Global Investment Backdrop

Staying the course as financial markets edge higher

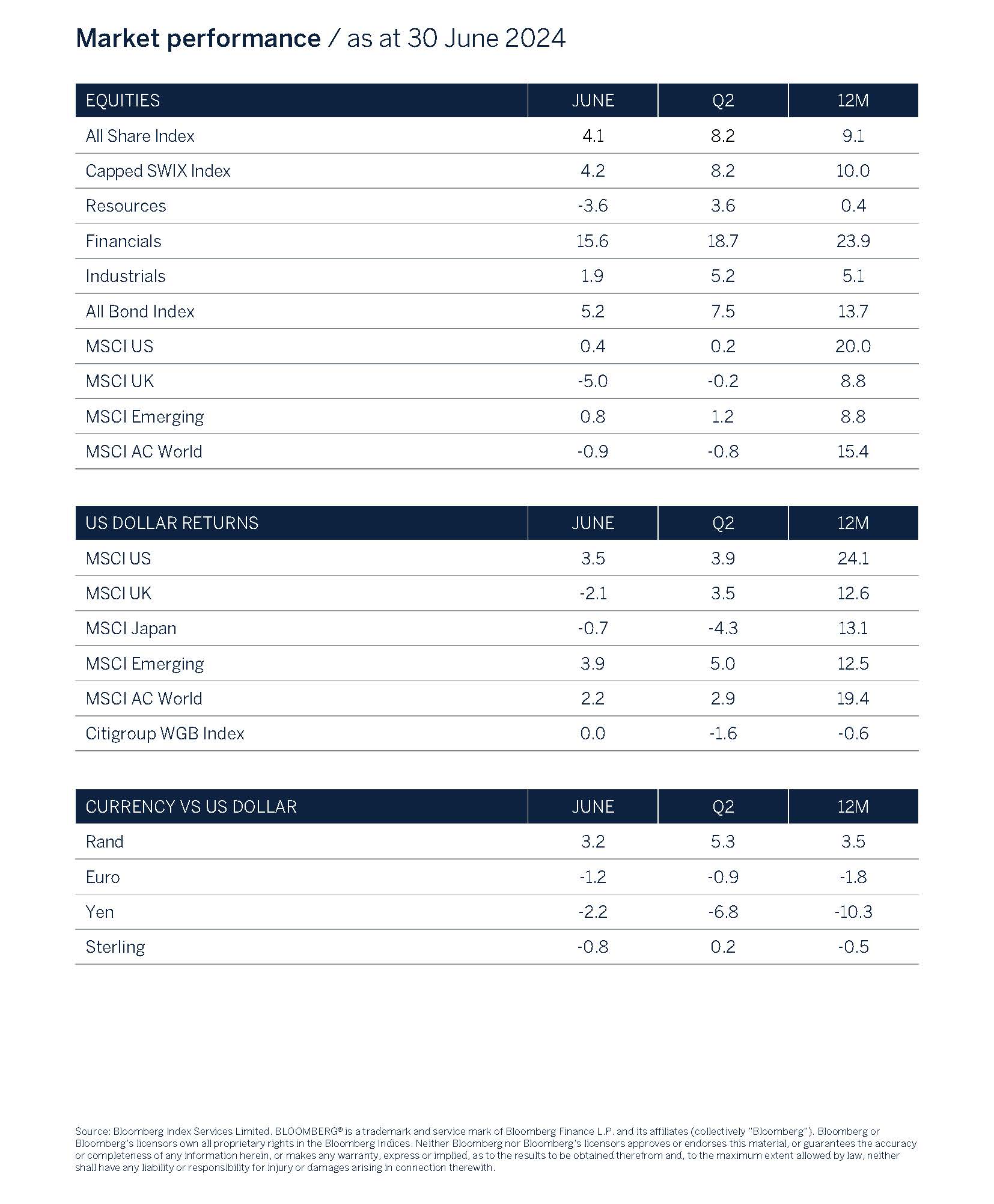

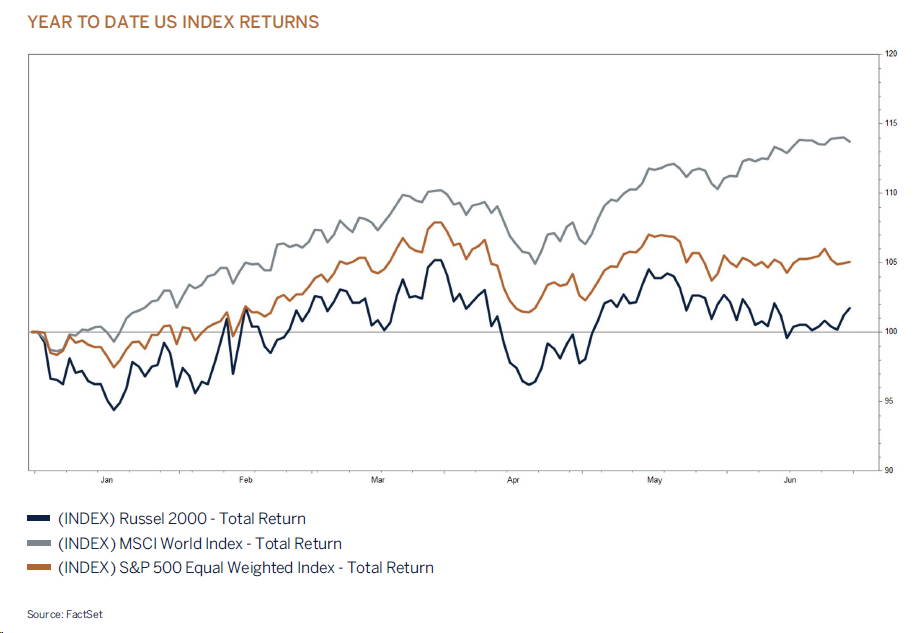

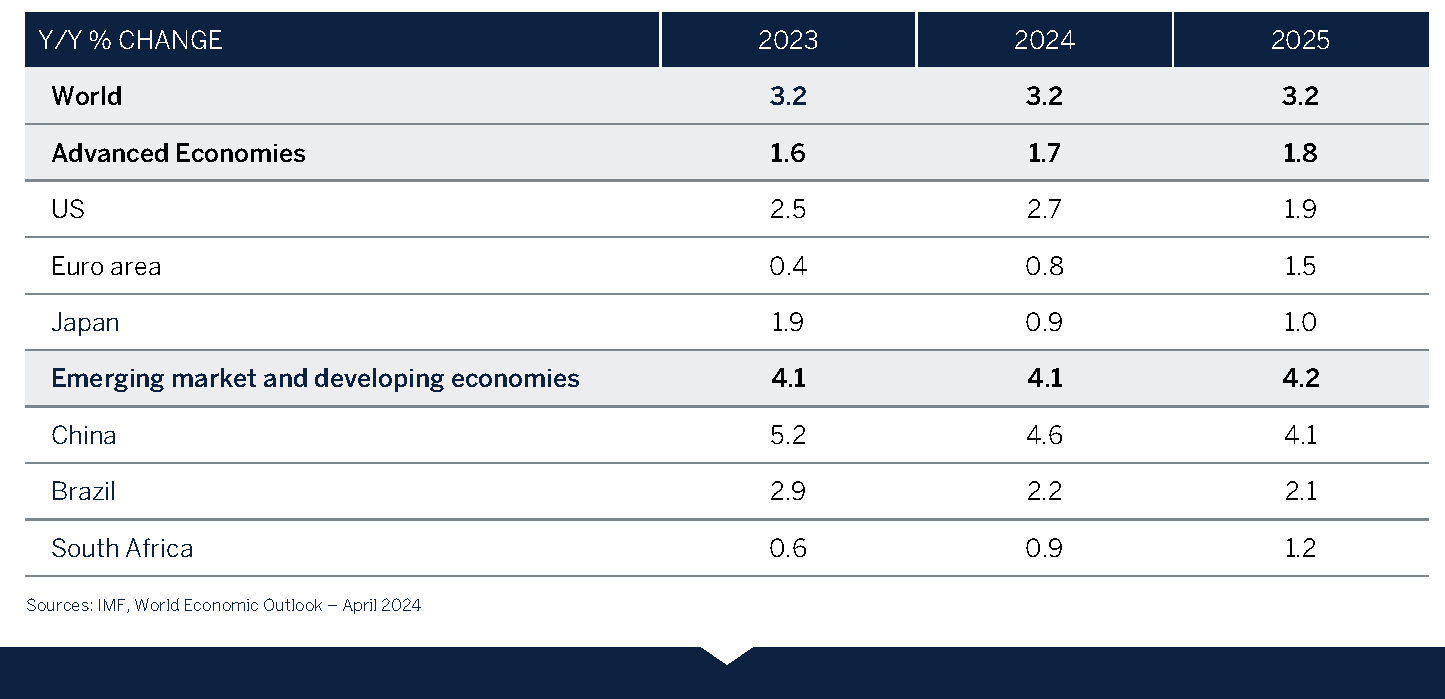

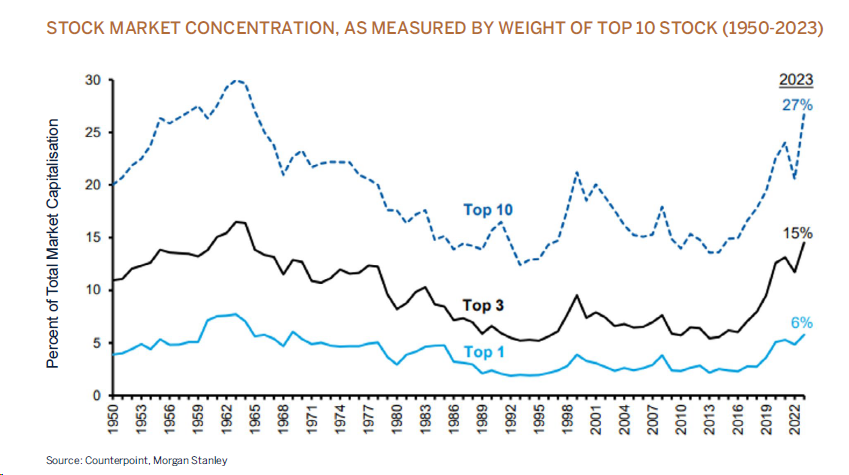

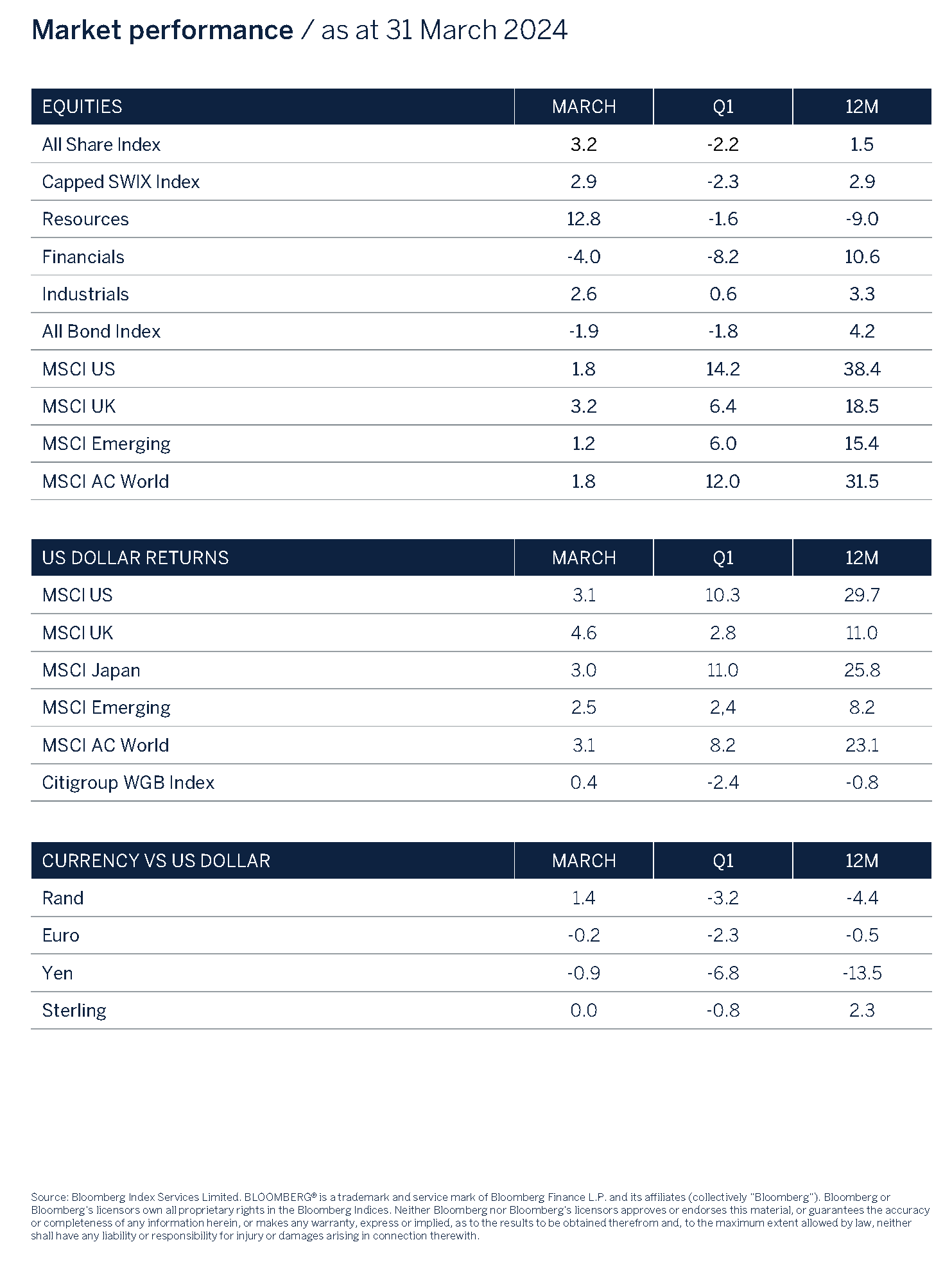

Risk assets enjoyed another positive quarter as global economic growth looks to be increasingly on a firm footing, and now expected to expand in line with historical trends of around 3% per annum over the next few years. Equity investors will be pleased with the returns at the mid-point of the year, with global equities up a little over 11% in US dollar terms and 12% in sterling terms. Some major western world equity indices are reaching new all-time highs, despite a hostile and volatile global geopolitical backdrop, and lack of support from global bond yields, which have been trending higher this year on the back of stronger than expected economic growth and still elevated core inflation. One of the features from the current uptrend in global equities has been the consistent trend of concentration amongst the