South African equities hold value

– if you know where to look

It’s relative

First, consider one of the two foundational ratios, beginning with the dividend yield. With JSE prices in a trough, the ratio of dividend payments to share prices is attractive. For example, using Standard Bank as a proxy for the market, the dividend yield of approximately 7.5% is meaningfully above inflation, which currently sits just above 5%.

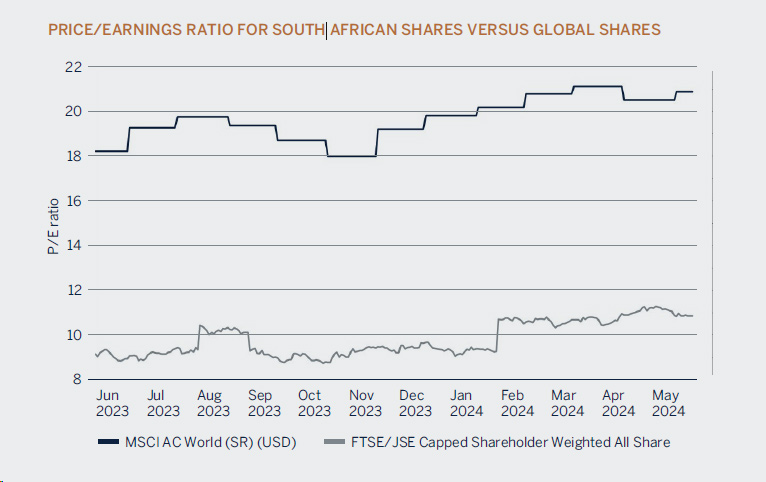

Another instructive ratio is the price/earnings (P/E) ratio. This is simply a company's share price divided by earnings per share. Higher P/E ratios suggest that investors may have priced in an asset’s full value. On the other hand, lower P/E ratios signal that there may be value in a share that markets haven’t yet priced in. This flags the potential for a future rise in share price to better reflect fundamentals. Again, the JSE shows signs of being attractively priced, with a P/E ratio significantly below the MSCI, a benchmark for large global shares.

Second, although we often speak about the JSE as shorthand for one place to invest, it is really a diverse bourse. Companies listed on the JSE vary greatly in size, industry and value. When we analyse the JSE for its value for money, we run the risk of missing those companies that are attractively priced. That is because the index tends to be skewed by the largest companies that compete on a global stage. This means there is value to be found in the smaller caps – if you’re willing to look for them.

Next, remember that not all companies listed in South Africa are truly South African investments. Some JSE assets are, in fact, investments in overseas operations. Prominent examples are Naspers, Richemont and BHP. This makes companies like these hedges against rand weakness.

Finally, a significant drag on local share prices is now nearing an end. Rule changes by National Treasury in 2022 increased the limits on retirement and unit trust investments held offshore by South Africa portfolio investors. The new upper limit of 45% resulted in substantial flows out of the JSE. That dampened the prices of local equities. However, this process now seems largely complete.

In sum, all investing is relative. What can you buy an asset for, and what can you sell it for? What yields does it provide you while you hold the asset? And what other nuances and trends suggest value to be had in this calculus?

Applying this thinking to the JSE certainly doesn’t remove the headwinds that local shares face. However, a granular analysis enables us to see value where it lies.It also equips us to address our question: “Is there value in local equities?”. Yes – if you know where to look.