Up, up and away!

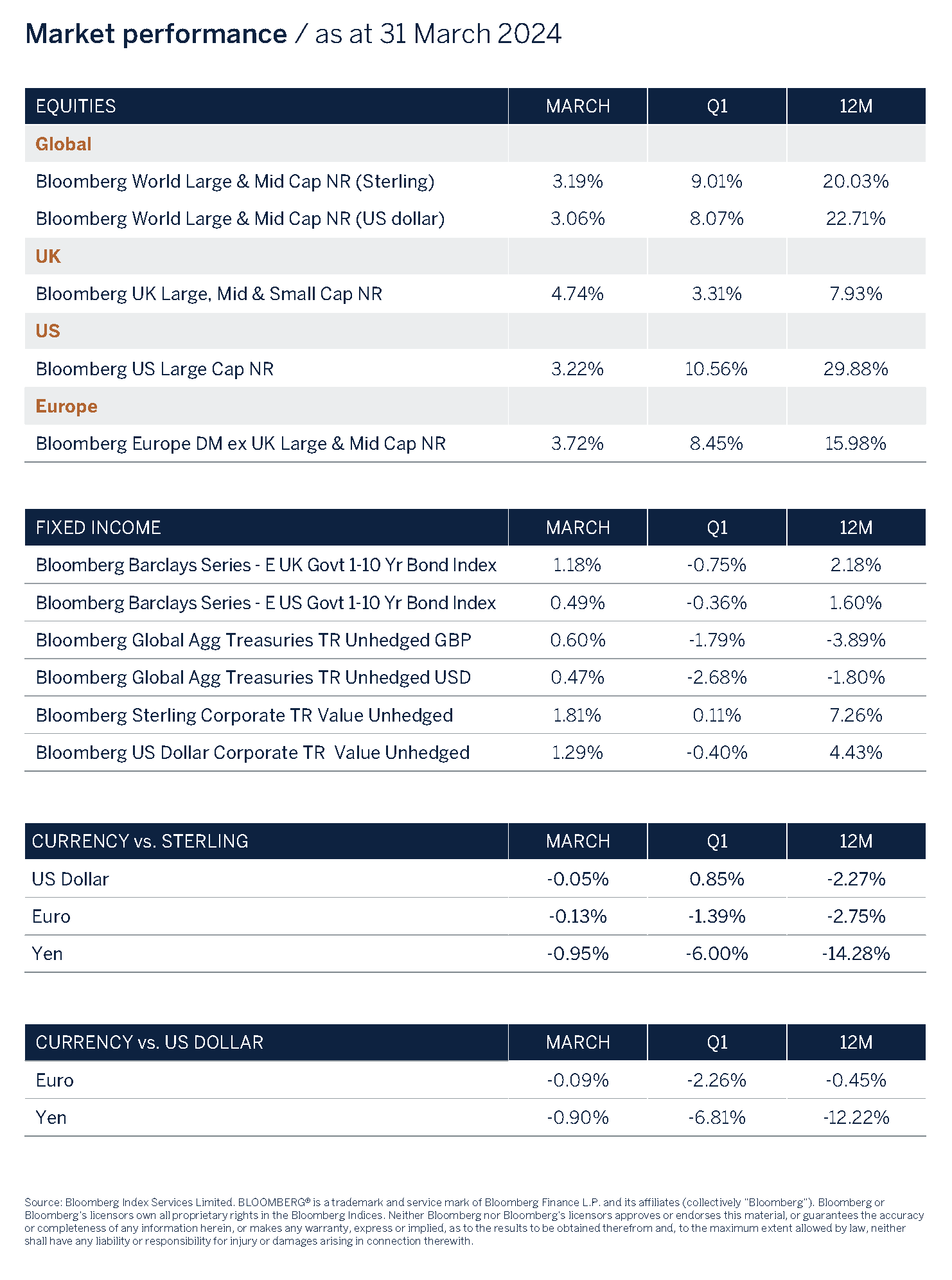

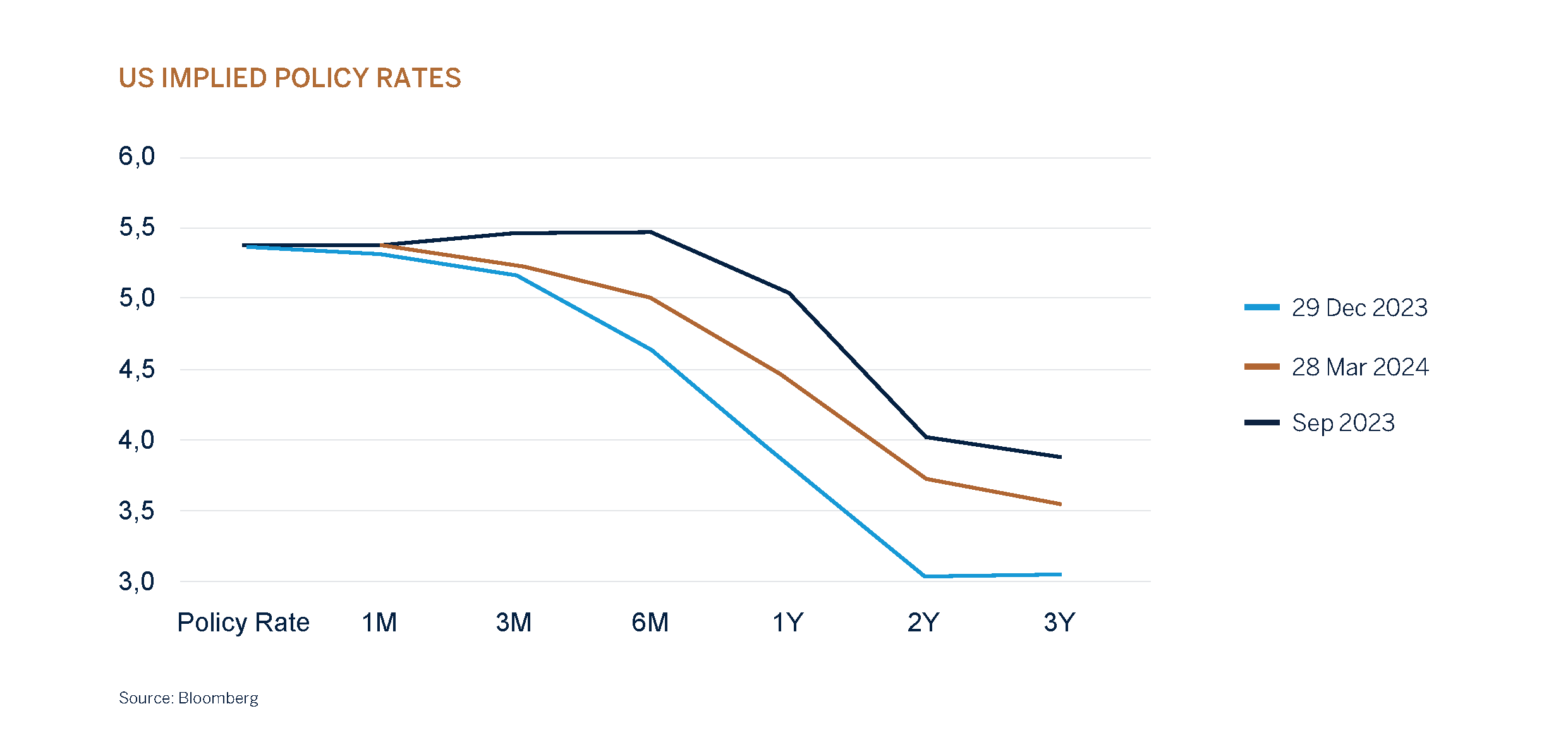

Global equity markets reached new highs as the world’s economic expansion and corporate earnings cycle have proven to be more resilient than was predicted only a few months ago. Investors have also been front-running expectations of lower interest rates to be sanctioned in the second half of the year as inflation continues to trend lower. In US dollar terms global equities are up +8% year-to-date, +23% over the past 12 months and an eye-watering +44% since the October 2022 bear market low point whilst in sterling terms they are +9%, +20% and +20% respectively.

