on private debt.

The structural drivers above are not exhaustive and there are also cyclical drivers. Those would include interest rate levels, credit spreads and corporate default rates. The impact of these cyclical drivers will oscillate between positive and negative, but the most important thing to remember is that they are underpinned by structural growth.

S&P Indices

S&P has built a strong moat with its flagship benchmark - the S&P 500 index. The division is approximately 11% of revenue and an impressive 17% of operating profit. The division’s stable and relatively consistent operating margin of approximately 70% is very attractive. It is less cyclical nature also helps compensate for the more volatile ratings business.

S&P monetizes its indices business from three main client categories:

- Exchange-traded futures and options, i.e. index subscriptions, asset-linked fees, and transaction royalties.

- Active asset managers that subscribe their indices for performance measurement

- Exchange-traded derivatives, i.e. generates trading royalties.

Index benchmarks are critical to asset owners, asset managers, and consultants, and they often have little incentive to switch benchmarks. Once an index becomes dominant in a certain segment and has widespread acceptance among stakeholders, it tends to remain that way and that results in pricing power.

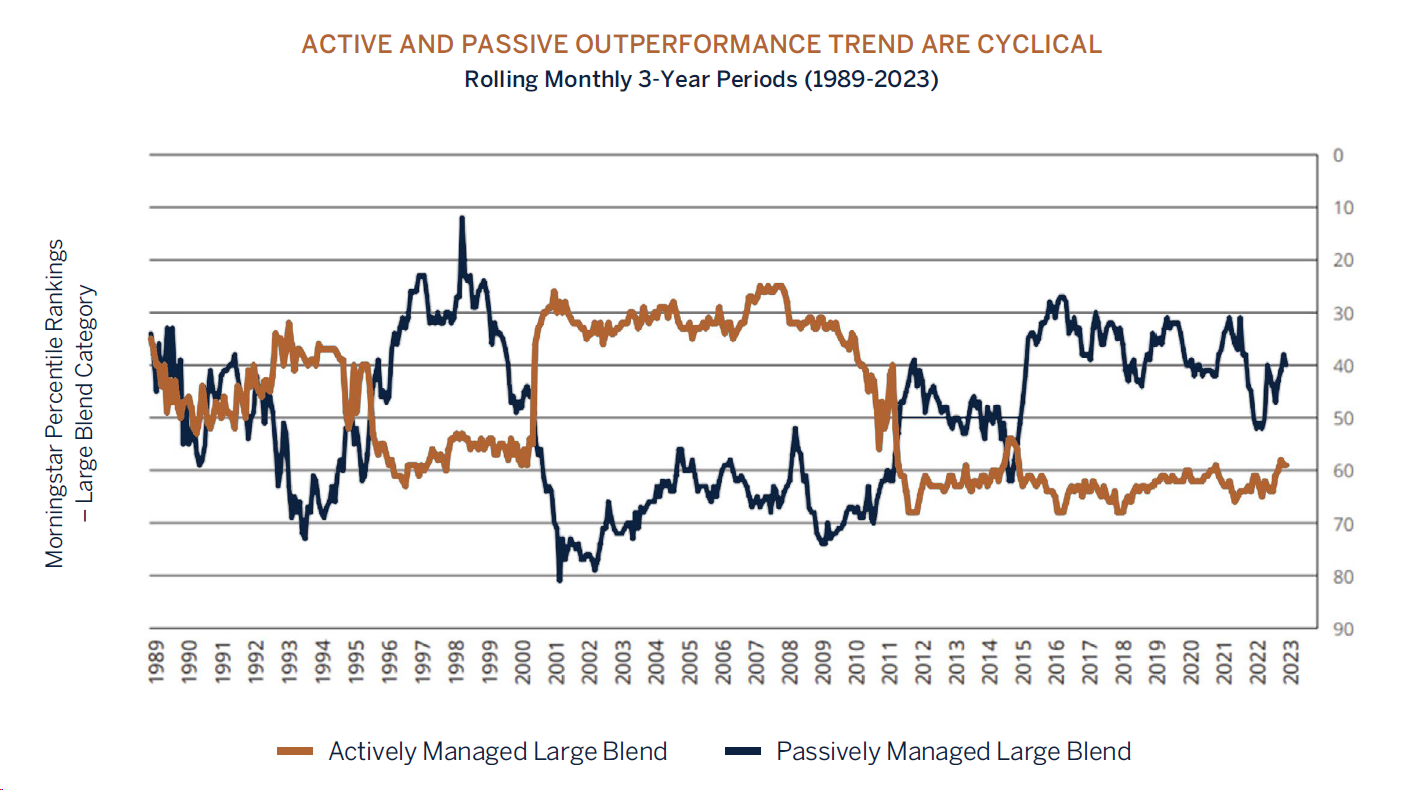

The division has increased its revenue from $323m in 2011 to $1.6bn in 2023, a laudable annual growth of 14%. The major reason for this was the increased popularity of passive funds, with the proportion of actively managed mutual funds/exchange traded funds decreasing from 81% in 2010 to just 52% in 2023.

The graph below shows that part of the reason for increased passive popularity, was that passively managed outperformed actively managed for most of that period. Taking a longer-term view, one can see that the results are mixed, with outperformance between the two being cyclical. Nonetheless, the current outperformance should continue to be tailwind for passive investment as a whole and S&P in particular.

Market Intelligence

This division can be considered different from its core business but still related. At 34% of total revenue and 24% of operating profit, it is a significant proportion of the business. In essence it provides productivity enhancing news, market and financial data and analytics platforms for investment professionals. Its S&P Capital IQ platform competes with the likes of Bloomberg and FactSet. Once, these systems are embedded in their clients’ workflows they tend to be sticky. There is more competition than the ratings and indices businesses, but its products have an excellent reputation, and it remains a very healthy revenue stream.

Conclusion

Quality rhymes through most of S&P’s diversified revenue streams. The business has won its spurs through many decades of a strong track record of profitability and growth. Leveraging its strong brand reputation, customer loyalty and excellent market position to achieve truly global reach. All these attributes enable it to capture compound growth over the long term. We believe in investing in quality companies that can withstand the sands of time, because often the more things change, the more they stay the same.