noteworthy performers, primarily driven by the technology sector. If it were not for the sector’s relative strength, global equities would not have much to boast about this year. With Artificial Intelligence (AI) / Magnificent 7 stocks continuing to dominate, the defensive names and sectors seem to remain in competition for the wooden spoon. With regards to the lack of market breadth, look no further than the Russell 2000 (small caps) and/ or the equally weighted S&P500 index, both of which remain rangebound on the back of lackluster revenue and earnings growth. Chris Willis (our global technology analyst) discusses this topic on page 4, Concentration in the Stock Market: A Closer Look.

Central banks will be pleased that an early year inflation acceleration is fading but will be hesitant to cut interest rates too soon or too aggressively while core inflation is hovering above 3%, as tight labour markets and elevated wage gains limit service sector disinflation. The implications of higher-for-longer policy stances over the medium term are uncertain, and something that we will continue to monitor closely.

While risks remain, we acknowledge that inflation rates have declined sharply over the past year and that the disinflationary trend appears to be firmly intact. Also, interest rates have peaked, and financial conditions have eased materially which has contributed to the reduction in risk premium across asset classes. These factors combined with the expected broadening out of corporate earnings growth across a wider range of sectors as the year progresses are expected to keep valuations afloat. As such, we are moving to an overweight global equity position in client portfolios.

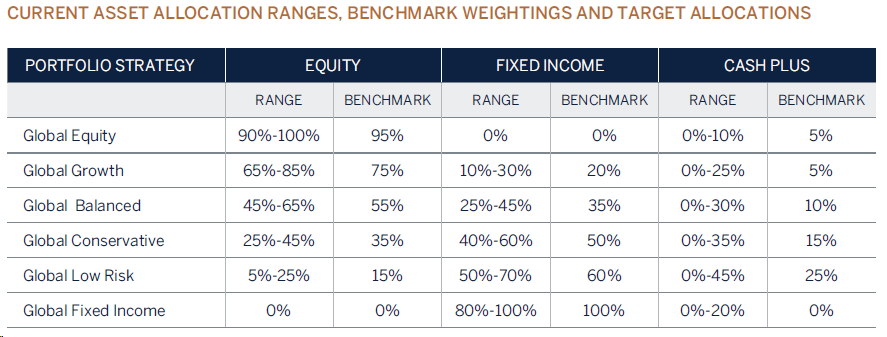

Changes to benchmark weightings and asset allocation ranges in global portfolios

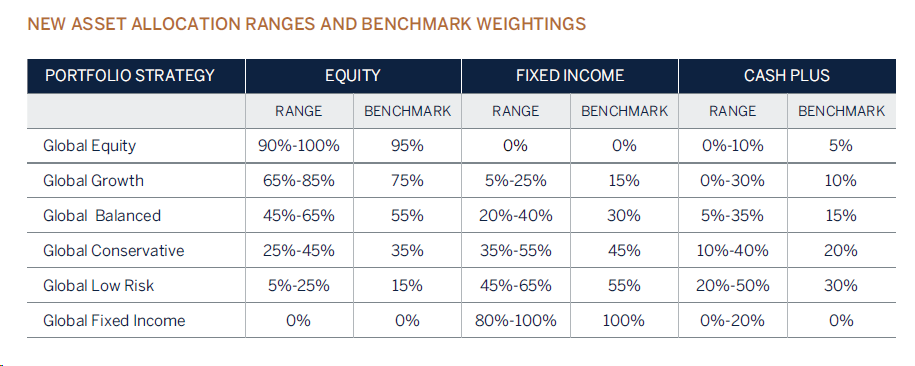

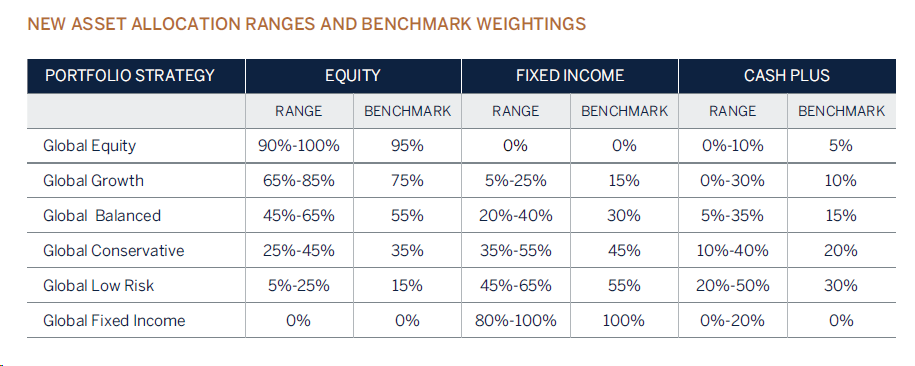

As part of our continuing wish to both evolve and deliver clarity and transparency to our investment solutions, we have recently completed a comprehensive review of our successful risk adjusted model portfolio strategies and have decided to modify the benchmark weightings and asset class ranges of these core strategies.