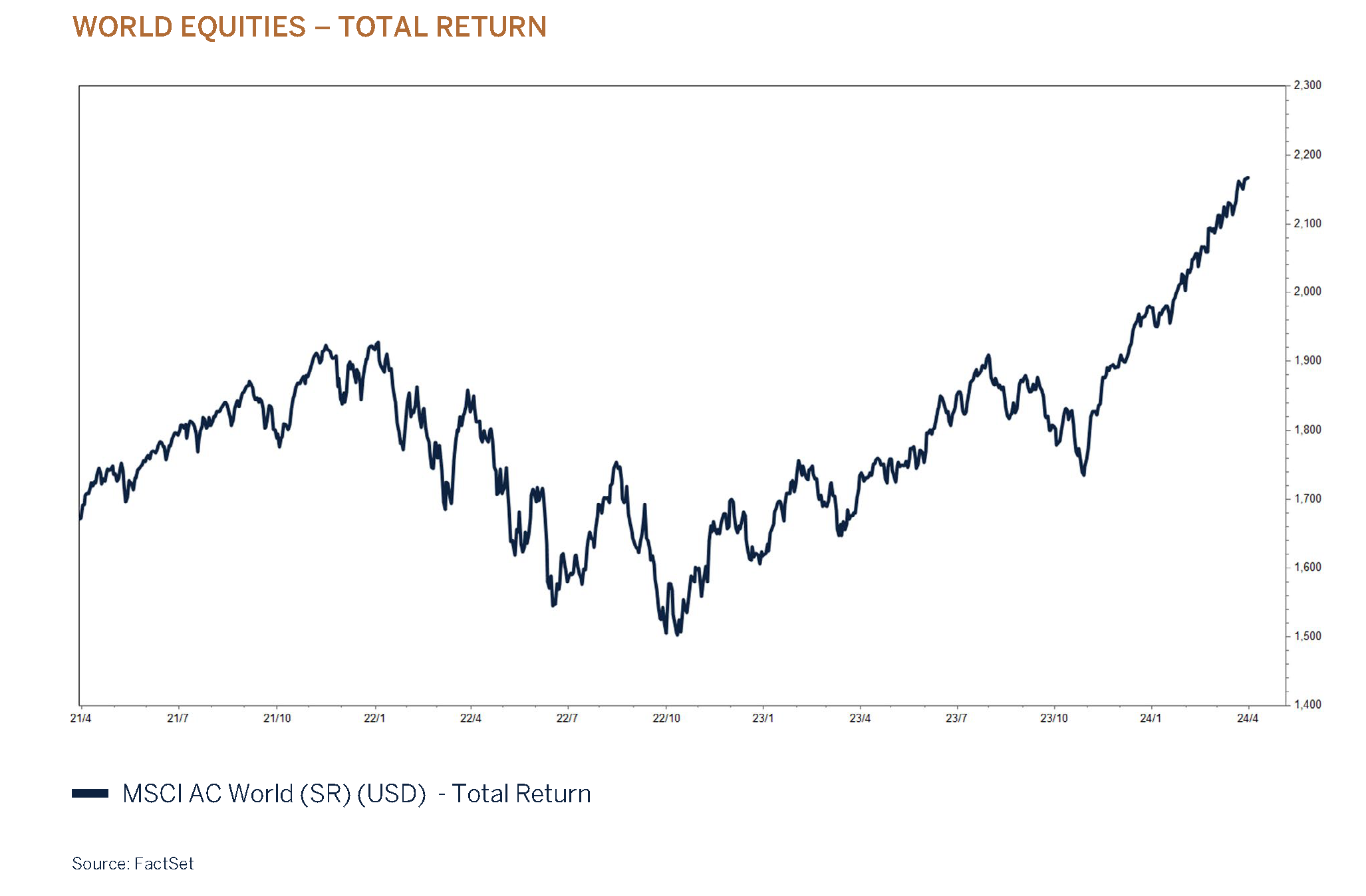

While high interest rates have played their part in dampening credit extension and in turn slowing excess demand, fiscal support together with drawdowns on savings and buoyant labour markets have in most part offset the negatives from restrictive monetary policies. Whereas a mild economic recession (soft landing) was our base case for 2024 it would now appear that a “no landing” outcome for the global economy is more likely. Corporate profits and the investment cycle have turned positive, thereby providing an important underpin to the labour market which has benefitted from an improvement in the participation rate (supply of workers) as enticing wages lure employees back to work.

