From our Fund Manager’s Desk

The Consumer Shift: Rethinking Brand Loyalty

Consumer behaviour has been undergoing a transformation. In today’s fast-paced world, consumer tastes have become increasingly fickle, with individuals constantly seeking new and exciting products and experiences. This phenomenon is driven by various factors, including technological advancements, the influence of social media, generational change, intensifying competition from local brands, and a shift toward prioritizing experiences over goods.

Brand loyalty has traditionally been regarded as a critical factor for the long-term success of consumer-facing companies. However, shifts in consumer behaviour have undermined this thesis in more recent years.

Factors Contributing to the Decline of Brand Loyalty

01/ Technological Advancements

Advancements in technology and the prominence of digital platforms have fundamentally changed the way consumers interact with brands. Social media, e-commerce, and mobile apps have made it easier for consumers to discover new brands and products. The increased accessibility of information has also empowered consumers to make more informed decisions. With just a few clicks, consumers can discover new products, compare prices, read reviews, and make purchases. The ease of access in today’s digital age has led to greater expectations and a desire for novelty and constant newness.

This digital transformation has also democratised access to the consumer, empowering smaller brands by breaking down traditional barriers that once limited their reach. In the past, only companies with substantial marketing budgets could afford high-cost channels like TV and print media to build brand awareness.

Started in 2012 by 19-year-old Ben Francis and a friend in his parent’s garage, Gymshark is a brand that overcame these traditional barriers to become a global success story. The company was one of the first brands to harness the power of social media influencers, partnering with fitness enthusiasts and bodybuilders on platforms like Instagram and YouTube. Gymshark cultivated a strong online presence and loyal community through their focus on digital marketing and influencer collaborations rather than traditional advertising. The company was able to reach its customers by selling exclusively through its own website, eliminating reliance on third-party retailers. Moreover, the brand emphasized community by organizing events like expos and meetups, giving fans the opportunity to connect with influencers and the company directly. These innovative strategies propelled Gymshark from a small startup to a global fitness powerhouse, reaching a valuation of over £1 billion by 2020.

02/ The Proliferation of Choices

The global marketplace offers an overwhelming array of choices, making it challenging for consumers to remain loyal to a single brand. With numerous alternatives available, consumers have a greater tendency to switch brands in search of better quality, price, or unique features. The beverage industry is an example of an industry that has seen a proliferation of brands fuelled by shifting consumer preferences and the rise of niche markets. Health-conscious consumers have driven the success of brands like LaCroix, which popularized sparkling water as a stylish alternative to sugary sodas. Similarly, the increasing focus on sustainability and plant-based diets paved the way for brands like Oatly, a leader in the oat milk category.

The rise of celebrity-backed brands has significantly increased the number of brands in the spirits segment. From tequila (Kendall Jenner's 818) to gin (Ryan Reynolds' Aviation Gin) and whiskey (Conor McGregor's Proper No. Twelve), celebrities have been able to leverage their massive social media followings and public influence to promote their beverage brands.

This abundance of options has diluted the impact of brand loyalty, as consumers prioritize their desire for newness and novelty over long-term allegiance.

03/ The Rise of Domestic Champions

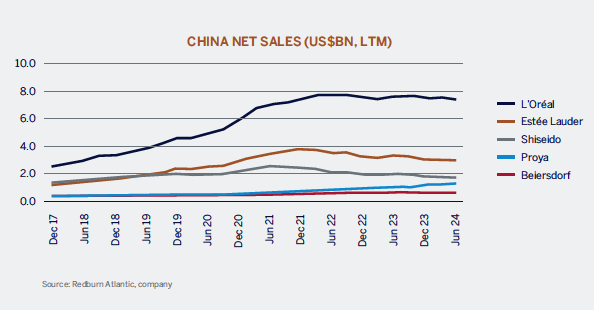

Historically, global giants such as Nike, L’Oréal, and Unilever have dominated consumer industries such as sportswear, beauty, and packaged goods. However, in recent years, we have seen the growing success of local competitors. These regional brands have become more popular with customers as the quality of their products has improved, their price points are seen as better value, and, in certain regions like China, there has been a greater desire for locally made products.

One such success story is Anta, a domestic Chinese sportswear brand that has experienced remarkable growth in its market share by focusing on product innovation, affordability, improved quality, and aligning itself with national pride through sponsorship of Chinese athletes and sporting events. In doing so, Anta has resonated strongly with local consumers.

This has enabled Anta to compete head-to-head with global giants like Nike and Adidas, carving out a meaningful share of the Chinese sportswear market. Over the past decade, Anta Group has grown its sportswear market share in China from approximately 8% to an impressive 21%.