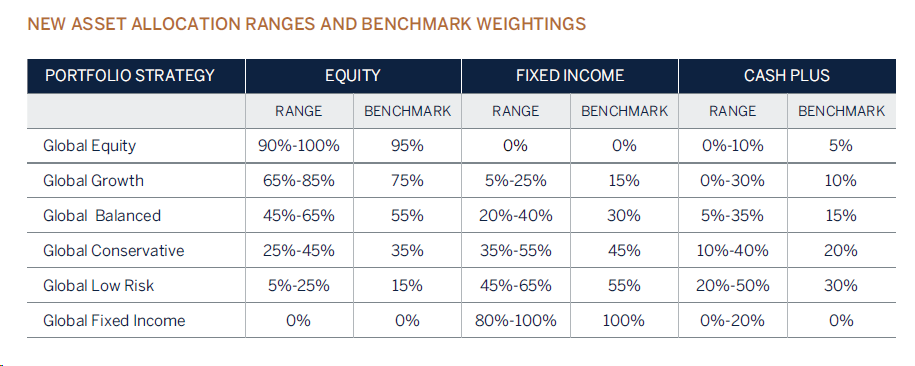

The key change is within the lower risk elements of multi-asset portfolio strategies. From the 1st of July 2024 we will be reducing our strategic (long-term) benchmark weighting to fixed income, which will also result in adjusting the tactical (short-term) ranges within this asset class. Concurrently, we will be increasing the benchmark allocation to the cash plus component and modifying the tactical ranges.

For some time now, as part of the cash plus weighting in client portfolios, we have, where appropriate, meaningfully allocated to short duration fixed income securities and alternative asset classes in order to generate returns over and above cash which on a look through basis has resulted in actual overweight allocations to fixed income. To allow for additional flexibility and diversification to these assets, when deemed advantageous, and to ensure overall portfolio exposure to fixed income is within tolerance and fully aligned to clients agreed risk/return objectives, we have decided to reduce our strategic allocation to fixed income in favour of cash plus. There is NO change to the equity benchmark weightings.

The new benchmark allocations and asset class ranges are shown below.

At the same time, following input from independent investment consultants, industry benchmark providers, and indeed clients, we have decided to reduce the domestic “home market” bias of the equity allocations of both our GBP and EUR portfolios. Currently the benchmark weightings of the equity allocations for GBP and EUR portfolios are split 40% UK / 60% Global and 40% Europe ex-UK / 60% Global, respectively. From 1st July these will be 30% UK / 70% Global and 30% Europe ex-UK / 70% Global. The free-float market capitalisation of the UK and Europe (ex UK) has fallen considerably over the past decade or so and they now make up less than 4% and 12% respectively of world equity indices. Given these changes to the underlying constituents of the benchmarks, and in the knowledge that a more diversified global portfolio typically performs considerably better than being too over exposed, on a relative basis, to one market, we are reducing the home market bias to ensure portfolios are not so overinvested in domestic stocks relative to global markets.

We are confident that these changes further enhance our robust asset allocation framework, which together with proven individual stock and fund selection capabilities will continue to feed through to sustained and favourable longterm relative and absolute investment returns. With your investment strategy in the capable hands of our seasoned investment professionals, your returns will continue to be managed to optimise upside potential whilst conscientiously managing downside risk and will remain aligned to the results from the regular client risk profiling exercise which lies at the heart of our wealth management process.

If you have any questions whatsoever about this change, please contact your Wealth or Portfolio Manager.

Concentration in the Stock Market: A Closer Look

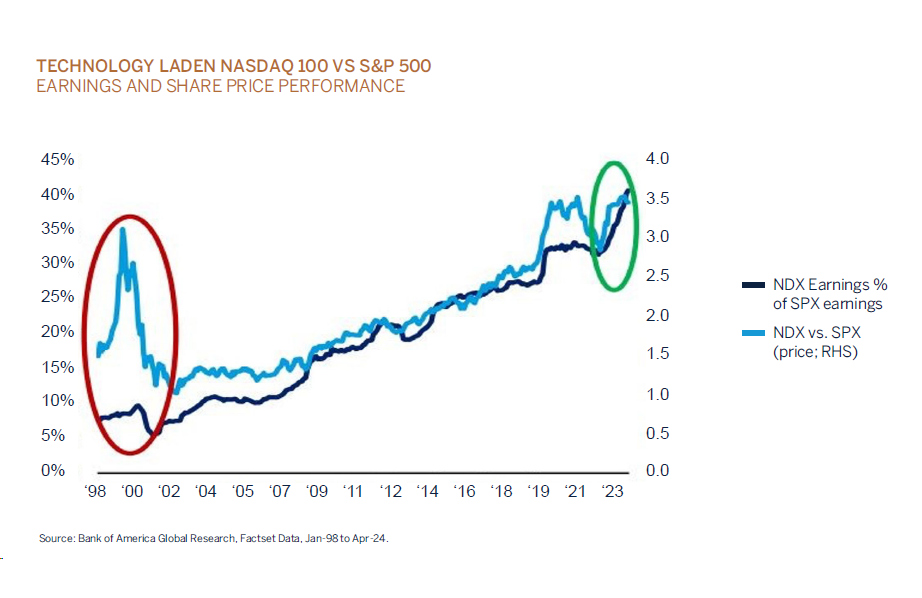

In recent years, the stock market has experienced a surge in concentration. In analysis by Morgan Stanley, the 10 years preceding 2023 saw the concentration of the U.S. stock market nearly double from 14 to 27 percent. A level now higher than the market concentration of the dot-com bubble.

This level of concentration is not unknown, in the period from 1950-2023 the concentration of the top 10 stocks peaked at 30% in 1963 while the lowest concentration over this time was 12% in 1993. As recently as 2014, the level was at 14%.

