From our Fund Manager’s Desk

We regularly articulate what we find compelling about one of the companies in the Fund. This time round we have chosen Starbucks.

Have you ever simply asked for a “coffee” at a Starbucks?

The world’s largest specialist coffee chain has transformed an ordinary product into an indulgent, albeit affordable, luxury product and experience. Starbucks has not only created a market, but a whole new lingo. Mine’s a “tall, half-caff, soy latte at 120 degrees”. The upshot is that the Starbucks’ multi-decade coffee revolution has caught the zeitgeist that places more value on ethical, emotional and aesthetic considerations. Consumers prefer to spend money on experiences than material things. To this extent, when he took charge of Starbucks, Howard Schultz created something people did not know they needed, but suddenly could not get enough of.

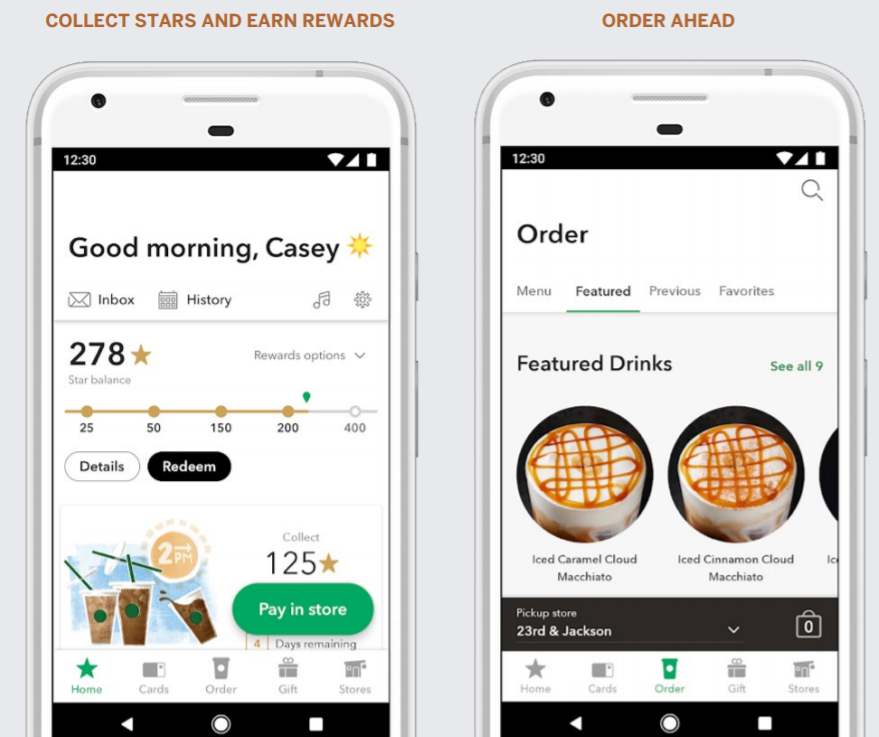

Unsurprisingly, selling coffees for $3 or more is a highly profitable business. There are also trade-up opportunities. ”Would you like a blueberry muffin with that?”. To boot, it is not only the attractive price points but also the regularity of purchase. It is routine for office workers to start their morning with a caffeine boost from their nearby café followed by a postprandial pick-me up later in the day. Starbucks locks in customer loyalty and drives higher spending through its innovative rewards programme. For example, you can earn extra points for free food or drink through “challenges” such as sampling their new range of Chai Tea Latte. The Starbucks app enables customers to order and pay in advance for their drinks and food, thereby skipping the queue when they arrive and encourage repeat ordering.

Costs are also lower compared to a traditional restaurant due to the absence of kitchens. As a result, Starbucks’ US cafés generate a restaurant industry-leading pre-tax return on investment of 66%. This compares to a very healthy 38% return for Mexican fast-food chain Taco Bell, which we also happen to own in the fund via the holding in Yum! Brands. In other words, if a franchisee was to set up a Starbucks in the US, he or she would be paid back on their original cafés build cost within one and a half years. Hence, there is a continuing business case to roll-out more cafés in the relative underpenetrated Midwest.

The US is still the main market for Starbucks, contributing three quarters of sales. The café chain continues to drive growth through beverage and food innovations. For example, its most recent beverage launch was the Cloud Macchiato, a healthier alternative to a Frappuccino given the creamy head is achieved by mixing the milky foam with egg whites. For those who view cafés as replacements for pubs, they can try Starbucks’ Cold Brew Nitro, which is cold brew coffee charged with nitrogen to give it a rich creamy head like a draft Guinness. As part of the showmanship, a pint of it is even served from a beer-like tap.

CAFÉS - THE NEW PUB?

Another driver is China, which is Starbucks’ fastest growing major market. This tea drinking nation is becoming increasingly hooked on the coffee experience. Starbucks is aiming to increase the number of its eponymous cafés in the country by 60% by 2022. Furthermore, the economics are even better than in the US. A Starbucks café in mainland China typically generates a return on investment of 86%, thereby paying back the set-up costs in just over a year.

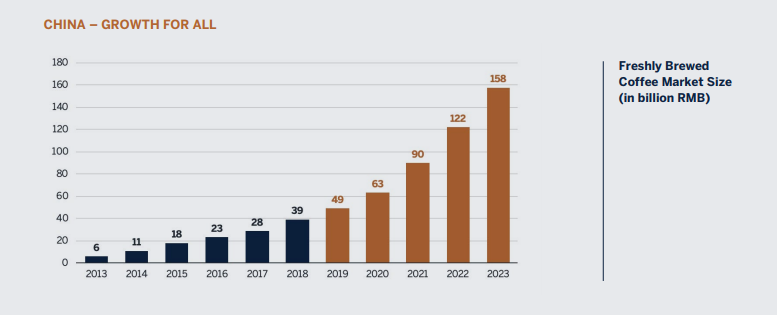

Despite strong growth in coffee consumption, the Chinese market remains underpenetrated with only six cups of coffee drunk per person every year. In Taiwan and Hong Kong average consumption is over 200 cups a year and in the US it is close to 400. A report by market researcher Frost & Sullivan forecast freshly brewed coffee retail sales in excess of $23bn by 2023 versus nearly $6bn in 2018. This equates to +32% sales growth per annum. The underlying driver is rising urbanisation and disposable income to support increased coffee consumption. Attracted by this growth new home-grown, competitors are popping up. The largest of these is Luckin Coffee, which has a slightly different smaller store format focused on delivery and pick-up orders. At this stage of market development, new entrants are a net-positive as they act as promoters of the coffee drinking culture, driving overall consumption.

In an espresso shot… Starbucks is a highly cash generative business with significant potential to grow through new innovations and geographic expansion. Despite a recent rally, the shares remain reasonably priced at around the 10-year average price-to-earnings ratio. Still a tasty treat.