04/ The Role of Influencers and Peer Recommendations

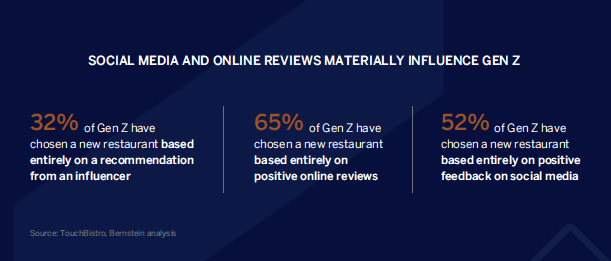

The rise of social media influencers and the growing importance of peer recommendations have reshaped consumer trust and loyalty. Influencers and peers can quickly sway consumer opinions, leading to rapid shifts in brand preferences. This dynamic environment makes it difficult for companies to maintain a loyal customer base.

Kylie Cosmetics, founded by Kylie Jenner in 2015, became an instant sensation using the power of her massive social media following. Collaborations with other influencers and celebrities further increased its popularity. The brand’s immense success established Kylie Cosmetics as a trailblazer in the new era of influencer-led beauty businesses.

05/ Generational change: The rise of Gen Z

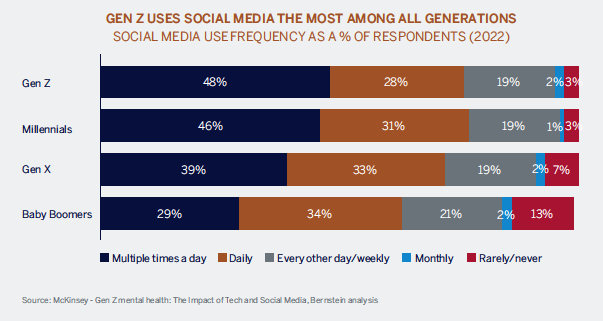

Gen Z (aged between 15 and 27) are magnifying disruptive trends. They devote significantly more time to social media compared to their counterparts from a decade ago, often at the expense of traditional TV watching. This generation places greater emphasis on experiences rather than material possessions. As digital natives, Gen Z spends much of their time online, drawing inspiration from social media and heavily relying on online reviews and social platforms to inform their decisions. Gen Z’s demand for constant innovation has challenged traditional brands to stay relevant and responsive in a fast-moving consumer landscape.

06 / Prioritizing experiences over goods

People are increasingly associating happiness and well-being with meaningful experiences rather than material possessions. Experiences, such as travel, dining, or entertainment, are seen as opportunities to create lasting memories and emotional connections. Platforms like Instagram and TikTok have amplified the appeal of experiences by enabling users to share highlights of their lives. Experiences are more visually captivating and shareable, fueling a culture where they are highly valued.

What does this erosion of brand loyalty mean for investing in consumer stocks?

This constant search for newness means that once “steady eddy” businesses have become less predictable, in constant flux, and at risk of missing the next wave. A large established player like Nestlé has been pressured to cut its long-term growth targets as it is forced to invest more to stay relevant.

We have seen many examples of companies facing waning brand loyalty across the consumer landscape. The beauty industry is one that vividly illustrates the decline of brand loyalty in today’s volatile consumer landscape. Traditionally, skincare consumers were deeply loyal to their preferred brands, trusting established products they used on their faces and remaining reluctant to switch. Established names like Estée Lauder built their reputation over decades, earning consumer trust through consistent quality and effective solutions. This trust, combined with traditional advertising avenues like TV and magazines, gave larger brands like Estée Lauder an edge by creating high barriers to entry.

In recent years, however, the dynamics have shifted. Social media has leveled the playing field, giving smaller brands direct access to consumers and amplifying their voices. This shift has posed challenges for giants like Estée Lauder, as consumer loyalty has become more fluid. Younger generations, in particular, are more open to experimenting with new products and are drawn to innovative, affordable, and niche skincare.

The beauty market is flooded with new brands, including regional and niche brands, offering innovative and affordable products. Social media and influencer marketing have made it easier for consumers to discover and try new products, reducing attachment to any single brand. Faster innovation cycles mean consumers are frequently exposed to new products or trends, making them more likely to experiment.

Domestic champions like Proya have taken share in the Chinese market, helped by more accessible price points and many of the online retailers increasingly championing domestic brands.

What have we done in the portfolio?

We have adjusted the portfolio to reflect these changing dynamics, with traditional consumer companies now representing less than 10% of the fund. What remains from a consumer perspective is LVMH, a diversified portfolio of heritage brands with heritage hard to replicate; Starbucks, a coffee company that has positioned itself to capitalize on coffee consumption as both a lifestyle and social experience; and Amazon, a brand-agnostic play on eCommerce.

We focus on finding and holding long-term investments that are consistent compounders rather than chasing companies driven by short-term brand momentum.