This rise in concentration is reflected in global benchmarks as well. In the MSCI All World Country Index, a broad measure of global mid and large cap stocks across developed and emerging markets, a similar pattern emerges. At the end of 2023, the top 10 stocks in the MSCI All World Country Index were 19% of the index, more than double what they had been ten years earlier. This shouldn’t be surprising as the U.S. makes up more than 60% of this global benchmark and 9 of the 10 biggest stocks in the index are U.S. companies.

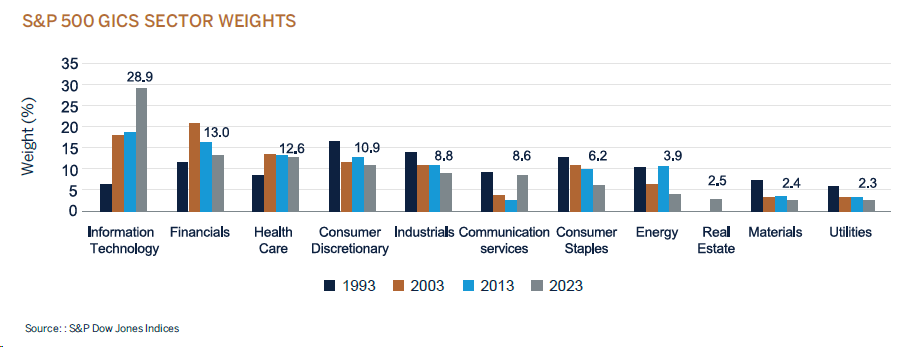

In the U.S. stock market, home to the largest technology companies in the world, the composition of the market has shifted over the last four decades to being dominated by technology and internet names.

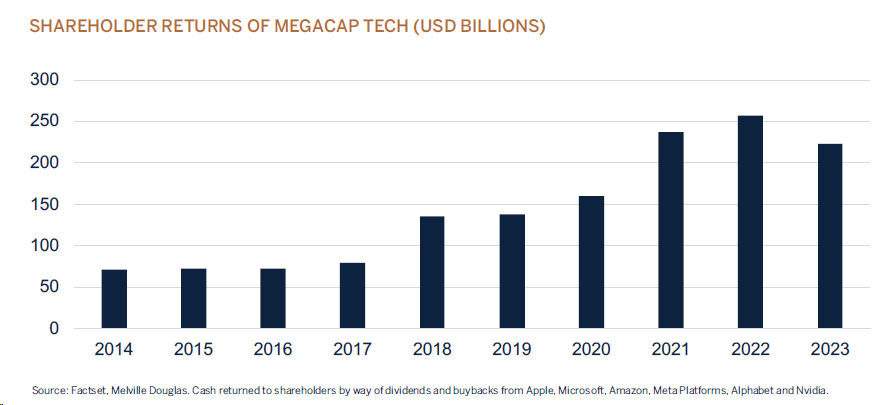

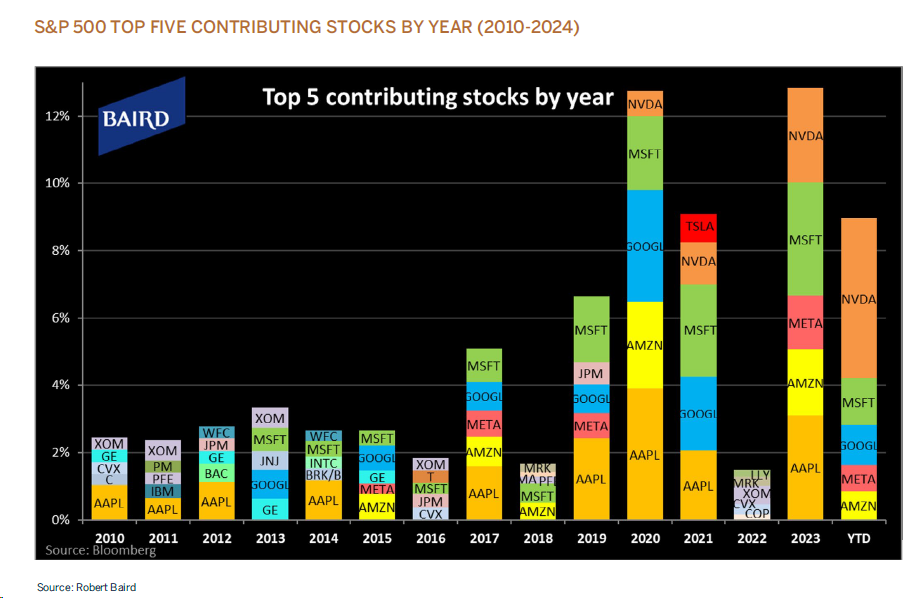

Over the last few years market returns have come to be dominated by a handful of tech giants, now known as the ‘Magnificent 7’. These household names wield significant sway over market dynamics and in 2023 were responsible for more than half of the index’s return. So far this year, just the top five names are responsible for 9% of the S&P 500’s return.

Adding to concerns around narrow breadth and market concentration, Nvidia is responsible for nearly 5% of the market return on a year to date basis and for a brief period in May was the largest company in the world by market cap. In data going back to 2010, this is the single largest contribution by any stock in a single year.

What feels disconcerting to many investors is the rate at which the change has happened and that it is being driven by a handful of high-flying tech names. Some of which didn’t even exist a few decades ago.

Considering the Evidence

A company’s size in any particular index is typically proportional to its total market capitalisation. The market capitalisation of a company is a representation of what investors believe a company to be worth. This can be skewed at times of euphoria and despair when valuations can become extremely inflated or depressed.

In the case of today’s largest technology companies, the valuations are neither abnormally low nor high at present. When considering the astronomical profitability of these firms and the compelling long-term case for their continued success, we think that they are within reasonable valuation ranges. As illustrated by Bank of America, during the tech bubble stock prices clearly decoupled from fundamentals, a phenomenon we have yet to see recently.

The largest tech platforms today span the globe, achieving distribution that was simply not possible before the advent of the internet. They are able to reach billions of customers, aggregating supply and demand, achieving levels of profitability not available to any other industry before them. The technology sector has come to be such a large part of the market because it reflects the economic weight and importance of technology and the internet to the global economy. With the rapid advances in productivity expected from AI, it is likely that technology will play an even more pivotal role in the future.