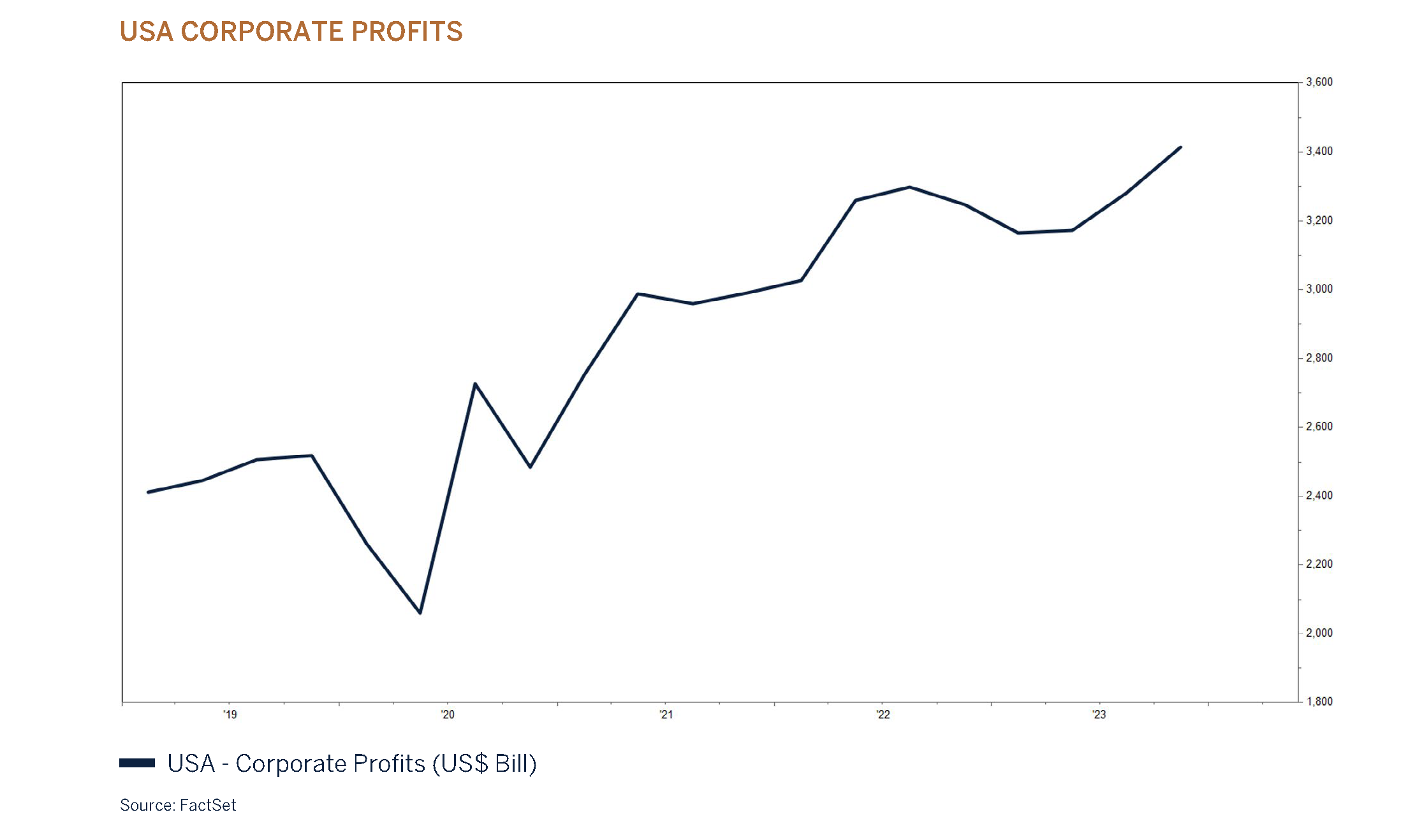

Further to this, financial conditions have eased considerably since many key central banks signalled in Q4 last year that interest rates had peaked. We did express our concerns in our end of 2023 report that bond yields appeared to

have overreacted to the improvement in the outlook for interest rates, a time when six interest rate cuts of 25bps each were priced for the rest of 2024. Since then, sovereign bond yields have adjusted modestly higher to reflect the reality that the path for core inflation, albeit lower, looks set to be both bumpy and sticky as the global economy recovers and favourable base effects begin to fade. However, we would expect that the speed of positive developments in Artificial Intelligence (AI) and other forms of disruptive technology to noticeably improve the day-to-day productivity and growth rates for many corporates and their employees, which supports the view for sustained lower inflation over the medium term.

It would not be unreasonable for fixed income investors to demand a higher rate of return than what we have become accustomed to since the 2008 Global Financial Crisis as debt metrics have worsened across many countries since the outbreak of the Covid-19 pandemic. Credit spreads on the other hand have tightened, perhaps too much, as expected default rates continued to ease as a result of improving macro fundamentals.

The strong performance from AI and technology stocks on the back of robust earnings growth have propelled global equity markets higher during the first three months of the year. The US equity market gained +10.3% due to its high exposure to growth (technology & communications) stocks and again benefitted from this secular growth trend.

Japan was however the best performing equity market within developed markets during the quarter, marginally outperforming the US with a gain of +11%. A weak Yen coupled with an improvement in industrial activity, corporate reforms and government support initiatives have all played a role in lifting Japanese equities to a new high, surpassing their 1989 peak! Continental Europe and UK markets lagged the strong performance from the US and Japan due to their tepid economies and lower exposure to technology companies.

During the quarter we have been increasing exposure to equities, acknowledging a more accommodative stance from central banks, easing financial conditions, and evidence that the corporate earnings cycle has bottomed. Valuations are however on the higher side and short-term investor sentiment appears optimistic, we have therefore settled on a neutral exposure to the asset class for the time being. To us the market is priced for a strong acceleration in earnings growth and significantly lower interest rates. While this is possible, tail risks from elevated interest and inflation rates and a very uncertain geopolitical backdrop remain prevalent, and we would prefer a more cautious approach with a focus on quality until the margin of safety from a valuation perspective becomes more favourable.

