From our Fund Manager’s Desk

We regularly explore the investment rationale of one of the companies we own in the Fund, to articulate what we find compelling. This time round we have chosen UnitedHealth.

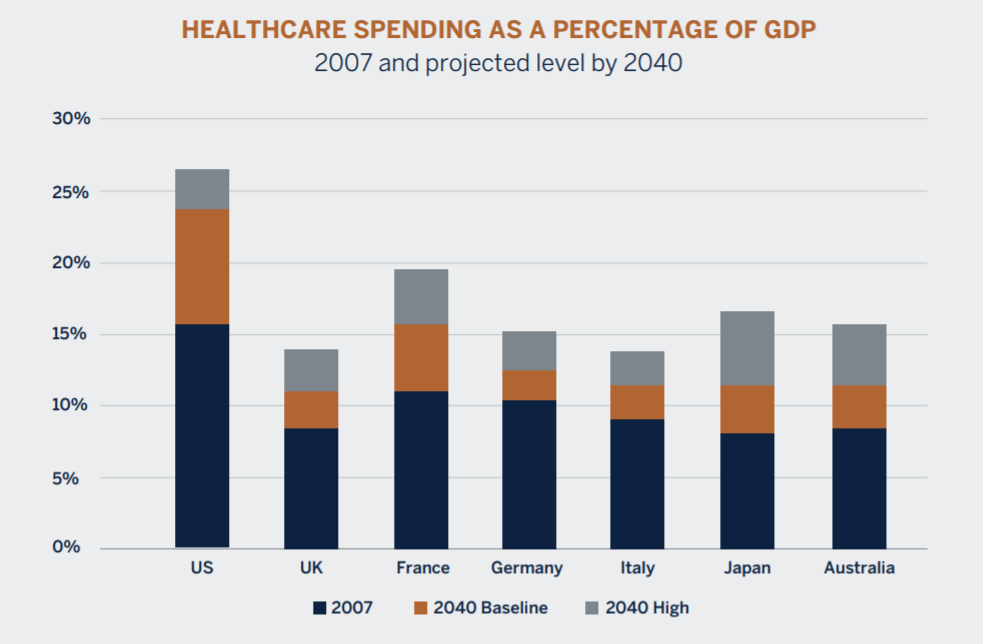

The ageing of the world’s population is a ticking fiscal time bomb due to explode on younger generations required to support outdated social welfare programmes designed for 10 years of retirement rather than 30 years. A silver (or grey) lining is that this demographic mega-trend is also a huge opportunity for companies operating in the healthcare sector given the expanding cohorts of elderly patients.

The chart shows healthcare spending will consume an ever higher proportion of GDP in future. Surprisingly, the United States is expected to be one of the fastest growers even though it is already the biggest spender and has comparatively better demographics. This is a problem because spending more than a quarter of your GDP on healthcare by 2040 - much of it on those retired from the workforce rather than on productivity boosting investment, such as education and infrastructure - is not conducive to national wealth creation.

Profligate US spending is a result of a Byzantine healthcare system that is over layered by middle-men, is fragmented and has practitioners incentivised to overspend on treatments and tests. For example, even refilling a prescription is complicated as a US patient requires a doctor deemed suitable by his insurance company, a health maintenance organisation, a list of approved drugs, an approved pharmacy, a pharmacy benefits plan, and up to three levels of government approval.

UnitedHealth Group, a top five position in the Fund, is a part of the solution to the US health sector’s inefficiencies and ballooning costs. In a nutshell this health insurance and services giant adds value through scale economics and a holistic approach via its broad offering. It has two business platforms: UnitedHealthcare and Optum. So, what does each do and why are they compelling?