Global Conclusion

The current economic expansion is marked by unprecedented shocks and vigorous policy responses, pushing global inflation to multi-decade highs despite global GDP lagging its pre-pandemic trajectory. Central banks have collectively tightened monetary policies significantly, aiming to control inflation without causing a significant economic slowdown or increased unemployment. Optimism has now replaced earlier fears of recession as economic growth has proven to be resilient, with expectations that inflation will ultimately stabilise at around 2% and policy rates may return to pre-pandemic levels. This positive outlook has bolstered risk appetite, driving equity markets to record highs and in anticipation that policy rate cuts in the US and Western Europe will be eased. However, alternative views foresee lasting impacts from pandemic-related shocks and policy interventions, with waning fiscal support potentially moderating global growth and interest rates staying higher for longer. Despite these challenges, strong corporate and household balance sheets coupled with a buoyant job market suggest resilience in various sectors and regions, underpinning continued economic stability amid elevated interest rates.

Unemployment, albeit a lagging indicator, remains historically low but is starting to move gradually higher while at the same time US housing market activity is showing signs of weakness, which may allow the US Federal Reserve (Fed) some wiggle room on the rate front as inflation eases. Other leading indicators point to a general slowdown in economic momentum, but not rapid enough to spook the market. With the global cutting cycle likely underway and a rate cut by the Fed potentially on the horizon, stocks are expected to be underpinned by an improvement in earnings momentum helped by easier 2023 base effects and subsiding inflation pressures, and as such equities are our preferred asset class, followed by bonds over cash.

Global Asset Allocation

Global Equity - Overweight

We are increasing exposure to equities in relevant offshore portfolio strategies as the global economic backdrop has proven to be more resilient than what was previously expected only a few months ago. This has resulted in an adjustment to the outlook for the global economy, with the base line view that annual global economic growth over the next two to three years is expected to be in line with trend growth of 3%, supported by monetary accommodation over the same period, as inflationary pressures continue to subside.

The turnaround in earnings growth has been driven by US stocks, and in particular the technology sector which is benefiting from large scale investments by corporates in AI technology. We would expect this to continue for a while and believe that productivity will be positively enhanced on the back of these investments, which bodes well for corporate profitability in future.

Earnings growth is expected to broaden out to other sectors during the second half of this year and into 2025. Base effects are favourable and operating cost pressures are expected to subside as labour costs moderate in line with lower inflation and as the job market cools off after a period of unusually strong growth in developed markets.

Equity valuations are not attractive compared to history, but this is predominantly a function of the value assigned to high earnings growth sectors/stocks in the US. Outside of the US, valuations are very much in-line with long term averages and the US market appears fairly priced on a price to free cash flow basis. We would expect valuation multiples to de-rate over the medium term but given that interest rates have peaked they are likely to remain elevated in the short term. Equity valuations have historically only contracted during recessions. Short term equity returns are more linked to earnings growth momentum than valuations, hence our decision to tactically overweight the asset class.

Global Fixed Income - Neutral

We maintain the view that developed market government bond yields peaked last year, however we also expect them to remain ‘higher for longer’ as more evidence of disinflation is required, particularly in the services sector. At the start of this year, we had our reservations about optimistic rate cut expectations priced into the market and forecast yields to trend higher given ongoing resilience in both economic growth conditions and inflation. We do expect the next move in developed market interest rates to be down (the European Central Bank have already cut once), but it appears premature to expect that ‘aggressive’ monetary easing will be sanctioned in the coming quarters. Markets remain focused on the US Federal Reserve (Fed) who have already dialled back their monetary policy expectations for this year to just one 25 basis point cut and there remain ‘data dependant’ risks that any easing is delayed until next year. For now, we expect longer-dated bond yields to trade in a range and direction will continue to be dominated by inflation, with a keen eye on whether sustained high interest rates are beginning to meaningfully impact economic growth conditions. Given the extent of the rise in yields since mid-2020 our outlook for the bond markets is not negative on a risk/reward basis and, taking a medium to long-term view, lower yields are a reasonable assumption. However, over the short-term, we are reticent to further extend durations in our strategies or increase the overall weighting to the asset class in multi-asset portfolios given the current environment of sticky ‘core’ inflation and subsequently ‘tighter for longer’ monetary policy than previously expected.

Cash Plus – Underweight

While cash and cash alternatives currently provide investors with favourable yields and diversification, we have decided to reduce the exposure in favour of equities, which are better positioned as interest rates decline over the next year.

A GNU era for South Africa?

South African financial markets reacted positively to the outcome of this year’s General Election and the formation of a Government of National Unity (GNU) with the newly appointed cabinet, which resulted in the rand strengthening by 5.3% against the US dollar during the quarter and the SA 10- year government bond yield declining sharply and returning 7.5%. These developments propelled SA equities 8.2% higher, outperforming global equities by 9%.

Some of the challenges that government will need to overcome include:

- Institutional Decay and Reform: After years of toxic arrogance, corruption, and state capture, vital institutions have weakened. The GNU must assess and strengthen existing checks and balances to prevent further abuse by rogue politicians

- Poverty, Unemployment, and Inequality: The ANC aims to tackle these pressing issues through the GNU. Addressing socioeconomic disparities requires effective policies and implementation / Navigating Ideological Rivalries: The coalition includes parties with diverse ideologies. Balancing their interests while pursuing common goals is crucial for stability and progress

- Overall, the GNU’s success hinges on constitutional values, transparency, and decisive action to uplift the nation

While implementation risks remain, we now have the building blocks in place for improved execution. We believe that South African asset prices stand to benefit from these positive developments on the political front as investor confidence improves and we have increased exposure to SA equity across portfolios to an overweight position.