Where do we find ourselves in the economic cycle?

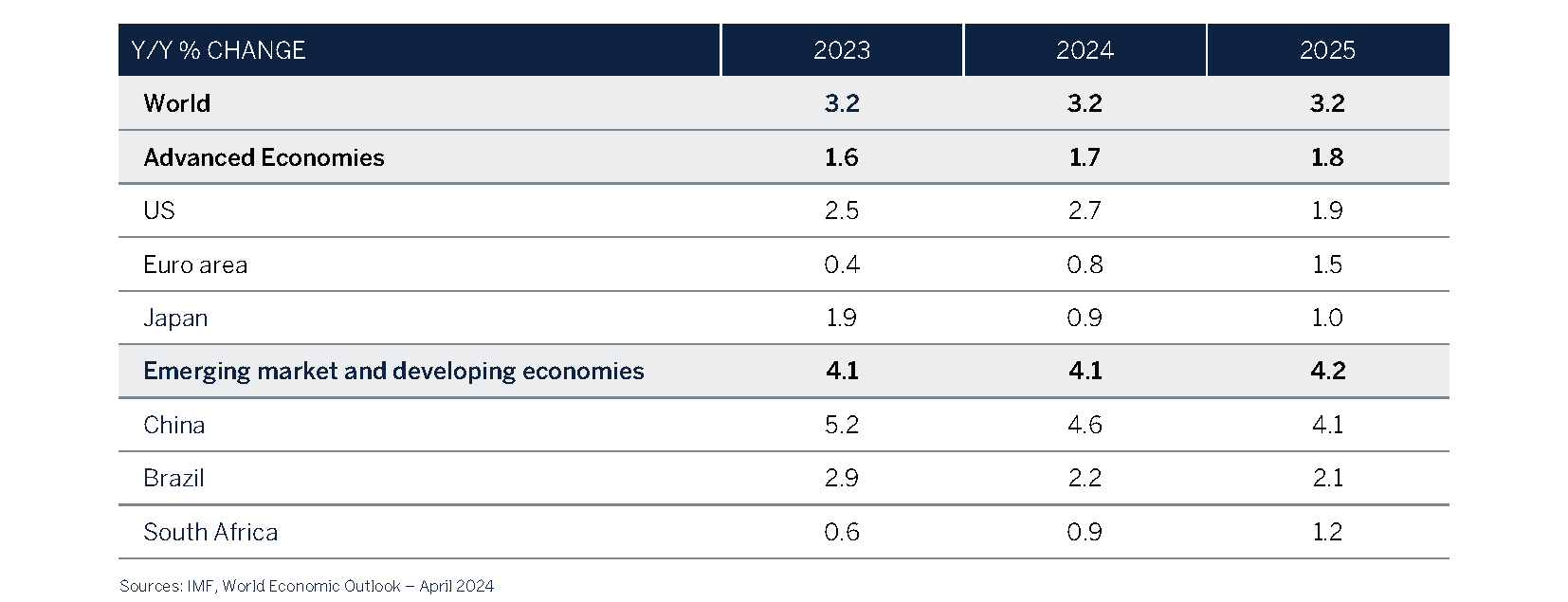

The outlook for the global economy has improved. On balance, economic data continues to surprise positively, resulting in economists upgrading their forecasts. The global economy is now expected to grow in line with its long-term average. This is supported by strength in underlying consumer demand, an improved outlook in capital expenditure (capex) by companies as a recovery in their profits continues which in turn should lead to the continuation of a buoyant employment market.

Furthermore, it is encouraging to note that leading economic indicators have not only bottomed but have turned positive supporting the view that the worst of the economic cycle is behind us. At the same time global economic sentiment (current situation and expectations) as measured by Sentix has turned positive.

Furthermore, it is encouraging to note that leading economic indicators have not only bottomed but have turned positive supporting the view that the worst of the economic cycle is behind us. At the same time global economic sentiment (current situation and expectations) as measured by Sentix has turned positive.

While we have no reason to doubt the improved economic growth outlook, we do recognise that several indicators suggest that the global economy appears rather mature or “late cycle”. Late cycle is not a sufficient condition for a significant slowdown in economic momentum or indeed the next recession, but it is usually associated with a period of more lacklustre investment returns as the starting point for valuations is higher than long term norms and the base for corporate earnings to grow from is not depressed given elevated profit margins - the best entry point for the equity market is when recovery potential is plentiful.