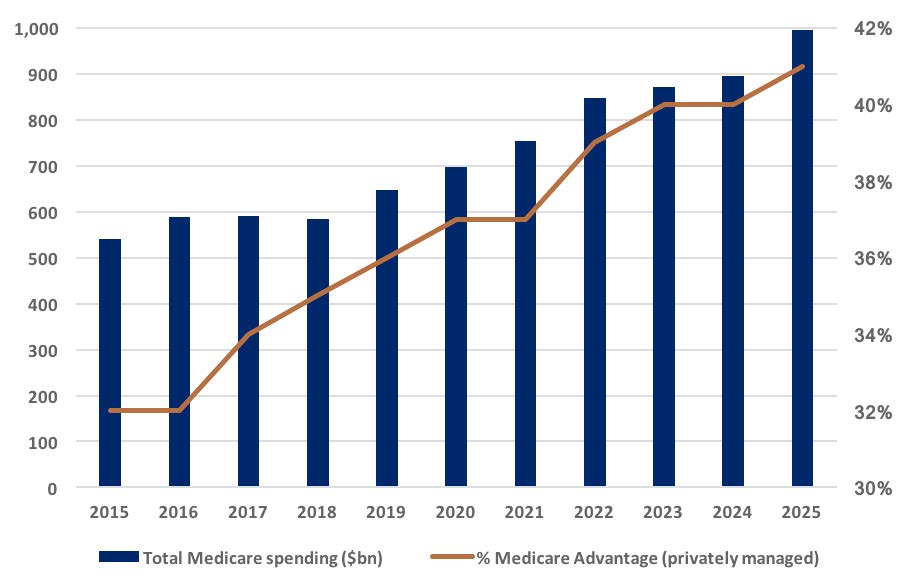

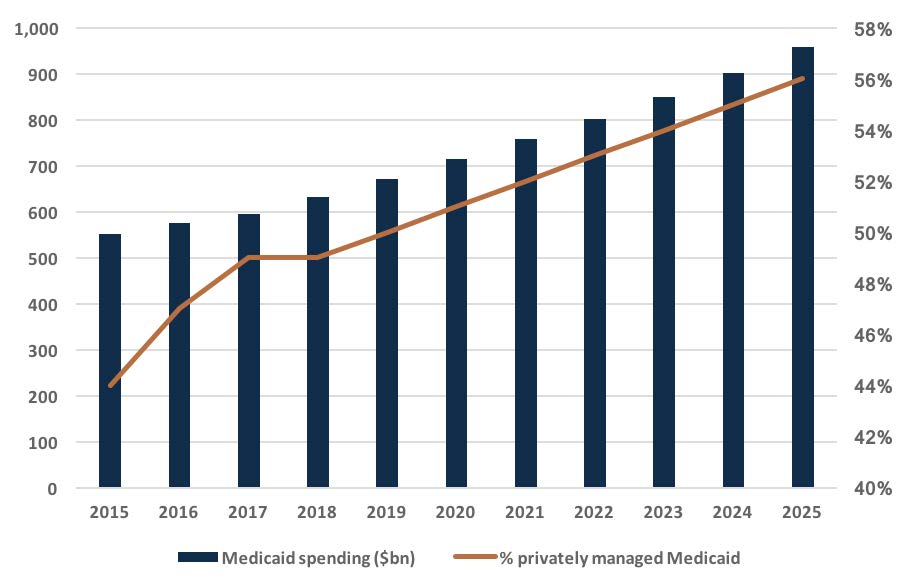

The first, UnitedHealthcare, offers health insurance and benefit plans primarily in the US for employer and government controlled schemes. It has a competitive edge over its peers due to a larger network of doctors and other medical clients. UnitedHealthcare is gaining a larger slice of the pie as the government seeks to control costs by effectively privatising a larger proportion of two inefficiently managed federal[1]state health insurance programmes, namely Medicare (for people aged 65 years or older) and Medicaid (for low income earners). The charts show the projected increase in the share of privately managed health insurance of these public schemes. We expect managed Medicaid and Medicare (called Medicare Advantage) to grow +8% and +9% per annum respectively to 2025. Market leader UnitedHealthcare is expected to grow revenues at a similarly vigorous rate.

The second business division is Optum, which is UnitedHealth’s healthcare data analytics, consulting and services arm. It is the ying to UnitedHealthcare’s yang. Optum’s origins were as an in-house effort to lower medical costs for its UnitedHealthcare offering. It now also offers its services externally across the US healthcare sector, whether it is through lower priced medications from its OptumRx pharmacy benefits manager, the use of hospital data analytics via OptumInsight, or avoiding member hospital visits via preventative medicine and wellness programmes.

As well growing rapidly, Optum is also more profitable than the core health insurance business. US health insurers are mandated by their regulator to spend 80% to 85% on medical costs, and must give excess profits back to members. By contrast Optum only has to ensure it provides good services at a fair price. This means it can and does achieve higher profit margins and growth than the regulated insurance business, enabling it to surpass UnitedHealthcare over time as the group’s largest business.

The combination of these two businesses will enable UnitedHealth Group’s earnings to grow at a robust low-to[1]mid teens clip to at least 2025 due to demand for its Optum services, rising expenditure on healthcare amidst an ageing population and the expanding share of privately (more efficiently) managed health care within the Medicare and Medicaid government programmes. In our view it will be a while before this growth stock is put out to pasture.