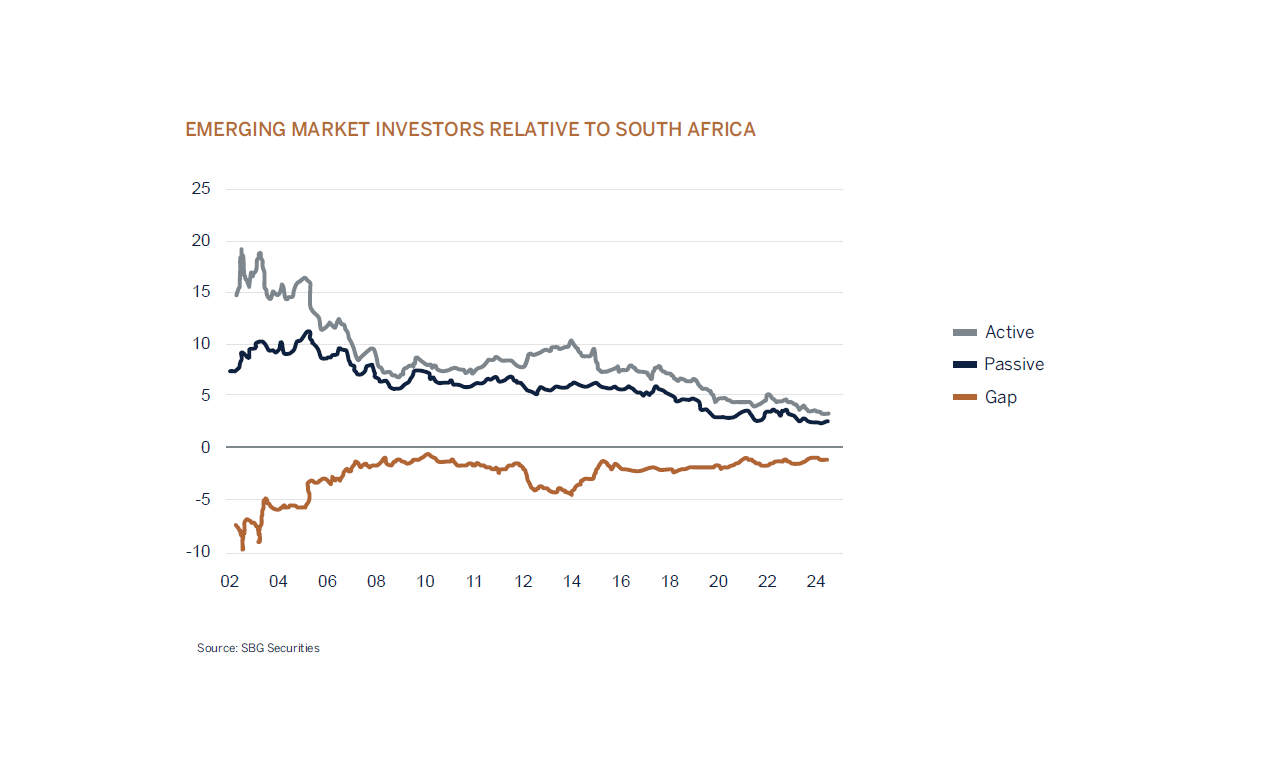

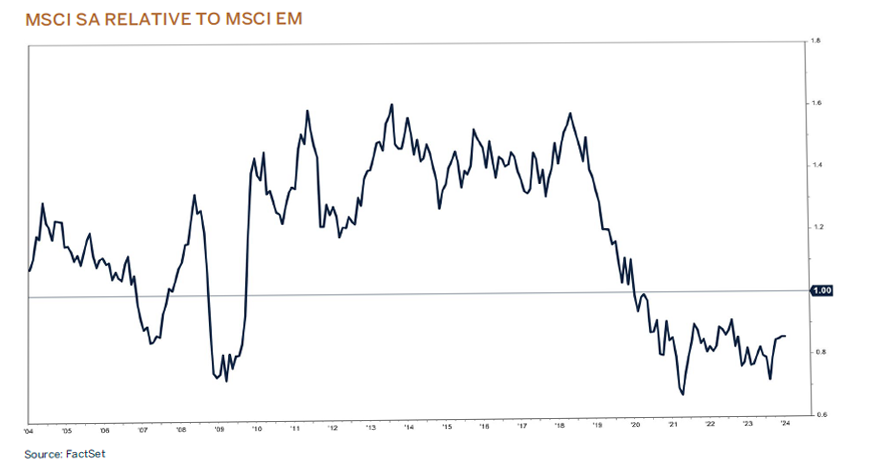

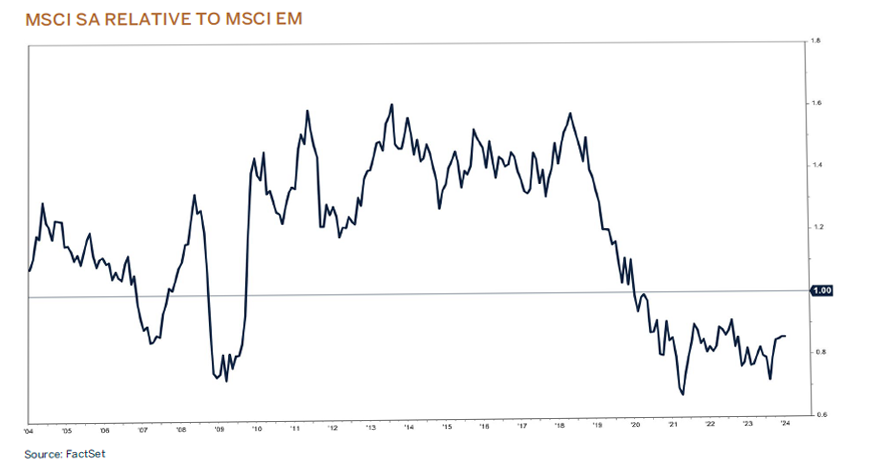

South African Equity, a compelling choice for Emerging Market Investors

Financial markets in South Africa have been on a de-rating trend over the past few years which has resulted in valuations across equity and bonds trading at a discount to the Emerging Market peer group. This has largely been a function of a disappointing economic growth environment caused by poor service delivery due to mismanagement, incompetence, and corruption. The impact of which has been a decline in household and business confidence, deteriorating debt metrics which led to a lower sovereign credit rating, and very little growth from corporates. Until only a few months ago, the domestic equity market traded at valuation levels last seen during the Global Financial Crisis and saw the 10-year benchmark government bond yield crossing the 12% mark. While we are certainly not out of the woods yet, the developments surrounding the GNU is a step in the right direction, and for many emerging market investors South Africa will once again become an attractive consideration, especially given the political uncertainty facing other countries in their universe, such as Mexico and India. Given their underweight allocation to SA, they may be lured back for several reasons.