This cycle has in fact been quite unusual by several measures. While central banks have done their best to lower inflation, growth and credit extension by way of aggressive interest rate hikes, at the same time governments have injected large amounts of fiscal support to ease the escalating “costs of living” due to the energy crisis whilst in the US President Biden used fiscal measures to support various economic growth and infrastructure initiatives. In other words, the world so far has avoided recession, an outcome many had understandably feared. It would therefore be reasonable to assume that the expected cyclical rebound (from an elevated base) will be more modest than what is usually the case after a sharp economic downturn.

We have listed some of the indicators below which would suggest that a strong cyclical recovery in economic momentum is unlikely this time around:

- The unemployment rate is at or near record low levels.

- The US personal savings ratio is materially below its historical average levels.

- Real interest rates are at elevated levels.

- Corporate profit margins have peaked and are trending lower.

- US High Yield credit spreads are trading at the bottom of their 15-year range.

- Equity valuations (MSCI ACWI P/E) are well above their 20-year average.

Conclusion

With the headwind from rising interest rates looking set to ease further in the second half of the year coupled with better-than-expected private sector financial health, a tight labour market and easier financial conditions the global economy has proven to be much more resilient than most predicted and the economic expansion now looks set to modestly gather pace as the year progresses.

While interest rates almost certainly have peaked, Central Banks can afford to be patient and wait for “more certainty” that inflation is indeed still declining and on a sustainable path to target levels before sanctioning interest rate cuts. Our base case is that interest rates will trend lower from June onwards, but we do acknowledge that there is a very real risk that interest rates stay higher for longer given how strong underlying global demand is. In addition, commodity prices have bottomed, and there are signs of a recovery in goods demand that should set the stage for a rebound in inventory accumulation.

Equity market valuations have benefitted significantly from the improved outlook in growth. Earnings for corporates outside of AI and IT have been rather lacklustre, but this too is expected to improve due to favourable base effects and as the economic recovery broadens. While we acknowledge that a combination of positive earnings momentum, lower interest rates and falling inflation bode well for equity returns, we believe that a lot of the good news is already reflected in many share prices, with little margin of safety for investors in the event of disappointment. The same dynamics have been playing out in the corporate credit market where risk spreads are trading at or close to historical lows which again points to an element of investor complacency.

As a result, we have positioned portfolios with a neutral allocation to global equity across multi asset portfolios, and a focus on quality global businesses with proven pricing power and healthy balance sheets. Bonds are fairly priced and together with cash currently provide investors with favourable income yields and diversification while equity markets are trading at elevated levels.

Investment Performance

Client equity and multi asset portfolios have performed broadly in-line with benchmarks during the period leading to favourable 3 month, 1, 3 and 5 year absolute and relative to peer group returns. At the asset allocation level, ourdecision to up the weighting to equities in January has, in the short term, proved correct whilst our robust stock selection disciplines and philosophy of investing in some of the world’s greatest global growth companies that areprice setters rather than price takers continued to add value. Fixed income portfolios and the fixed income exposurein multi-asset portfolios struggled on an absolute basis due to the prospect of higher for longer interest rates but ourresults are ahead of benchmark and peer group and we expect improved results from this asset class as the yearprogresses amid a backdrop of the commencement of lower interest rates.

Asset Allocation

Asset classes

| Equities | Neutral |

| Fixed Income | Neutral |

| Cash Plus | Neutral |

| Consumer Discretionary | Overweight |

| Consumer Staples | Underweight |

| Energy | Underweight |

| Financials | Overweight |

| Healthcare | Overweight |

| Industrials | Underweight |

| Information Technology | Neutral |

| Materials | Neutral |

| Communications Services | Neutral |

| Utilities | Underweight |

| Real Estate | Underweight |

Global Fixed Income – Neutral

| G7 Government | Underweight |

| Investment Grade - Supranational | Overweight |

| Investment Grade - Corporate | Neutral |

| High Yield - Corporate | Overweight |

Government bonds have struggled so far this year as markets adjusted to the prospect of fewer interest rate cuts than had only recently been priced in by the sharp slide in yields in late 2023. Bond markets have been forced to reappraise the interest rate outlook given ongoing resilience in major developed world economies (predominantly the US) and signs that the final downshift in inflation to the 2% target levels may prove to be more challenging to achieve or take longer than previously anticipated. Fearing a resurgence in inflationary pressures, central banks are understandably cautious about cutting rates too early but have indicated that the process will begin provided inflation appears to be on a sustainable path to target levels. We still expect rate cuts to commence in the second half of this year, despite recent evidence in some economies that the disinflation trend may be stalling, but currently do not believe this will mark the beginning of overly aggressive easing cycles. Clearly, lower interest rates should be viewed as a positive for global bonds, but we are cognisant that the dip in longer-dated yields from peak levels last year has done much to discount upcoming easier monetary policies. In addition, despite core inflation trending nicely lower over the past year it has recently hit a speed bump which is resulting in the delay of the commencement of interest rate cuts. Investors should demand a ‘real yield’ over and above inflation to compensate for this which may put a floor on how low longer-dated yields can fall, at least over the short to medium term.

We maintain our view that the US Federal Reserve (Fed) will sanction three interest rate cuts in the second half of the year. Importantly, the justification for these forecast rate cuts is centred squarely on inflation again continuing to trend closer to target levels in the months ahead rather than deteriorating economic growth conditions. With the US economy having posted two consecutive quarters of economic growth in excess of 3% and expected to grow at 2.1% this year, the threat of an imminent recession continues to fade especially if interest rate cuts are sanctioned. Consumers continue to benefit from the considerable wealth effect derived from a solid employment/jobs market, higher real (after inflation) wages, strong asset prices including property and shares whilst many still have the cushion of excess savings built up during the pandemic.

There is no doubt that the considerable stimulus measures sanctioned during the pandemic have resulted in a very ‘different’ economic cycle and one that has allowed the economy to be, for now at least, much less interest rate sensitive. However, growth can only defy the gravity of higher borrowing costs for so long and as such we gain much comfort that the US Fed are in a position to deploy considerable growth stimulus, should it be required, in the form of lowering interest rates which are currently sitting at the highest levels in over 20 years. This optimistic outlook for US growth tempers our outlook on how low longerdated yields can fall even if accompanied by lower interest rates, particularly as investors should now demand a yield over and above inflation. Easier monetary policy and lower inflation are a decent recipe for bond markets, and we find it hard to justify a view that yields will be moving materially higher in this environment. However, we also don’t believe the Fed are about to embark on an aggressive easing cycle, as economic growth is too resilient.

This probably equates to yields moving in a sideways fashion, within a range, which is no bad thing given how far they have risen from the lows of 2020. The outcome of the UK Monetary Policy Committee (MPC) meeting in March was an 8-1 vote in favour of leaving rates on hold at 5.25%. Whilst no change to policy was expected, they have laid the groundwork for rate cuts later in the year as the remaining two committee member hawks dropped their calls for hikes, with Governor Bailey acknowledging that market pricing of rate cuts in the second half of the year were “not unreasonable to me”.

The guidance was also updated to reflect the committee’s view that monetary policy could remain restrictive even if the base rate was reduced, given that they are starting from an already restrictive level. The UK economy dipped into a technical recession in the second half of 2023, however recent more positive news on inflation, encouraging retail sales and a strong labour market should be supportive for a return to growth in Q1 although projections for the full year remain anaemic (+0.3%), significantly lower than most other developed world economies.

Inflation is expected to continue falling towards the central bank target in the months ahead driven by favourable rolling base effects and the resetting of energy price caps.However, services inflation, a key component of the inflation basket, remains elevated at circa 6% and will be a concern for the committee. The bond market is pricing the first rate cut at the central bank’s June meeting and whether it happens at this meeting or not they have set the scene for rate cuts in the second half of the year - we are forecasting between 75 and 100 basis points of cuts before year end.