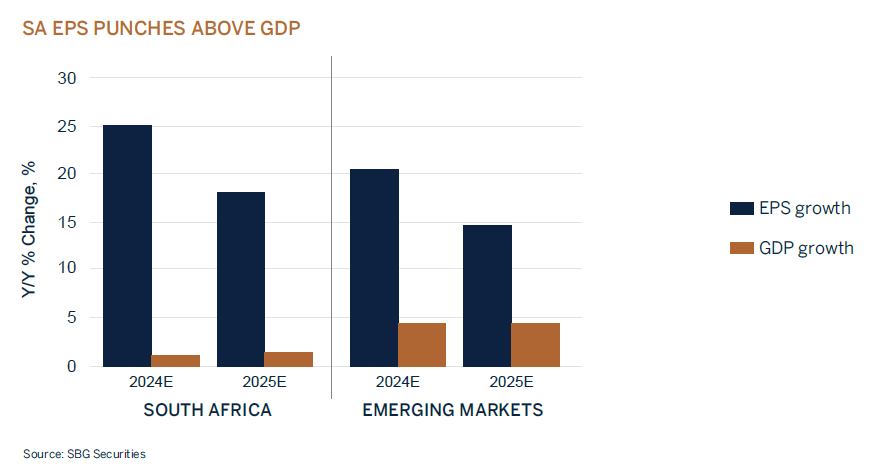

Global Equity – Neutral

One of them being that earnings growth from SA listed stocks is expected to be higher than the Emerging Market peer group, as can be seen below. This is despite lower real economic growth in SA. A small change to South Africa’s top line growth on the back of improved household and business confidence could very easily result in positive earnings revisions over the medium term.

SA Fixed Income – Overweight

Domestic Conclusion

Globally, optimism has now replaced the earlier fears of recession as economic growth has proven to be resilient, with expectations that inflation will ultimately stabilise at around 2% and policy rates may return to pre-pandemic levels. This positive outlook has bolstered risk appetite, driving equity markets to record highs and in anticipation that policy rate cuts in the US and Western Europe will be eased. Despite potential risks such as slowing growth and higher for longer rates, strong corporate and household balance sheets coupled with a buoyant job market suggest resilience in various sectors and regions, underpinning continued economic stability amid elevated interest rates. While the positive sentiment towards SA may catapult the country on a new path of growth and reform, investors should not expect an immediate recovery in the economy’s growth trajectory. South Africa has been stuck in a low growth environment for over a decade and is facing major headwinds in the near term such as high interest rates, escalating levels of national debt, high levels of unemployment, inequality, and poverty.

Financial markets are however forward looking, and the sharp increase in domestic asset prices reflects confidence by the investment community in the changes to SA’s political landscape. We are of the opinion that we have reached the peak in nominal interest rates, with the view of a rate cut of 25bps in the latter part of 2024. Looking forward, factors such as political stability, the implementation of growth supportive policy reforms, sustained inflation deceleration, and efficiency improvements in our ports, rail infrastructure and Eskom are expected to bolster the South African economy and financial markets in the medium to long term, hence our tactical overweight position to SA assets

Domestic Asset Allocation

SA Equity - Overweight

The favourable and market friendly outcome from the South African elections with the formation of the Government of National Unity is expected to unlock value for shareholders, as growth reforms are implemented through various initiatives and with greater public/private sector partnerships. Emerging Market investors currently hold an underweight position to South Africa. However, we expect a shift in this allocation due to the improved economic outlook, particularly when contrasted with the political uncertainties faced in countries such as India and Mexico. Consequently, we could witness an uptick in valuations, as South Africa is currently trading at an atypical discount relative to Emerging Market peers.

Our strategy remains to be invested in high quality businesses with strong balance sheets and robust cash flow streams. With that in mind, valuations remain supportive, and we expect an improvement in earnings growth momentum over the next year, underpinned by favourable base effects, lower interest rates, and an improvement in economic activity as confidence improves.

After a difficult start to the year, SA bonds bounced back strongly as the GNU was announced. Financial markets experienced some volatility going into the elections as uncertainty clouded the political landscape. The concerns related to the potential move away from government’s well documented and articulated economic reforms and policies, in the event of a coalition between the ANC with the EFF or perhaps the MK party. In the end, these risks have dissipated and have been replaced with optimism about SA’s “new” future under a GNU.

The appointment of a carefully selected cabinet reinforced Ramaphosa’s and government’s commitment to economic prosperity and inclusiveness, and the drive to stamp out corruption. The appointment of Enoch Godongwana as Minister of Finance was also well received by fixed income investors, given his commitment to prudent fiscal management.

South Africa’s inflation rate has been coming down in line with international trends, which opens the door for monetary relief, so desperately needed to support growth in South Africa. An improved growth trajectory in SA on the back of economic reforms and political certainty could very well result in the narrowing of SA’s sovereign risk spread over US Treasuries in time, especially when this is supported with some consolidation in government’s debt metrics. All of which could result in SA bond yields trending lower if credit rating agencies adjust their outlook on SA - not our base case, but also not impossible.

We anticipate lower interest rates in the second half of 2024, but we believe that the monetary easing cycle could be shallower with only 100bps of cuts expected over the next 12-18 months. Much of course will depend on the outlook for global inflation and by how much developed central banks will be cutting policy rates.

We continue to believe that local bond yields, currently at 11.2%, are attractive in both absolute and inflation adjusted terms (real yield) and maintain our overweight position to the asset class.

Global Equity - Neutral

Our view on global equity in domestic portfolios is the same as that mentioned on page 9 under Global Asset Allocation – Global Equity. In summary, the global economy is expected to grow in line with long term averages as inflation has peaked and interest rates are expected to decline. Earnings growth is expected to broaden out, to sectors outside of technology and we believe this environment is supportive for risk assets. We have a neutral exposure to global equity in domestic portfolios due to our tactical overweight position to SA assets, on the back of the positive developments post the recent elections.

Global Fixed Income – Underweight

With interest rates having peaked, central banks worldwide have either initiated or are poised to begin their interest rate reduction cycles in the latter half of this year. Our outlook suggests a gradual easing process, rather than an overly aggressive one. Despite the robust economic conditions and elevated inflation, we anticipate only modest declines in bond yields from their current levels. We also project that the US Federal Reserve (Fed) will authorise two 25 basis point rate cuts in the fourth quarter.

Our underweight recommendation is premised not only as a function of the increased exposure to SA equity but also on a risk/reward basis, taking into account the ongoing risks of stubborn inflation, and interest rates remaining higher for longer.

SA Cash – Underweight

We favour long duration fixed income assets over cash in SA as interest rates decline.