Asset Allocation

Global Equity – Neutral

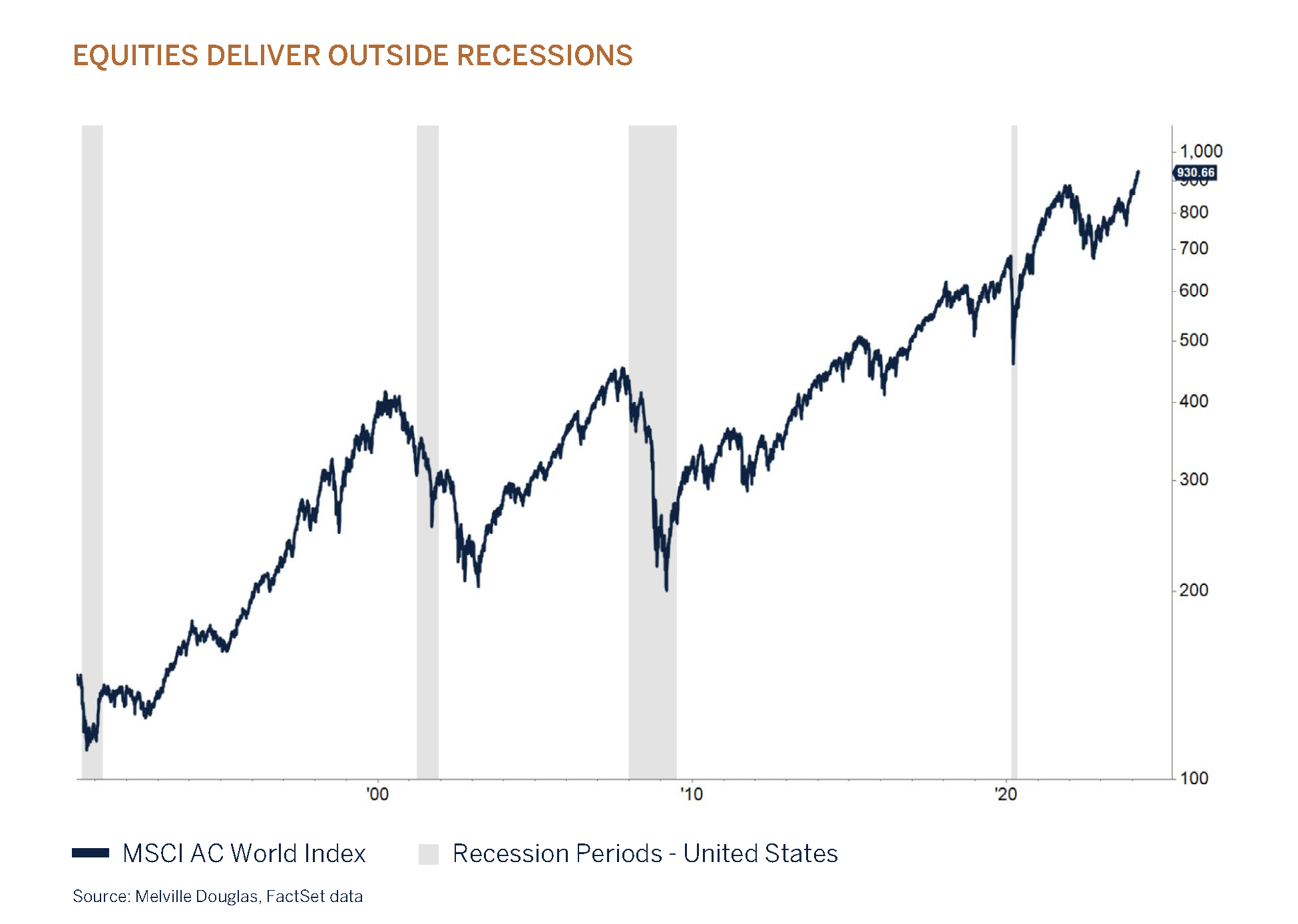

Contrarian investors will be nervous about global stock markets at new all-time highs. However, it is worth noting that share prices do not have memories. A record high only equates to a market peak if it is the last high in an upturn. And bull markets can last for years. They are typically killed off by an economic recession or aggressive central bank rate hikes rather than price action per se.

As shown by the grey shaded areas on the chart, economic recessions are not conducive to rising stock markets. To a greater-or-lesser extent, company profits are inextricably linked to the wider economy. Even essential items, such as consumer staples, are adversely impacted as a more frugal consumer seeks to trade down to a cheaper brand or private label product.

Investment Performance

The problem with predicting economic downturns is that we will only know with hindsight how long and deep they end up being. For example, during the depth of the 2008/2009 financial crisis, there was talk of a potential lurch into

another 1930s-type depression. The MSCI All Country World Index plummet of -55% was a partial reflection of the heightened risk of this Armageddon scenario playing out.

That is not to say, market selloffs/corrections do not occur outside recessions, they happen often. However, nonrecession selloffs tend to be shallower and shorter-lived experiences. The most recent example being the -23% peakto-

trough fall in the MSCI All Country World Index in 2022. The fear was that sharply higher interest rates and soaring inflation would send the world back to 1970s-type stagflation. Fortunately, these worst fears were not realised. As eminent economist Paul Samuelson quipped in 1982, “the stock market has predicted nine out of the last five recessions”.

What does this mean for the outlook for this year?

As well as the rate of inflation coming down, the main driver for the stock market rally in 2023 was that the world skirted a widely expected recession. If these conditions can continue to hold then markets can progress further.

Of course, nothing is certain. The apple cart could be upset by a corporate earnings downturn, further deterioration in the Chinese economy as deflation and the weak property sector take its toll or inflation not playing ball which would likely result in more monetary tightening.

Nonetheless, the current improving macro data has lowered risks compared to this time last year. This bodes well for another positive year in 2024 for equities as an asset class. The neutral tactical position against strategic benchmarks in client investment portfolios reflects the supportive backdrop counterbalanced by elevated share price valuations, largely in the US, resulting in a nuanced risk/reward compared to bonds and cash. Longer term, equities remain one of the most effective ways to preserve and grow wealth.

Cash Plus – Neutral

Cash and cash alternatives currently provide investors with favourable yields and diversification while equity markets are trading at extended levels.